In a stunning display of financial slapstick, Bitcoin decided to turn the market into a rollercoaster – and not the fun kind. Less than half a day, or to be more precise, less than twelve hours, and the market had handed out a generous dose of humble pie to over-leveraged traders. About $66 million in BTC positions vanished faster than socks in a tumble dryer, and a hefty 93% of that was from longs. Apparently, some traders were so bullish they must have forgotten to look down – turns out, the market has a sense of humor, and it prefers slapstick.

The big scene happened when Bitcoin dipped below the seemingly indestructible $101,000 – a number as reliable as a weather vane in a hurricane. This triggered a chain reaction, like dominoes crying out for mercy, pushing prices down to a humble $99,200 before the market’s sense of self-preservation kicked in and pushed it back up to around $100,100. Not exactly a rollercoaster designed by a genius, but enough to make anyone who bet the farm consider growing vegetables instead.

This sudden shift coincided with funding rates cooling off faster than a penguin in a blizzard, hinting that traders, in a rare moment of rationality, began tapping the brakes and reducing their exposure – or perhaps just looking for a place to hide their cash while they wait for the chaos to cool down.

The blood, sweat, and $713 million wiped out

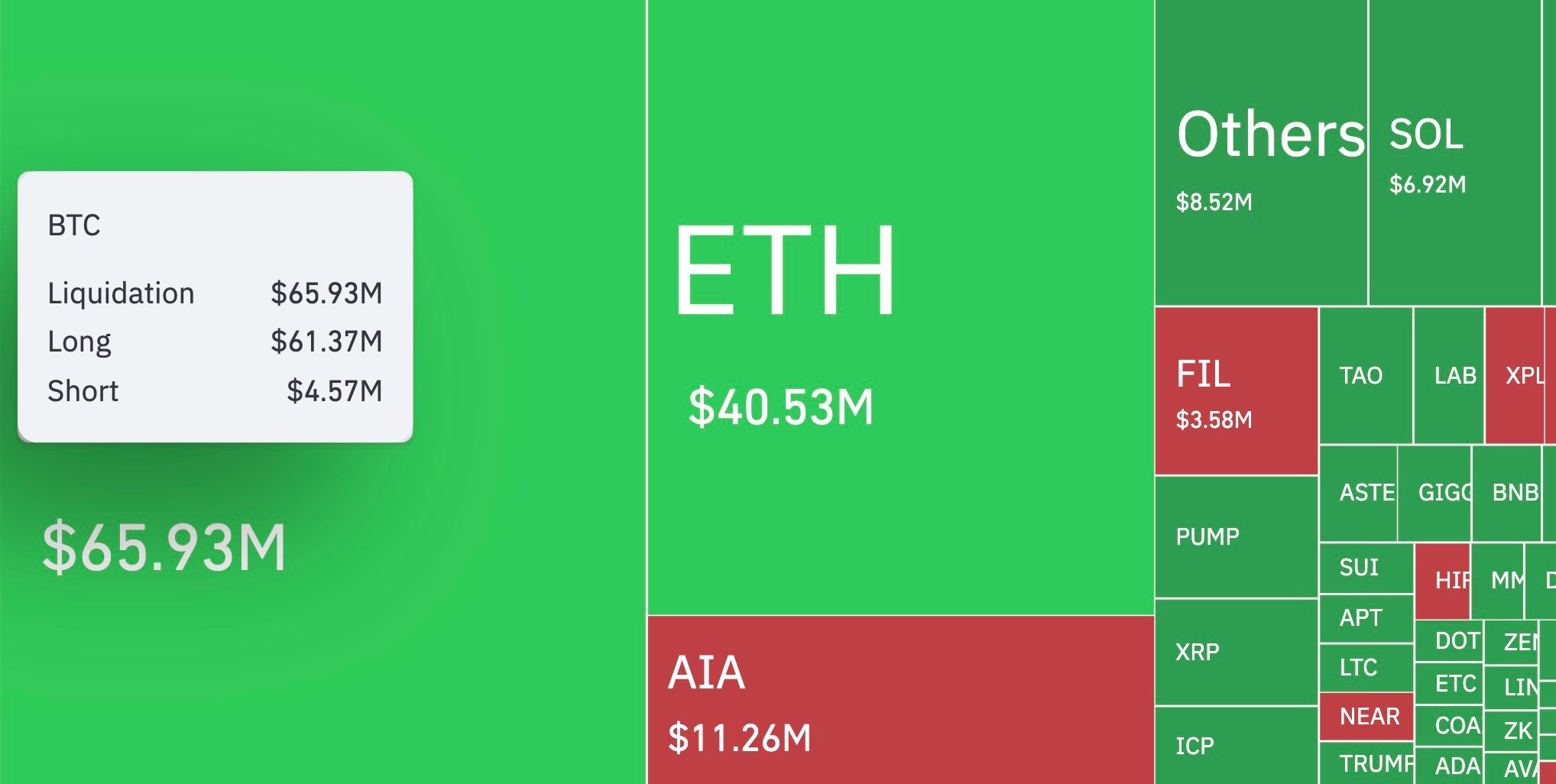

Across the grand stage of the market, a staggering $713 million went poof – evaporating like bad magic tricks in a morning show. Ethereum, the not-so-little sibling in the crypto family, saw $40.53 million vanish; AVAX and SOL, two of the smaller jokers, lost $11.26 million and $6.92 million respectively. The record here belonged to a brave soul on Hyperliquid who liquidated a $15.31 million BTC/USD position – obviously, even giant traders aren’t invincible when destiny (or market volatility) decides to intervene.

Most charts now look like a game of “hot or cold,” with liquidity pockets hanging around $98,500 and $101,300. Whether Bitcoin finds the stability it so desperately craves or continues its erratic dance into the weekend depends heavily on whether it can stay between these two financial limbo lines, or whether another liquidating circus awaits.

As for now, the leverage cycle has been reset – think of it as hitting ‘restart’ on the chaos but with a lingering hangover of bruised confidence. One bad candle, and billions of dollars in make-believe gains could vanish faster than your best excuse for missing meetings.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ARS PREDICTION

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

2025-11-07 19:00