Ah, another week in the abyss of human folly and financial madness! The markets, like a tormented soul in the depths of despair, have once again plunged into the abyss. Bitcoin, that proud titan of the digital realm, has fallen from its lofty perch, crashing toward the $80,000 mark with the grace of a drunkard stumbling down a staircase. 🥃💸

Rewind, if you will, to the fateful Friday past, when the world was already awash in the tears of investors. Bitcoin, once the darling of the crypto sphere, had lost its grip on the $100,000 summit, tumbling below $95,000-a level not seen since the halcyon days of late April. The bears, those voracious beasts of the market, had taken control, driving the price southward with relentless ferocity. 🌪️🐻

A brief respite came over the weekend, as the asset flirted with $96,000, only to be dragged back into the abyss by the merciless claws of the market. By Tuesday, the price had slipped below $90,000, a level that held-for a moment. But hope, like a fragile candle in the wind, was swiftly extinguished. By Wednesday, BTC had plunged to $88,000, and by Thursday, it had fallen further to $86,000. A minor rebound to $88,000 was but a fleeting illusion, as the bears returned with renewed vigor, driving the price to just over $80,000-the lowest since April. 🕯️💔

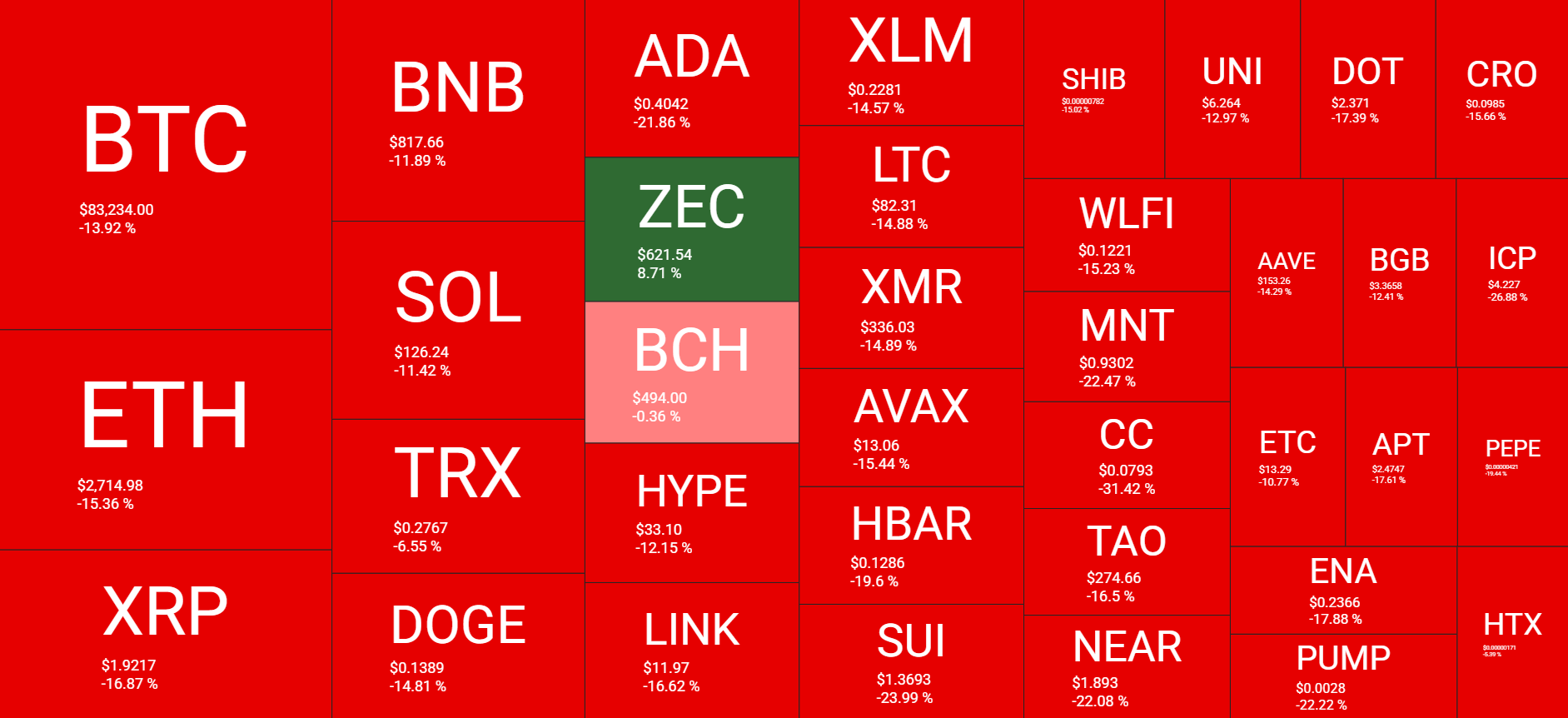

In the midst of this calamity, a glimmer of hope emerged. The New York Fed President, John Williams, hinted at the possibility of interest rate cuts, a beacon of light in the darkness. BTC rallied to $85,000, but the momentum was short-lived. Like a dying ember, it flickered and faded, leaving the asset at $83,000-a painful 14% weekly loss. The larger-cap alts, those faithful companions in misery, followed suit, with ETH, XRP, DOGE, LINK, and HYPE all charting similar declines. Only ZEC, that lone rebel, managed a 9% gain, a defiant middle finger to the market’s despair. 🤡📉

Market Data

Market Cap: $2.935T | 24H Vol: $307B | BTC Dominance: 56.6%

BTC: $83,200 (-14%) | ETH: $2,715 (-15%) | XRP: $1.92 (-17%)

The Week’s Farce: Crypto Headlines You Can’t Ignore

XRP ETF Debut: A Tale of Two Funds 🎭. Amid the market’s chaos, Ripple’s XRP saw the launch of its second ETF in the US. Bitwise’s XRP debuted on Thursday, but its performance paled in comparison to Canary Capital’s XRPC, which had stolen the spotlight the week prior. A battle of egos and algorithms, indeed. 🏆💼

Bitcoin’s Crash: Liquidations and Whales 🐳💥. As BTC plummeted, over $1 billion in longs were liquidated, with even the infamous Andrew Tate feeling the sting. Meanwhile, an OG whale dumped $1.3 billion worth of BTC in just over a month, a move as subtle as a sledgehammer. Yet, on-chain data revealed a resurgence in whale buys during the initial correction, with over 100,000 transactions worth more than $100,000. A game of thrones, played out in the digital realm. 👑🐋

Kraken’s Bold Move: IPO Filing and Funding 💼💰. Kraken, the crypto exchange, made waves this week by securing $800 million in funding and submitting a confidential IPO filing with the US SEC. A power play in a sea of uncertainty. 🦑📈

Peter Schiff’s Taunts: Bitcoin vs. Gold 🏆✨. As BTC fell, Peter Schiff emerged from the shadows to gloat, claiming Bitcoin’s losses were worse when compared to gold. A never-ending feud, as tiresome as it is predictable. 🤹♂️🥇

Saylor’s Strategy: Buying the Dip 🛒💎. Amid rumors of a sell-off, Saylor’s Strategy defied expectations by purchasing 8,178 BTC for over $835 million, its largest buy since July. A move as bold as it is baffling. 🧙♂️📈

Charts: A Glimpse into the Abyss 📉

For a deeper dive into the charts of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid, click here. But beware-the abyss gazes back. 🕳️👁️

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- CNY JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- POL PREDICTION. POL cryptocurrency

- GBP RUB PREDICTION

- PI PREDICTION. PI cryptocurrency

2025-11-21 19:15