Bitcoin, that enigmatic lover, continues to linger beneath the formidable fortress of $107,000-$108,000, its heart fluttering with a mere 1% descent in the past 24 hours. Now, it meanders around $105,000, with the comforting embrace of $104,000 looming as a sanctuary. 🧱

Despite this minor setback, the market’s fervor has surged, with spot trading volume swelling by 23%, as if the very air crackles with renewed hope. Analysts, those modern-day prophets, whisper that this surge signals a return of the speculative masses, their eyes fixed on Bitcoin’s fleeting ascent to $106,000. 🧠

Popular crypto sage Ted, ever the dramatist, notes that Bitcoin’s current plight mirrors a CME gap near $104,000. He also mused that Bitcoin often finds its footing on Tuesdays, a curious habit that might yet save the day. 🗓️

With Nov. 11, a Tuesday, on the horizon, traders may witness a gap fill and a subsequent leap, as if the market itself were staging a comeback. 🎭

$BTC was repelled by the $107,000-$108,000 citadel.

The next refuge for Bitcoin lies around $104,000, where a CME gap awaits. 🧱

Typically, Bitcoin finds its lowest point on Tuesdays, suggesting a CME gap fill and a hopeful rebound.

– Ted (@TedPillows) November 11, 2025

Analyst Kamran Ashgar, ever the optimist, claims Bitcoin is poised for a grand uprising. He posits that if the $104,000 support holds, the cryptocurrency may soar toward $110,000, a vision as lofty as a poet’s dream. 🌟

$BTC is Reloading! Breakout confirmed. 🚀

A perfect dip back to $104K. If this support holds, we send it to $111K.

– 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) November 11, 2025

Whale Activity: A Dance of Deception

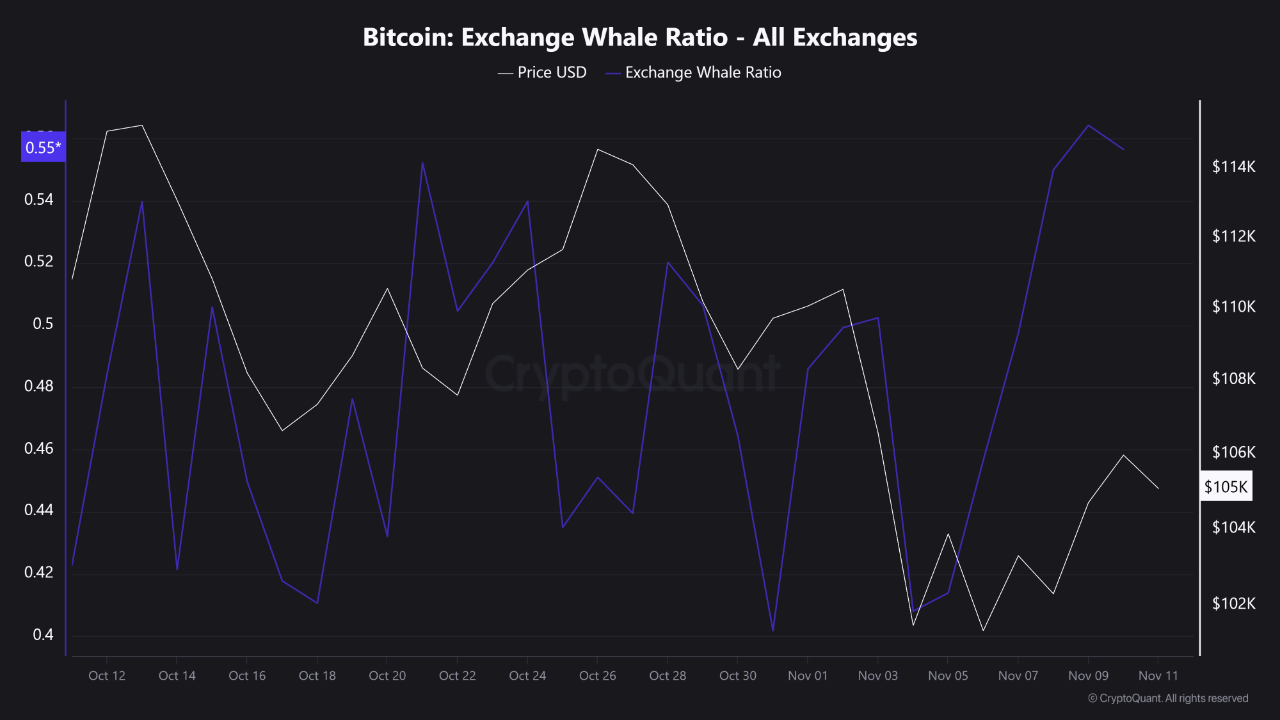

Meanwhile, the Exchange Whale Ratio (EWR), that elusive barometer of large-wallet movements, has ascended from 0.35 to 0.55, a sign that major holders are either plotting profits or repositioning during the early stages of recovery. 🧛♂️

This EWR uptrend coincides with Bitcoin’s bounce from $100,000, hinting that giants may have gathered during recent dips. 🧱

Bitcoin exchange whale ratio | Source: CryptoQuant

A CryptoQuant analyst, ever the sage, claims this whale activity often heralds a bullish reversal, though one must wonder if it’s merely the market’s way of luring the gullible. 🤷♂️

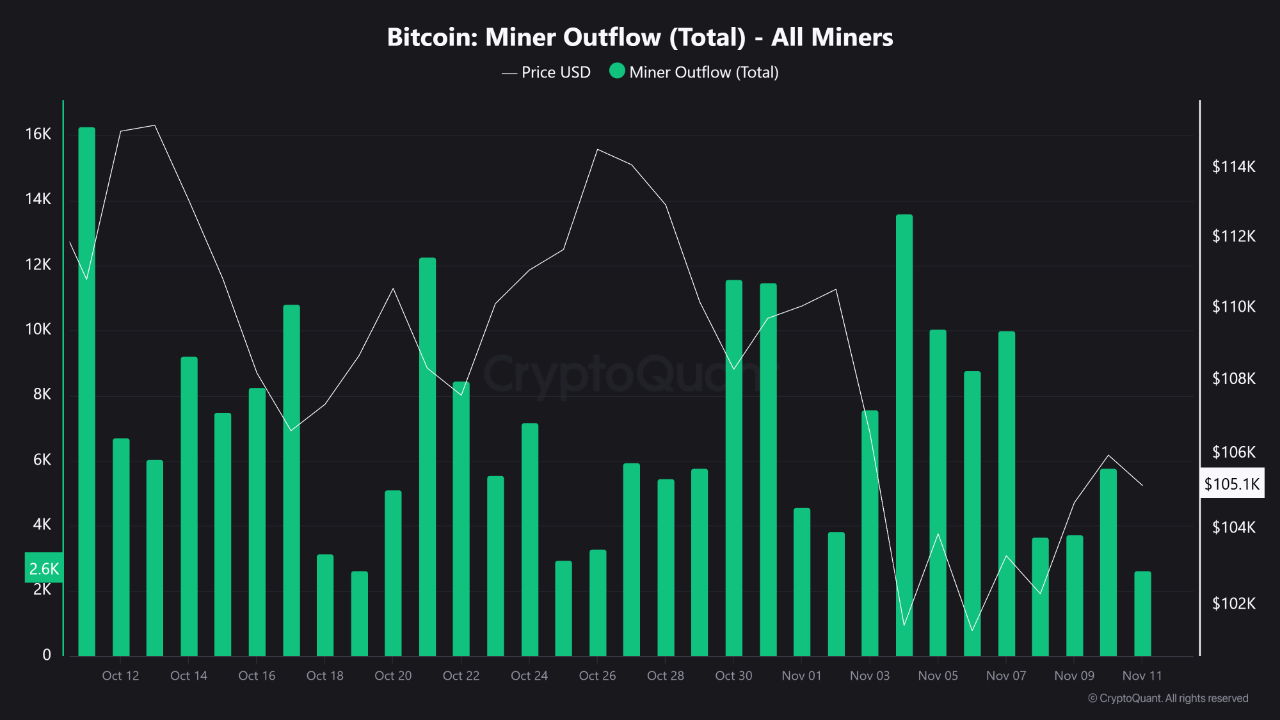

Miner Behavior: A Silent Rebellion

Miners, those stoic custodians of Bitcoin, have seen their outflows dwindle throughout November after a tempest in late October. This suggests they are hoarding their coins, curbing short-term selling. 🧱

Historically, such periods signal accumulation or recovery, as fewer coins flood the exchanges. Current outflows are but a shadow of April-June 2025, when miners sold recklessly during rallies. 🧱

With BTC trading near $105K, this miner restraint hints at a neutral-to-bullish outlook, provided stablecoin inflows continue-a hope as fragile as a whisper in the wind. 🌬️

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- Gold Rate Forecast

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- EUR RUB PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

- EUR AUD PREDICTION

- WLD PREDICTION. WLD cryptocurrency

2025-11-11 18:57