Alright folks, buckle up! According to the latest market data, Uniswap’s price is acting like it’s on a caffeine high, with accumulation growing and volatility narrowing. Analysts are crossing their fingers, hoping the coin might reclaim that sweet $11 zone and maybe-just maybe-surge toward $14 in the next rally cycle. But who knows? It’s crypto, baby! Anything can happen. 💸💥

Bull Flag Setup and Fibonacci Resistance Levels: A Wild Ride Ahead!

Now, let’s talk about crypto guru CW. This guy-he’s got a nose for technical setups, posting charts on X like it’s nobody’s business. In a November 2025 post, CW pointed out that Uniswap’s stuck in the final phase of a descending wedge formation. Translation? It’s like the coin is trying to catch its breath before making the big leap (or face-planting, depending on your view). 😂 According to CW, this formation often signals that the corrective pressure is just about done, and the trend might just start trending again.

But wait-there’s more! CW marked $11 as the ultimate “sell-wall” resistance (because, of course, it’s a brick wall that nobody can get past-yet). This just happens to line up with the 1.0 Fibonacci retracement level. Meanwhile, the 1.618 extension is like, “Hey, why not aim for $14?” 🎯 So, if Uniswap can bust through that upper wedge line with more volume than a TikTok dance challenge, we might just see that bullish trend continue all the way through Q4. Fingers crossed! ✨

UNI Hitting $7.85 as Market Takes a Breather

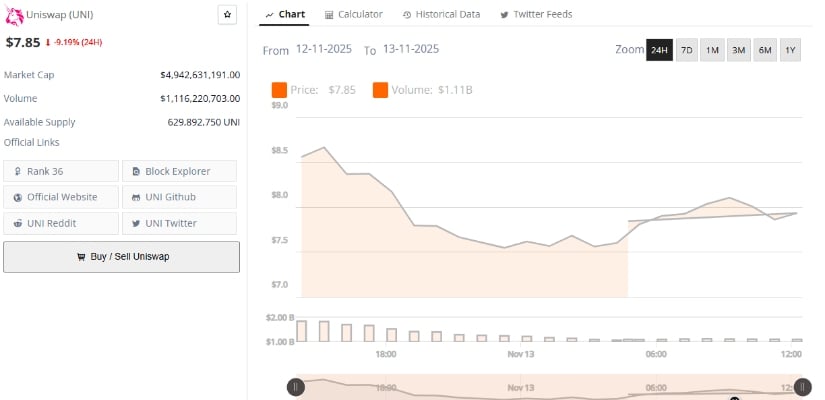

Fast forward to November 13, 2025, and guess what? Uniswap’s trading at $7.85, after a 9.19% drop. Oof, right? It’s like taking one step forward, two steps back. 🕺 Despite the brief dip, it’s still holding strong with support between $6.30 and $6.50. This range? It’s like a comfy pillow for the coin, historically a hotspot for accumulation. So, even if the market’s taking a nap, Uniswap is still in a relatively comfy spot. 💤

Oh, and did I mention Uniswap’s market cap is sitting pretty at $4.94 billion? Yep, that’s right-$1.11 billion in daily trading volume, with a total of 629.89 million tokens in circulation. So it’s ranked #36 globally. Not too shabby, huh? But despite all this, there’s still short-term volatility going on. But don’t worry, analysts are saying buyers are keeping it together-at least for now. But will it hold up? Time will tell. 🕰

Technical Indicators: Buckle Up for Volatility & Momentum

Brace yourselves: the technical indicators are signaling that we might be in for a wild ride. The Bollinger Bands are widening-so, yeah, it’s like strapping in for a rollercoaster ride! 🎢 The price is flirting with the upper band at $8.53, which means traders are getting their groove on. But the baseline support sits at $6.38. If it drops below that, we’re heading toward the lower band at $4.23. Talk about a plunge, huh? 😱

And the RSI? Oh, it’s sitting at a respectable 58.89, which means momentum is picking up, but it’s not yet at “I need a nap” levels. Historical RSI reversals in this range have sometimes led to big rallies-so, could this be the moment we’ve all been waiting for? Maybe. But analysts say we need a solid breakout above $11 and some consistent volume before calling this a sure thing. So, don’t start popping the champagne just yet! 🍾🍾

Read More

- Gold Rate Forecast

- GBP CNY PREDICTION

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- POL PREDICTION. POL cryptocurrency

- USD MYR PREDICTION

- USD VND PREDICTION

- EUR RUB PREDICTION

2025-11-13 21:25