Bitcoin and Ether ETFs had a week from hell, hemorrhaging $1.84 billion while Solana sipped margaritas in the ETF lounge. 💸🥤

Another Red Week for BTC and ETH ETFs as Solana Holds Its Winning Streak

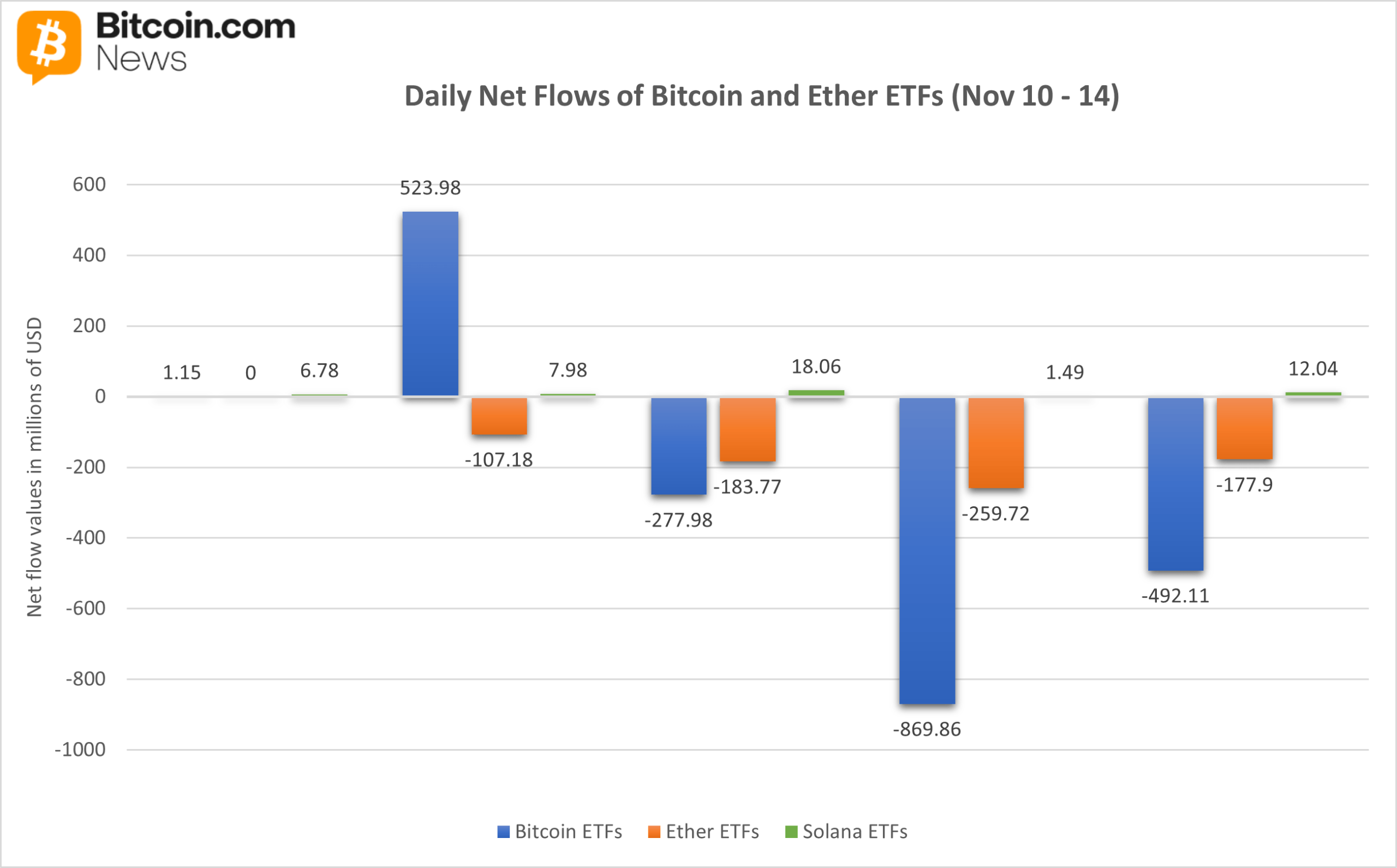

Some weeks unfold slowly; others tell the story of a market shifting beneath the surface. November 10-14 delivered the latter, with bitcoin and ether exchange-traded funds (ETFs) facing relentless pressure while solana quietly extended its winning streak. The contrast was striking, especially as major funds saw billions in assets rotate out. 🎢💸

Spot bitcoin ETFs recorded a $1.11 billion net outflow, marking their third consecutive negative week and the second billion-dollar outflow in succession. Ether ETFs saw $729 million pulled from the ecosystem, marking their third-largest weekly exit in history. Meanwhile, solana ETFs stood alone in the green, collecting $46.34 million in fresh inflows. 🌱🤑

Bitcoin ETF Flows

Blackrock’s IBIT took a cannonball to the face, losing -$532.41 million. Grayscale’s Bitcoin Mini Trust? Tossed into the shredder with -$289.92 million. Fidelity’s FBTC? -$88.99 million in redemptions. Bitwise’s BITB? -$38.61 million. Invesco’s BTCO? -$30.80 million. Vaneck’s HODL? -$8.34 million. Valkyrie’s BRRR? -$3.05 million. Wisdomtree’s BTCW? -$6.03 million. Franklin’s EZBC? -$5.69 million. Ark & 21Shares’ ARKB? A paltry $1.68 million inflow-like finding a $5 bill in a dumpster fire. 🔥

Ether ETF Flows

Blackrock’s ETHA? -$421.37 million. Grayscale’s Ether Mini Trust? -$135.37 million. ETHE? -$121.89 million. Fidelity’s FETH? -$37.30 million. Bitwise’s ETHW? -$4.44 million. Invesco’s QETH? -$4.42 million. Vaneck’s ETHV? -$3.78 million. Altogether, the nine ether ETFs combined for a -$729 million weekly outflow-like a crypto version of “Titanic,” but with more panic and fewer roses. 🚢💔

Solana ETF Flows

Solana ETFs once again separated themselves from the broader trend. Bitwise’s BSOL led the charge with a strong $33.97 million inflow, continuing its run as the category’s dominant liquidity magnet. Grayscale’s GSOL added another $12.37 million, marking the newly launched product’s best weekly showing yet. Together, these flows pushed solana to a $46.34 million net weekly inflow, its third straight week of gains. 🚀💎

In a week defined by heavy selling across bitcoin and ether products, solana emerged as the lone bright spot. The sharp divergence underscores a deeper shift in investor behavior: capital isn’t exiting crypto, it’s rotating, concentrating in assets showing momentum and narrative strength. 🧠📈

FAQ📉

- Why did bitcoin and ether ETFs post another red week?

BTC and ETH ETFs saw a combined $1.84 billion in outflows as investors continued rotating out of major assets. (Spoiler: They’re not buying a llama farm instead. Yet.) 🦙 - Which funds were hit hardest during the sell-off?

Blackrock’s IBIT and ETHA led the week’s withdrawals, accounting for the largest share of redemptions. (They should’ve invested in a better marketing team.) 📢 - How did solana ETFs perform amid the broader weakness?

Solana ETFs secured $46 million in inflows, marking their third consecutive positive week. (Clearly, they hired a financial advisor who’s seen the future.) 🔮 - What does this divergence signal for the crypto ETF market?

Capital is shifting toward assets with stronger momentum, showing rotation rather than a full market retreat. (Translation: Bitcoin and Ether are stuck in “Slow Mode,” while Solana’s on hyperdrive.) 🚀

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- USD KZT PREDICTION

- EUR KRW PREDICTION

- PI PREDICTION. PI cryptocurrency

2025-11-17 16:14