BNB is clinging to life like a chihuahua on a cliff, inching toward $960-$970. Short-term sentiment? Improved, because apparently, “tightening ranges” and “steady trading activity” are code for “we’re not dead yet.” Analysts are watching like hawks to see if this is the base for the next “upsurge” – which, in crypto-speak, means hoping someone buys enough to stop the bloodbath. 🚀

Buy Wall Reinforces Key Support Area on BNB Chart

On November 13, 2025, crypto soothsayer CW pointed out the $945-$950 region as a “buy wall” on X. Let me guess: it’s a magical zone where buyers mysteriously appear every time the price dips. CW’s chart shows retests of this band, each met with “visible buyer absorption” – a fancy way of saying “somebody finally stopped selling their soul for gas fees.” 🤷♂️

The latest rebound? A modest higher-low formation, which in normal language means “we’re not falling faster today.” Volatility compressed? Of course, because nothing says “stability” like a coin bouncing between two numbers like a broken toaster. Sustained defense of this support band? Critical. Because if it breaks, we’ll all be living in a post-apocalyptic bunker funded by crypto losses. 🏰

Overhead Resistance Cluster Limits Near-Term Breakout Potential

Despite all the “steady accumulation,” BNB is still stuck in the $990-$1,030 “sell wall” – a place where every rally dies like a sad balloon. CW calls it a “dense sell wall,” which is just crypto for “people are terrified and selling their dreams.” A confirmed breakout? Requires “expanding trading volume and consistent demand retention” – in other words, a miracle and a new religion. 🙌

The recent recovery attempts hit the lower boundary of this resistance cluster and then… poof. Sellers are still active, but the range narrowed “notably” – because nothing says “equilibrium” like a coin trapped in a straitjacket. Analysts call this compression an “early sign of volatility,” which is just a polite way of saying, “We have no idea what’s happening.” 🤯

Macro Structure and Long-Term Trend Remain Constructive

Long-term analyst Zeus (yes, like the Greek god, but less thunder, more spreadsheets) claims BNB is in a “multi-year uptrend.” Let’s break that down: $300 in 2024 to $1,300 in 2025, then a crash to $950. Zeus calls this “natural profit-taking,” which is code for “people panicked and sold everything.” But hey, the “ascending channel remains intact” – because if you squint, it looks like a line. 🎯

Zeus also mentions “ecosystem development” and “network usage” as reasons for resilience. Translation: “We added a few NFTs and a meme coin, and now it’s ‘resilient.’” The token’s relative strength is “due to consistent trading activity” – which is just a way of saying “we keep trading it because we’re out of options.” 🧟♂️

Intraday Data Shows Gradual Recovery and Stable Volume

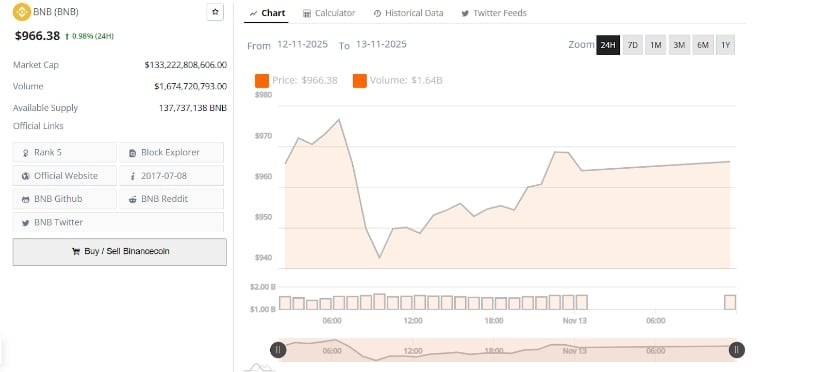

BraveNewCoin reported BNB/USD rebounded from $940 to $960-$970. “Gradual recovery”? More like a slow crawl on a trampoline. The 24-hour pattern shows “rising demand from lower levels” – which is a poetic way of saying “people bought it because it was cheaper.” Trading volume? “Consistent,” because nothing says “bullish momentum” like everyone holding their breath. 🫁

Analysts call $955-$960 “interim support,” which is just a fancy label for “if it breaks, we’re all in trouble.” A firm hold above this? Could open a path to $990-$1,030 – but only if the universe stops being a jerk for five minutes. Until then, enjoy the ride. 🎢

Read More

- Gold Rate Forecast

- GBP CNY PREDICTION

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- POL PREDICTION. POL cryptocurrency

- USD MYR PREDICTION

- USD VND PREDICTION

- EUR RUB PREDICTION

2025-11-14 01:05