In the shadow of the 50-day Simple Moving Average-the so-called “Golden Line”-Bitcoin trembles, a digital Sisyphus rolling its boulder between wealth and oblivion. Here, in this narrow corridor of code and capital, bulls whisper of a $135,000 dawn by 2025, while bears chuckle like ghouls at the folly of hubris. “A line drawn in the sand,” one analyst sighs, “between salvation and the abyss.” Or, as the market might say: “Here be dragons.” 🐉

Bitcoin Tests the Golden Line-The 50 SMA Holds the Key

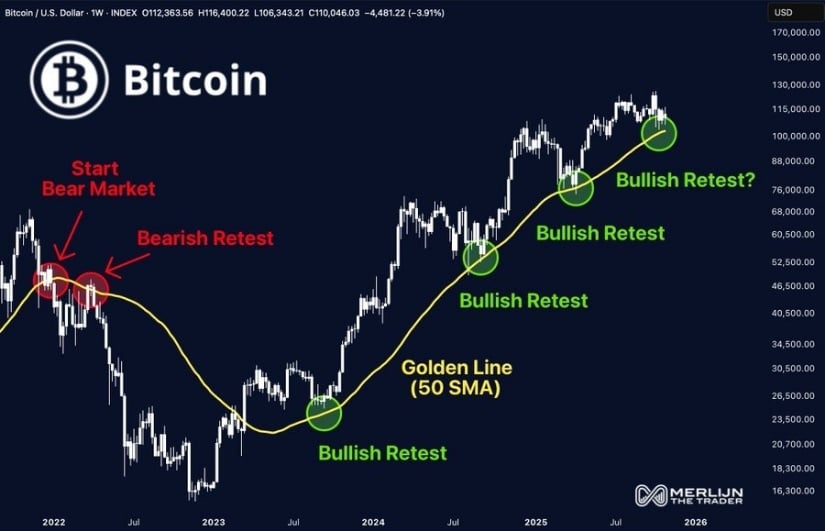

Merlijn The Trader, oracle of the charts, declares the 50 SMA a “divine arbiter” since 2021. In 2021, it summoned bears; in 2024, it blessed bulls. Now, Bitcoin hovers like a moth before a flame, daring to test this sacred threshold. “The 50 SMA decides everything,” he writes, as if the algorithm itself were a judge with a calculator. One wonders if the line knows its own power-or if it’s just a glorified spreadsheet. 📊

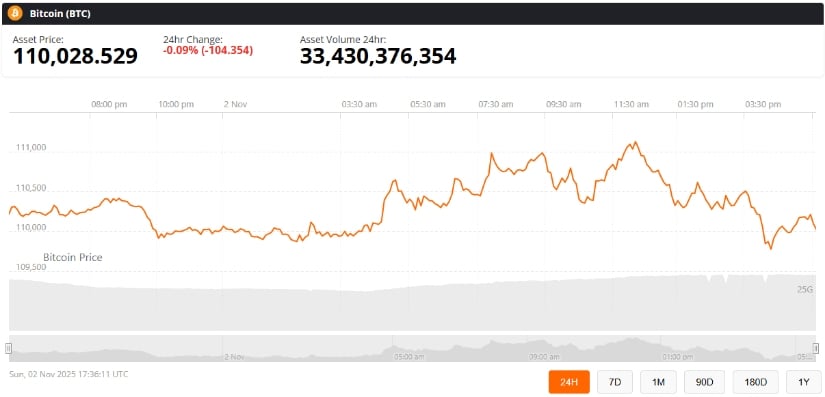

History, that fickle narrator, corroborates the tale. When Bitcoin stumbled below the line in 2021, it tumbled into the $20,000 void-a fall that would make Job weep. Yet when it clung to this line in 2023, it clawed its way back, a phoenix with a blockchain. Now, at $110,000-$112,000, the coin teeters, a tightrope walker without a net. Will it bounce-or break? The crowd holds its breath, clutching coffee cups and crypto wallets. ☕💼

Analysts Eye $135K-$140K Top by Late 2025

BigBullMike7335, prophet of Elliott Waves, prophesies a $135,000 zenith by 2025. “$BTC tops in Dec 2025,” he tweets, as if scribbling in the Book of Revelations. “Moon boys, prepare your wallets.” One imagines him typing this from a bunker, surrounded by candles and candlestick charts. Ambitious? Perhaps. But then again, who needs modesty when you’re trading in zeros? 🌕

This vision, though grand, rests on the halving mythos-a ritual as old as time, where scarcity breeds frenzy. The 2024 halving, that alchemical event, has become the crypto equivalent of the sower’s spring. And yet, as institutions pour billions into ETFs (BlackRock, Fidelity, Grayscale-the titans of tradition), one wonders: Is this a new dawn… or just a very expensive Ponzi scheme? 🤔

Bitcoin vs. Gold-BTC/Gold Ratio Signals Reversal

TedPillows, the chartist with a penchant for paradoxes, unveils a BTC/Gold ratio chart. “Bitcoin could outperform gold,” he muses, “if the US government shutdown ends.” A delicate dance between risk and safety, between the old god of gold and the new god of code. Yet gold, that ancient relic, clings to power, buoyed by trade wars and panic. But Ted, ever the optimist, suggests momentum may soon shift-like a pendulum tired of swinging. ⚖️

The chart, a tapestry of trendlines, whispers of reversal. Gold’s strength, he argues, is a mirage-fueled by fear, not faith. But Bitcoin, that digital phantom, waits in the wings, ready to pounce when the macro winds change. One suspects the market’s next move will be less about numbers and more about nerves. 🤞

Macro Backdrop and ETF Inflows Could Support BTC Recovery

Institutions, those colossuses of capital, march on. BlackRock’s IBIT and Fidelity’s FBTC swell with inflows, their coffers growing fat on the dreams of the hopeful. Legitimacy? Liquidity? Or merely a house of mirrors, reflecting our collective greed? Meanwhile, macro conditions-easing inflation, government shutdowns-teeter like a drunkard’s walk. If these align with the 50 SMA, perhaps Bitcoin will rise. Or perhaps it will fall, dragging ETFs into the depths with it. 🌊

Bitcoin Outlook-Bullish Above the Golden Line

The question remains: Can Bitcoin hold the line? A simple query, yet one that haunts traders like a ghost. The 50 SMA, that digital Rubicon, stands between glory and disgrace. With ETFs, market cap, and gold ratios in play, the stage is set for a drama as old as markets themselves. Will the bulls prevail? Will the bears laugh last? Or will we all be left holding $135,000 and a headache? Only time-and the algorithm-will tell. 🕰️

Traders watch, their screens glowing like modern altars. A rebound from the 50 SMA could spark a rally-another run at history. But let us not forget: Markets are fickle. They reward the bold, punish the arrogant, and leave the rest of us wondering why we trusted a tweet. 🐦

If history repeats, the 50 SMA will be the launchpad for Bitcoin’s next cycle-a leap toward $135,000, or a plunge into the unknown. Either way, the show must go on. After all, what is crypto if not the 21st century’s greatest gamble? 🎲

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- CNY JPY PREDICTION

- USD MYR PREDICTION

- USD COP PREDICTION

- OP PREDICTION. OP cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

2025-11-03 02:03