Markets

What You Absolutely Need to Know (or Don’t, But Here It Is Anyway):

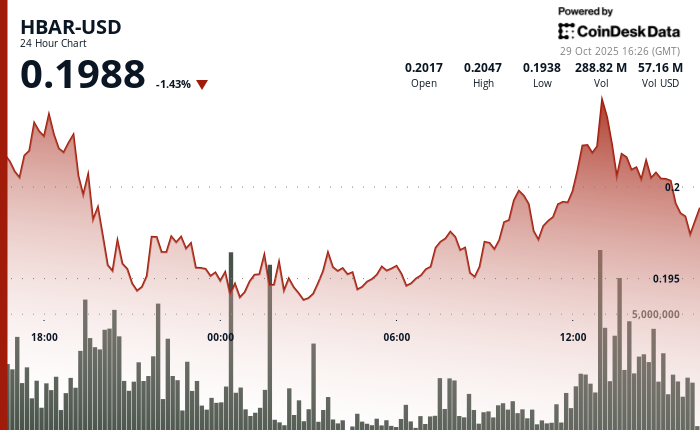

- HBAR’s facing some serious resistance at $0.2055, and guess what? A 137% spike in trading volume screams “institutional selling!” (or just a lot of people with money to throw around).

- Support at $0.1938 is like that one friend who never leaves the party – keeps showing up, hanging on, but at some point… is it really going to last?

- Even the shiny new Nasdaq-listed HBAR ETF gave HBAR a little boost, but now? It’s back to the sellers, baby. Volatility is in the air like a bad perfume, and who knows when it’ll stop?

HBAR dropped by 0.3% to $0.2010 on Tuesday. Let’s be real, it was like watching a slow-motion car crash as sellers took the wheel again. The token bobbed up and down in a range tighter than my jeans after Thanksgiving dinner, reaching a high of $0.2059 before gravity had its way.

Volume surged like a Netflix binge – 249 million tokens traded, a whopping 137% above average. So what does that mean? Well, looks like someone’s offloading a ton of HBAR at $0.2055. Institutional selling? Probably. Hope you didn’t just buy in, huh?

Support at $0.1938 is still hanging in there, holding firm like that one chair you refuse to get rid of. But with a series of lower highs at $0.2044, $0.2032, and $0.2017, it’s starting to look like a bear market-just without the cozy fur.

The drama continued between 13:33 and 13:48 when the price swung up and down faster than a toddler on a sugar high, moving from $0.2015 to $0.2029 on 20.6 million tokens. Then, just when things got interesting, trading halted at 14:16. Oh, the plot thickens-market disruption or just some really bad data? Who knows? But keep your eyes on $0.2014 as a new pivot point, folks.

And yes, this whole rollercoaster began just after the launch of the spot HBAR ETF on Nasdaq. But now it’s like that surprise guest who came in all excited but didn’t bring any snacks.

HBAR Technical Overview (aka, the “We Told You So” Section)

- Support / Resistance

- Support at $0.1938 has held strong, like your mom holding onto that embarrassing childhood photo.

- Resistance at $0.2055 remains unbroken – no matter how many times you try, it’s just not budging.

- Volume Analysis

- Volume jumped to 249M tokens, a 137% increase. Clearly, the big players are out there making moves. Just don’t get caught in the crossfire.

- Signals institutional selling pressure-if you didn’t already feel that coming.

- Chart Patterns

- A descending trendline means we’re in for more bad news. The lower highs at $0.2044, $0.2032, and $0.2017 are like that sinking feeling you get when your favorite show gets canceled.

- The price action is stuck in a range, but sellers seem to be in charge. Sorry, bulls-your moment is over for now.

- Targets / Risk-Reward

- Downside target: If it breaks below $0.1938, we could be in for even more trouble.

- Upside potential: Sure, there’s a chance it could recover, but first, it has to fight through $0.2017 and that pesky $0.2055 resistance. Good luck with that!

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

- HBAR’s Price Tango: A Bumpy Ride with a Bearish Twist!

2025-10-29 20:25