As the most astute observers of this cosmic comedy monitor whether the accumulation of chaos is building or the breakdown of sanity is imminent, one wonders if the next directional move will be a waltz or a pratfall. 🕺

Analyst Points to Key Demand Zone & Fibonacci Targets

Dear reader, allow me to present the coin’s current predicament: it resides in a demand zone so defined, one might mistake it for a Victorian drawing room. Analyst Crypto World, with the precision of a poet, notes clear entry levels, upside projections (a term as optimistic as a snowball in hell), and a stop-loss criterion-should the daily candle dare close below 0.618, the entire charade collapses like a poorly constructed soufflé. 🥚

The chart, a canvas of Fibonacci levels, ascends with the grace of a drunken staircase: 0.788, 0.857, 0.947, 1.029, and the grand finale at 1.515. Each level, a potential resistance zone where profit-takers may pause to sip champagne and ponder their next move. 🍾

However, the bullish outlook hinges on holding the support band around 0.672-0.618. Should this fortress crumble, the setup becomes a house of cards in a hurricane-and the downside risk? Let’s say it’s less “opportunity” and more “tragic opera.” 🎭

Price Action and Open Interest Signal Market Stalemate

The recent chart action reveals a downtrend so persistent, it could teach a lesson to the most stubborn of Victorians. The coin peaked near ~0.86, then embarked on a melodrama of lower highs and lower lows, a bearish ballad sung in the key of doom. Bulls rally, but with the enthusiasm of a deflated balloon. The price now hovers around 0.70, consolidating like a debutante at her first dance-but still trapped in a bearish waltz. 🕺

The Aggregated Open Interest (OI) metric, a symphony of unwinding positions, suggests traders are shedding their wigs rather than opening new ones. OI stabilized at 76.5 M, a number that whispers of positioning ahead of a volatility event. Should WLD break below 0.70, the downward spiral continues; reclaiming 0.74-0.75? A faint hope, like finding a rose in a desert. 🌵

Worldcoin Data Reflects Gradual Accumulation Trend

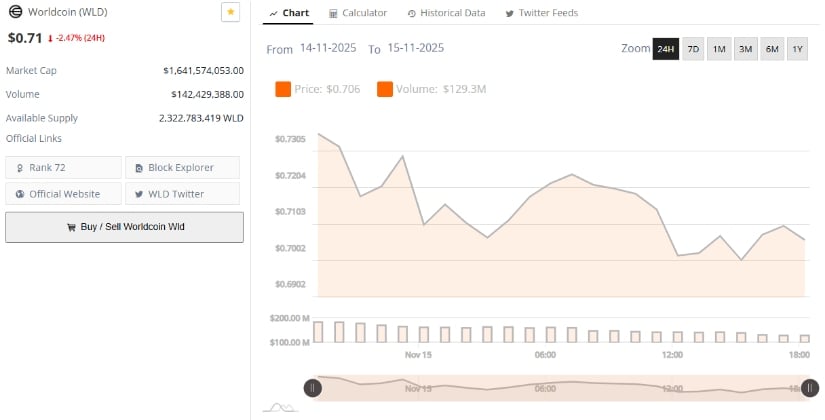

As of November 15, 2025, Worldcoin trades at $0.79, a 0.50% daily increase that feels less like progress and more like a sigh. With a market cap of $1.64 billion, it’s a mere footnote in the grand ledger of wealth. The 24-hour volume? A paltry $142.42 million. Yet, outflows to self-custody wallets suggest long-term holders are playing a slow waltz of accumulation-a dance that may one day end in riches or ruin. 💃

Analysts, ever the optimists, interpret this as a prelude to upward volatility. One can only hope they’re right-or at least entertained by the spectacle. 🎭

Technical Indicators Show Compression Ahead of Breakout or Breakdown

At press time, WLD/USDT trades near $0.704, a number that oozes weakness like a leaking teapot. The Bollinger Bands, in their infinite wisdom, have compressed the market into a macabre ballet of oversold territory and low volatility. 🕺

The baseline (middle band) at $0.79 acts as dynamic resistance, while the upper band near $0.915 looms like a specter. Momentum indicators? Bearish, of course, but the histogram’s neutrality hints selling momentum may soon tire of its own theatrics. 🎭

Candlesticks, with their long wicks and tight ranges, scream indecision. Yet, without a surge in volume, rebounds are as fleeting as a Victorian’s patience. A macabre finale awaits-whether a breakout or breakdown, only time will tell. Or perhaps not. After all, this is crypto. 🎭

Read More

- Gold Rate Forecast

- GBP CNY PREDICTION

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- Oh Dear, Plunge in Crypto Could Have You Pining for Traditional Acorns

- STX PREDICTION. STX cryptocurrency

- USD KZT PREDICTION

2025-11-16 02:35