Welcome, dear reader, to the US Crypto News Morning Briefing-a place where the air is thick with caffeine and existential dread. ☕😅

In the past year, Bitcoin has surged like a penguin on a trampoline, posting returns that make traditional assets blush. Yet, while some see stability, others ponder: is this a golden goose or a goose with a penchant for fireworks? 🦆🧨

Crypto News of the Day: The Great “Store of Value” Kabuki Theater

Since January 2024, Bitcoin ETFs have soared 100%, mirroring gold’s glacial pace, while the S&P 500 dawdled at 45%. This has sparked a debate: is Bitcoin a “risk-on” asset or a “store of value”? (Spoiler: it’s neither-it’s a mood.)

Spot BTC ETFs: 100% return. Gold ETFs: 100% return. S&P 500: 45% return. So, is Bitcoin gold or a stock? Or perhaps a confused chameleon? 🐍🤔

– Nate Geraci (@NateGeraci) November 17, 2025

Mr. Geraci, with the sagacity of a man who’s seen both stock markets and his in-laws, noted the parity with gold. Yet, investors now wonder: is this a golden ticket or a golden ticket to a rollercoaster? 🎢💸

“ETH has been flat for years. Is this a ‘store of value’ or a ‘store of regret’?” asked one user, clearly channeling their inner Scrooge. 🎃

Bitcoin’s rally may mimic gold, but its volatility remains as temperamental as a cat in a room full of rocking chairs. Risk-adjusted returns? A phrase that makes investors clutch their pearls. 💎

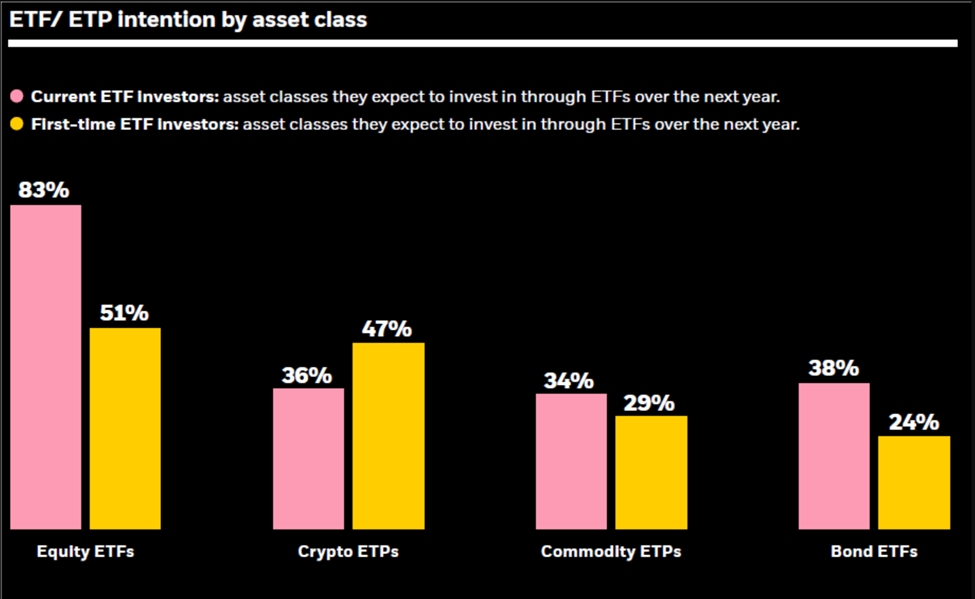

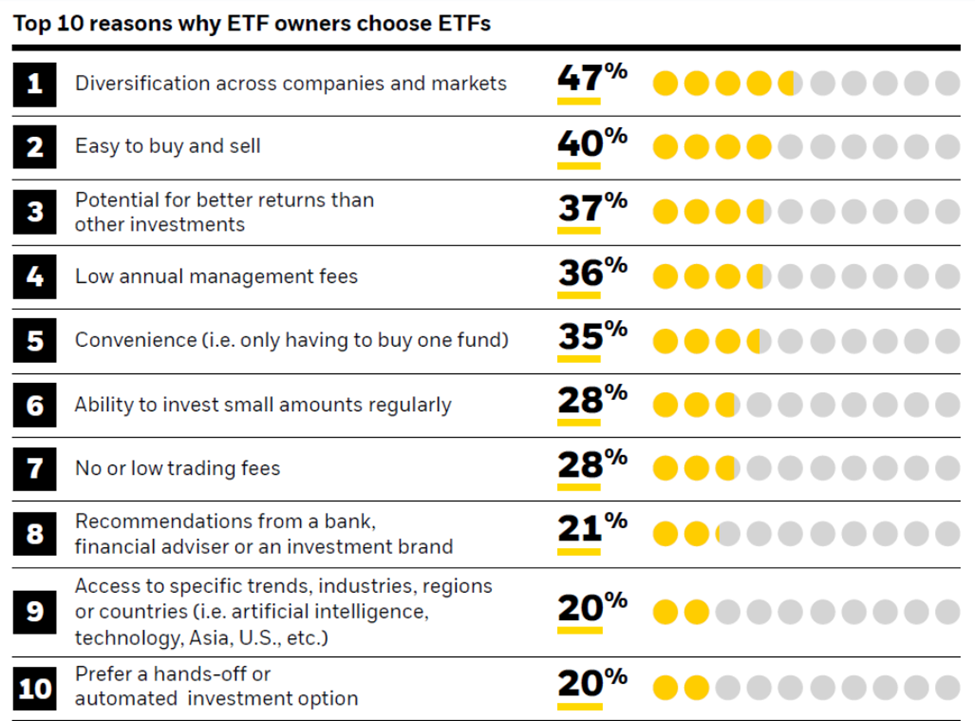

BlackRock’s People & Money report reveals retail investors, particularly the youth, are flocking to ETFs like moths to a crypto-flame. Key stats:

- ETFs: fastest-growing retail product. Because nothing says “growth” like a pyramid scheme with better branding. 🏗️

- 19 million US adults will buy ETFs next year. 44% first-timers. 71% under 45. The future is now-and it’s very confused. 😅

- 47% of new investors: crypto ETFs. A generation betting their futures on digital ponies. 🐴

Young investors now treat crypto like a side dish at Thanksgiving-optional but increasingly necessary. Traditional wisdom? Out the window! 🪟

BlackRock Moves and Market Sentiment: A Bear Market in Disguise?

Institutional players, like BlackRock (the bear in a top hat), deposited 4,880 BTC ($467M) and 54,730 ETH ($176M) into Coinbase. Whale watchers gasped. 🐋

BlackRock deposits 4,880 $BTC and 54,730 $ETH into Coinbase. Is this a prelude to selling-or a midlife crisis? 🤷♂️

– Whale Insider (@WhaleInsider) November 17, 2025

This is the second such move this month. Last time, the market dipped like a soufflé in a hurricane. Now, Bitcoin hovers near $104K. Sub-$100K next? Kyle Doops asks. We all hold our breath. 🫁

“Could be rebalancing,” someone muttered. Yes, or a prelude to a bloodbath. Either way, prepare your emergency cash. 🚨

Institutional moves may amplify swings, turning crypto into a carnival ride with no seatbelts. Fasten your wallets! 🎢

Is Bitcoin digital gold? A high-risk gamble? Perhaps both? The answer lies in the tea leaves-or a crystal ball. 🌟

2026’s crypto fate hinges on retail flows, ETFs, and macroeconomic whims. Young investors, with their crypto ETF allocations, may bring growth and chaos. A portfolio strategy? Essential. Or futile. 🎲

Charts of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of November 14 | Pre-Market Overview |

| Strategy (MSTR) | $199.75 | $200.01 (+0.13%) |

| Coinbase (COIN) | $284.00 | $284.44 (+0.15%) |

| Galaxy Digital Holdings (GLXY) | $26.34 | $26.30 (-1.15%) |

| MARA Holdings (MARA) | $11.99 | $12.05 (+0.50%) |

| Riot Platforms (RIOT) | $13.95 | $13.96 (+0.072%) |

| Core Scientific (CORZ) | $14.93 | $15.01 (+0.54%) |

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- USD KZT PREDICTION

- EUR KRW PREDICTION

- PI PREDICTION. PI cryptocurrency

2025-11-17 17:59