Markets

What to know:

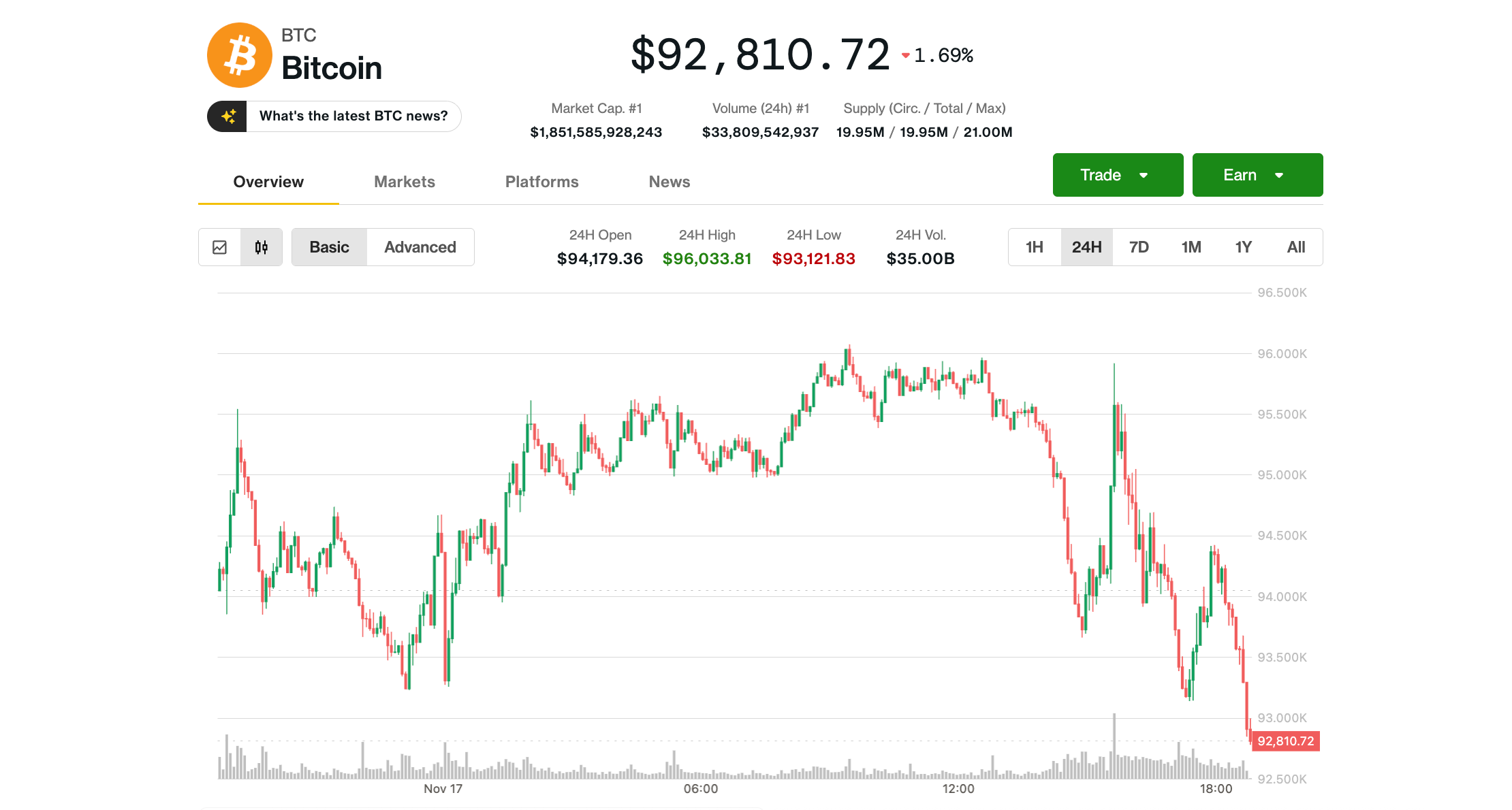

- Bitcoin, that elusive specter of digital dreams, now lies prostrate beneath the weight of $93,000, a six-month low that whispers of forgotten triumphs. 🧠📉

- The economy, that fickle lover, has grown stronger, casting doubt on the Fed’s promises of rate cuts, which now seem as distant as a summer’s first snow. ❄️💸

- Bitfinex analysts, those modern-day prophets, foresee a local bottom-though one might wonder if they’ve mistaken a mirage for a mountain. 🌅🔮

Bitcoin, that mercurial dancer, stumbled to a fresh six-month low on Monday, its steps faltering as crypto sentiment, that fragile bird, took flight into the abyss. 🦋💸

After a fleeting rebound from overnight lows, BTC-oh, how familiar this tale is-resumed its descent in the U.S. session, falling to $92,500. A 2.4% drop in 24 hours, a 13% tumble in a week. The largest crypto now wears a crown of thorns, erasing all 2025 gains and 27% from its October zenith. Ether, that loyal companion, hovers above $3,000, yet even it cannot escape the shadow of 2% losses. 🕳️💔

The bearish plague spread to crypto-related equities, those once-golden children of innovation. Coinbase, Circle, Gemini, and Galaxy-oh, how they weep! Their values plummeted 7%, while companies tethered to digital treasuries, like Strategy (MSTR) and BitMine (BMNR), sank like stones in a metaphorical pond. Solana-linked Upexi (UPXI) and Solana Company (HSDT) joined the descent, their shares dancing to a mournful tune. 🎶📉

Yet, the miners, those steadfast builders of digital cathedrals, found solace in the embrace of AI and high-performance computing. Hive Digital (HIVE) leaped 10% on news of a Dell Technologies partnership, while IREN (IREN) and Hut 8 (HUT) posted modest gains. A flicker of hope in a sea of despair? Or just a mirage? 🧠🚀

Diminishing chance for Fed rate cut

The government shutdown, that bureaucratic specter, has left the markets in a fog, making even the most obscure reports feel like prophecies. 🧙♂️🔮

This morning’s Empire State Manufacturing Survey, that unexpected spark, surged to 18.7, a number that has the Fed’s dance with the markets, a tango of uncertainty, now leaning toward stasis. Polymarket traders now bet 55% on a rate hold, while the CME FedWatch Tool whispers 60%. A coin toss, perhaps, but the market, ever the gambler, bets on both. 🎲📈

CoinDesk’s James Van Straten, that astute observer, notes a technical headwind: Bitcoin futures on the CME opened at $93,840, leaving a gap to $91,970 from April-a chasm that may yet swallow the brave. 🧭📉

Meanwhile, Bitfinex analysts, those sages of the crypto realm, suggest the market is nearing a threshold. “Sustainable bottoms,” they muse, “form only after short-term holders capitulate.” A poetic notion, if one ignores the tears of the desperate. 🧡💸

They add that this is the third-largest pullback since 2023, a tale as old as time. Yet, they dare to whisper, “a local bottom could form relatively soon.” A promise, perhaps, or a cruel joke? 🤔💸

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- STX PREDICTION. STX cryptocurrency

- USD KZT PREDICTION

- EUR KRW PREDICTION

2025-11-17 22:33