Out on the digital plains, where Bitcoin rides, sometimes struggling to keep its footing above that $110,000 mark 📉. The wind’s picking up as the month wanes, and traders could feel the nervous jitters echoing through the digits. It’s a delicate dance, following the moonlit waltz of volatility through the market’s fragile structure, with wise sages waving caution flags, warning it could retrace its steps to lower demand waters before finding its steady legs.

But, for every head-shake of doubt, there’s a shoulder shrug of optimism from those with a longer view. It seems the old gods of the macroeconomic heaven have fallen in once more with Bitcoin, as rates got trimmed by 25bps and quantitative tightening’s curtain call has been set for December 1st. These calculated moves are setting the stage, or so the hopeful believe, for what they’ve playfully dubbed the “dawning liquidity cycle” – a sip of fortune for Bitcoin’s grand voyage.

Now, if you listen closely to the chatter on the blockchain canyon, it’s the rustle of old coins maintaining their composure. These venerable digital bits show stubborn resolve: no hurried hand-offs here, folks, not yet! It’s like watching a steadfast crowd at a Steinbeck ball, gala-gowned, who sit through the night, knowing they’re in for the long story. Even amidst the turbulent twists, there’s a collective breath held for what the future winds might bring.

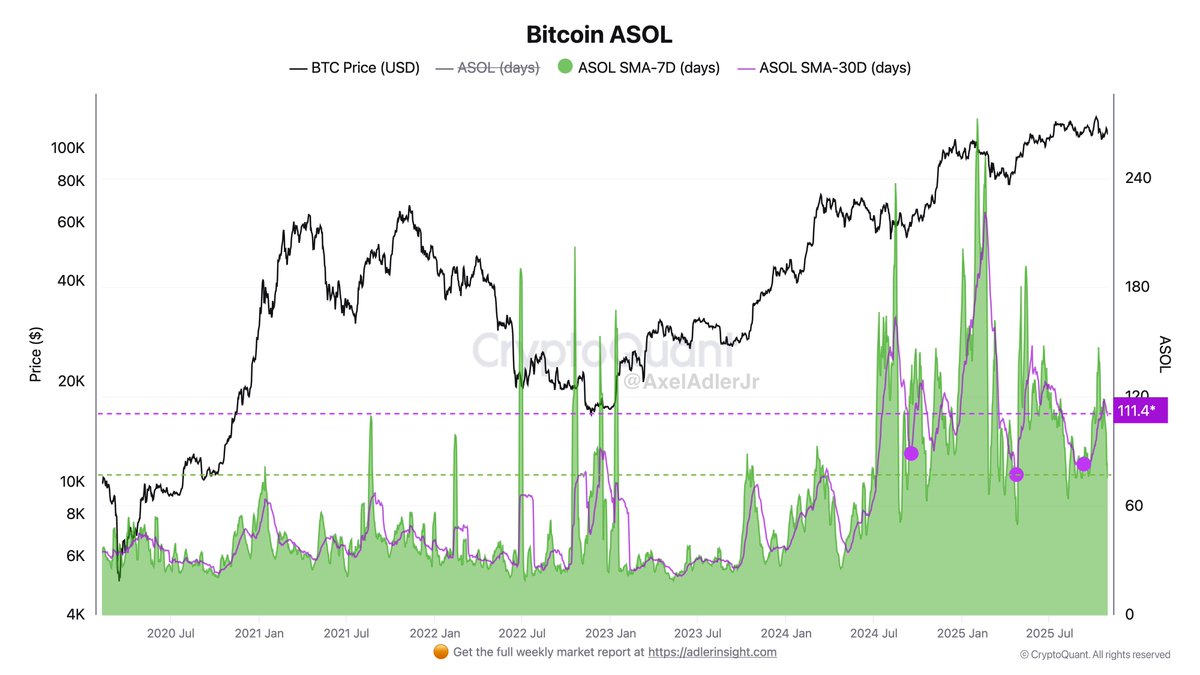

Low ASOL Activity: Old Hands Bear No Scowl

According to the wise words of analyst Axel Adler – picture a modern scribe deciphering digital runes – the exchange within the ranks of Bitcoin’s long-standing holders remains a tale of steadfastness. The story is measured in the Average Spent Output Lifespan (ASOL), showcasing coinage as aged as fine wine. Now, there’ve been brief peaks, but their tales pale against the greater epic sung back in spring: that of a meaningful coin shift, a prelude to the correctional ride.

This distinction’s mighty important, you see: back then, older coins moved like a family heading out for the season, marking a clear ‘letting go’ phase. Today, the glacial pace of those mild upticks signifies not a single seasoned hand is eager to slip from their grip. Adler eyes the 30-day ASOL average lounging near 111 days, nodding at a yardstick for consolidation, rather than a giveaway.

Aye, these long-time believers in the digital pasture care not for short-lived storms. They hold their ground, despite the buffeting macro winds and short schedules. Meanwhile, the new ones arrive, sipping from the well of incoming liquidity, a testament to the tightening threads of Bitcoin’s availability. This slow stitching of market threads, where the available is snugly wrapped, underpins a stability even when speculative flies buzz about, restless yet contained.

So, we find ourselves in the midst of a foundational phase, not at the tail end of breaths. As the thirst for liquidity is quenched and headwinds begin to mellow, this hushed resolve among Bitcoin’s old guard may well pave the road to another upward climb – when demand surges anew. For now, beneath the digital surface, the market sits calmly, an embodiment of latent accumulation and silent expansion rather than a hasty retreat.

Bitcoin Treads a Precarious Path: $110K Holds, Yet Resistance Fades

Bitcoin, like an old cowboy steadying himself on the edge of a steep bluff, teeters around $110,100, licking its wounds from its last run-in with the towering $117,500 resistance. As shown by old-timer charts, each charge toward the higher pastures meets an abrupt end near the shadowy congregation of moving averages, with sellers always ready to hustle it back to the lower, safer lands of mid-range support.

The current ground Bitcoin is standing on, that sacred band of $108,500 to $110,000, acts like an old oak’s roots during the storms in late-September and early October. Keeping one’s boots within this charm circle is key for the bulls looking uphill. A tumble below, and Bitcoin could find itself in the shadowy valley between $104,000 and $106,000, haunted sites of the October 10 cash flush.

Trudging upward, a true climb requires commandeering that prized highland of 50- and 100-period averages on the granary charts, and claiming a stead above $114,500. Only then could the sentiment gather steam towards a fresh challenge of the $117,500 stronghold, with victory there flinging the reins towards the expansive prairies of $120,000 to $123,000.

For now, Bitcoin, like a weary traveler, takes the road less noisy, caught in a dance betwixt optimistic overtures and the whims of lingering market stock. As the riders of volatility saddle up once more, the next bold venture’s time will likely come when the market’s ear is tuned to the rhythm of policy echoes and liquidity’s winds chime a certain direction.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- DOGE PREDICTION. DOGE cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

2025-10-31 05:15