Well, well, well, it looks like the wild ride has taken a breather. The short-term volatility has calmed down, but don’t get too comfortable, folks. It seems that some fresh blood might be stepping into the market soon to shake things up a bit. Let’s dive in and see where this rollercoaster is headed next. 🚀

Open Interest Indicates Cooling Phase for The Markets

Take a gander at the WIF/USD 1-hour chart-quiet as a mouse after a multi-day downtrend. Currently, the token is sitting pretty at around $0.406. Not exactly a thrill ride, but it could be worse. Open interest (OI) is hanging out at $75.5 million, a far cry from the peaks we saw last week. What’s that tell us? The traders who bet on the big moves have likely taken their profits or just closed shop entirely. Smart move, eh? 🤑

Now, we’ve seen this act before: declining OI often comes before the market gets a big reset, where fresh faces jump in and try to push things in one direction or the other. Get your popcorn ready. 🍿

If that OI starts to climb again alongside some positive price action, we might be in for a wild ride up to the $0.44-$0.46 range. But if OI stays stuck, don’t be surprised if WIF just bounces around aimlessly like a cat on a hot tin roof. For now, it’s a consolidation party, not a panic one. Hold tight, people. 😎

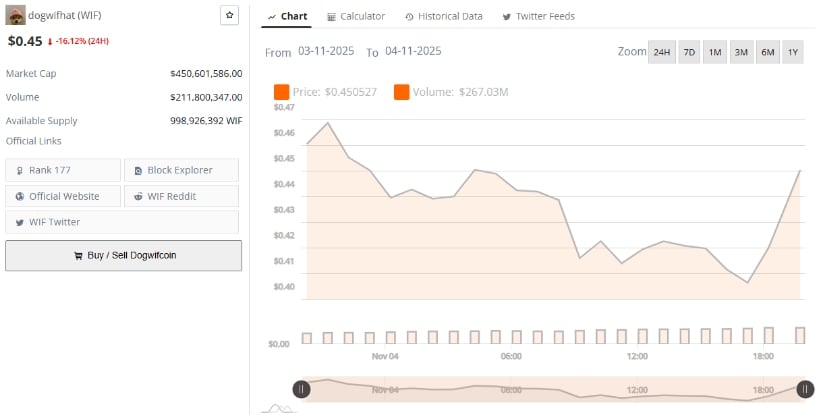

Data Shows Market Pullback and Moderating Volume

As per BraveNewCoin’s latest updates, Dogwifhat is hanging around the $0.405 mark, showing an 8.16% dip in the last 24 hours. Not exactly a cause for celebration, but hey, it’s not the end of the world either. The token’s market cap is cruising at $404.7 million, and trading volume has dropped to $82.5 million. Looks like the market took a breather after that wild October ride. It’s like the calm before the storm, right? 😏

Despite this cooling off, liquidity is still strong enough to spark a short-term rebound if meme coin sentiment turns around. The decline in daily volume suggests the short-term flippers have taken a step back, leaving room for the true believers to stock up. The market cap hovering around $400 million is a good sign, but don’t get too cocky. Buyers need to protect that $0.40 level, or we might be facing a real dip. 🙄

Oversold Conditions and Technical Exhaustion

Now, let’s talk charts-because who doesn’t love a good chart analysis? The WIF/USDT daily chart from TradingView shows the token is flirting with the lower Bollinger Band at $0.44, with the 20-day SMA acting as a pesky resistance around $0.519. Those expanding Bollinger Bands are like a warning sign-volatility might be coming soon. 🚨

The RSI is hanging out at 31.43, just above oversold territory, which could mean a rebound is on the horizon. We’ve seen similar situations before where WIF’s price made a quick recovery. But don’t get your hopes up too high just yet. WIF needs a solid close above $0.44 to confirm things are looking up. If that doesn’t happen, we might be in for a deeper dip toward the $0.36-$0.38 zone-where buyers last made their stand in early October. Buckle up, buttercup! 😬

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- EUR ARS PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

2025-11-05 02:02