So, guess what? BNB Chain has just kicked TRON to the curb and claimed the crown as the most active network for stablecoin transactions. How? By riding the wave of decentralized exchange (DEX) volume and, of course, a little help from Binance’s magic incentive wand. 🎩✨ But wait, ARK Invest points out that things are getting a little chaotic in the crypto world-because, you know, too many cooks in the kitchen and all that.

//media.crypto.news/2025/10/suidhfiusdhfseh7frewh.webp”/>

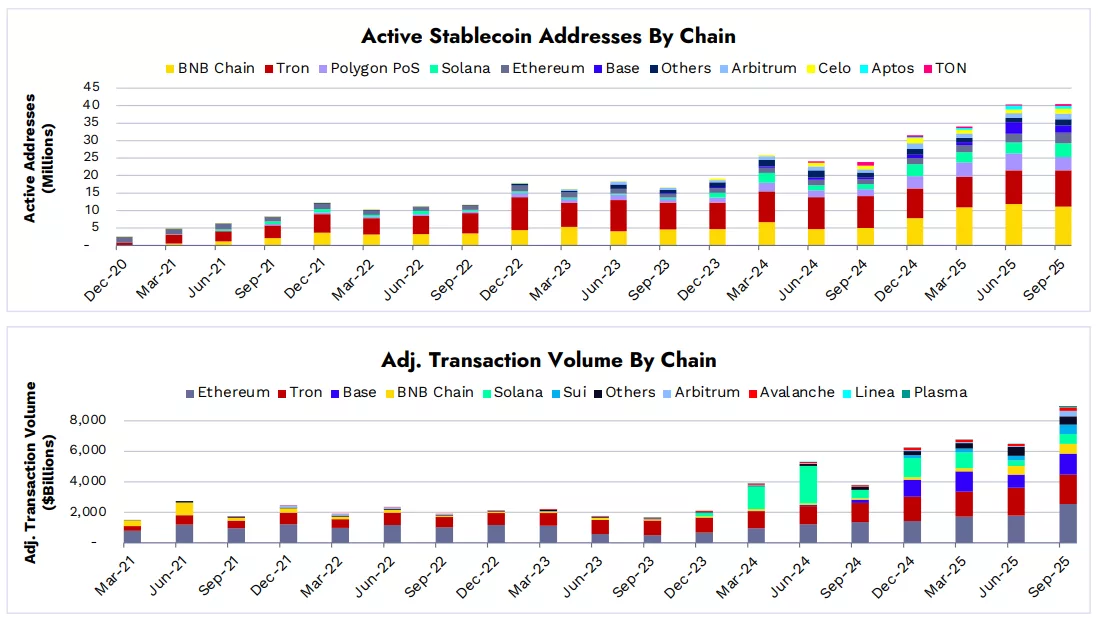

So, ARK’s analysts casually mentioned that quarterly stablecoin transaction volume has grown 43% year-to-date. Translation: people are really loving stablecoins. And it’s almost like they’ve become the new digital currency rockstars, circulating faster and across more networks than ever before. 💸🚀

Network Shares – It’s Getting Spicy

Ethereum is still the big elephant in the room, casually strolling through the market with its Layer 2s like Base and Arbitrum. Together, they’re handling about 48% of all stablecoin transactions. Meanwhile, TRON was holding strong in emerging markets with USDT flows, but guess what? It’s losing ground. As ARK Invest points out, Ethereum’s share has risen from 51% to 55%, while TRON’s has slipped from 32% to 26%. Ouch.

And in the middle of all this chaos? BNB Chain swoops in like a stealthy ninja, picking up the slack left by Solana, which is basically the crypto equivalent of a mild fizzle right now. 🥱

That’s right, the market shift has been nothing short of dramatic. As BNB Chain took its rightful place, Solana’s share of the DEX pie plummeted from 47% to a sad 19%, while BNB Chain shot up from 11% to a whopping 47%. Go big or go home, right? 🏆

The Boom of TVL – More Like a Boom of $$$

Now, ARK Invest has also pointed out that this surge in DEX volume can be traced back to Binance’s zero-fee trading program. Let’s be real-who doesn’t love free stuff? 🤑 This program sent PancakeSwap volume through the roof, while memecoin trading ditched Solana and found a new home on BNB Chain. It’s like a crypto house party and everyone’s flocking to BNB.

BNB Chain is also the winner when it comes to trading efficiency. In Q3 2025, BNB had the most spot DEX volume relative to total value locked (TVL). The ratio? A jaw-dropping 94.7 times TVL. Ethereum? Only about 3.83x. What does that mean? Well, BNB Chain is the king of fast and furious trading, while Ethereum’s still playing it cool with long-term capital. 🏎️💨

Growing Competition – This Party’s Getting Crowded

But here’s the kicker: stablecoin supply trends are shifting, with newcomers entering the scene. USDT and USDC’s market share dipped from 93% to 89% this year, thanks to fresh faces like Ethena Labs’ USDe and PayPal’s PYUSD, which surged by 68% and 135%, respectively. Ethereum’s still the party host, though, with most of PYUSD chilling on its network. 🍻

And guess what? On-chain trading is really starting to overtake centralized exchanges. In 2024, the DEX-to-CEX ratio rose by 192%. The underdogs are having their moment in the sun, folks. 🌞

So, while BNB Chain probably won’t dethrone Ethereum as the main network for institutional stablecoin custody, it’s definitely winning the user engagement and DEX-led trading battle. ARK’s report suggests that we’re entering a fragmented market where stablecoins are hopping around to different chains and venues more than ever before. It’s a bit like a crypto buffet-take what you like, leave the rest. 🍴

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- GBP EUR PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

2025-10-31 15:23