In a spectacle that would make even the most stoic turn to fortune-telling, on-chain data reveals an unseemly surge in the inflow of Bitcoin and Ethereum to the tune of a staggering $40 billion. One might wonder whether the market’s recent tumble has inspired investors to hoard or hastily abandon ship amidst the doldrums.

Bitcoin & Ethereum’s Seasonal Fest of Deposits: A Week in Fervor

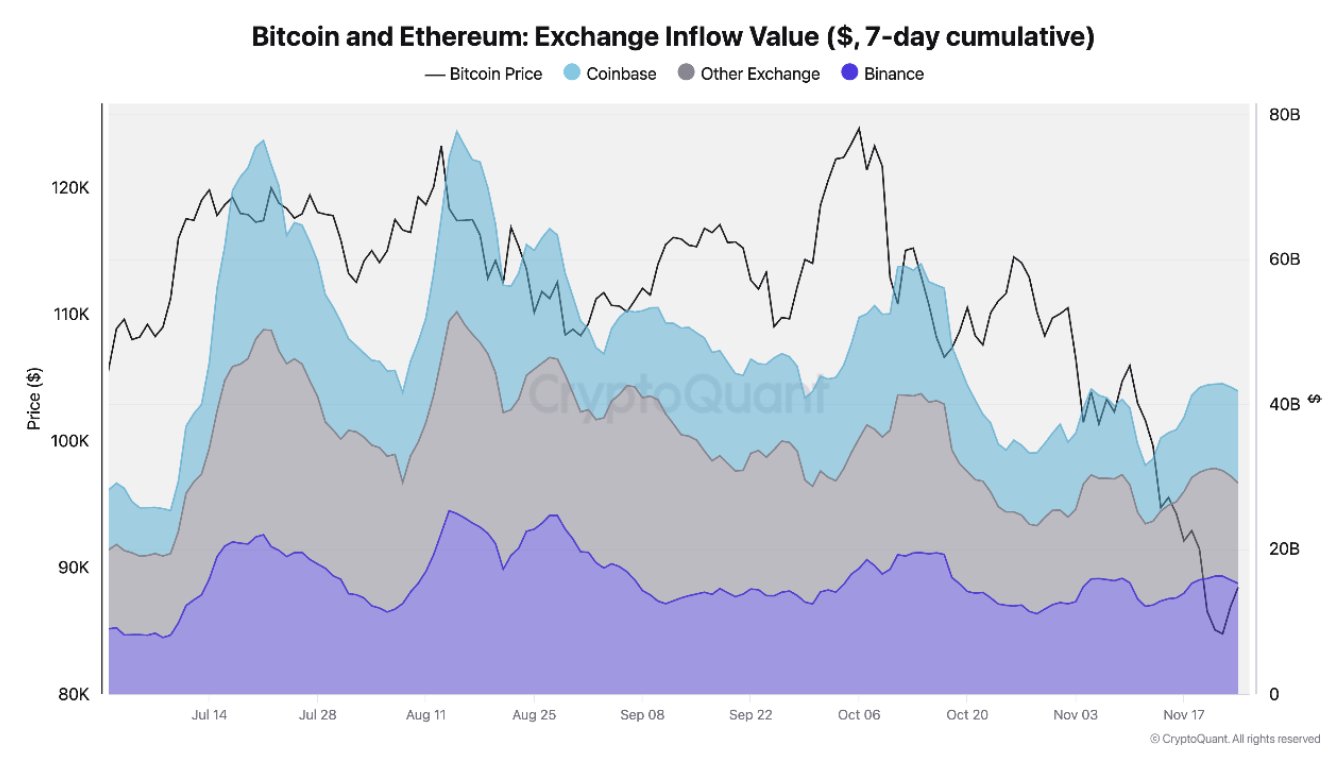

CryptoQuant, the so-called oracle of digital fortunes, has taken to X to elucidate the latest developments in exchange inflows. Here, “Exchange Inflow” is a fine term for the deposit of assets-primarily USD equivalent-into wallets linked to the all-important centralized exchanges. The message is clear: when this figure gallops higher, investors are either preparing for a wild sale or hopelessly entranced by the siren call of trading opportunities.

When the numbers reach such feverish heights, it typically signifies a mass exodus from HODLing to the frantic world of buy-and-sell-perhaps in pursuit of the latest quick profit or an urge to cut losses. The recent chart, which looks suspiciously like a rollercoaster, illustrates a 7-day cumulative influx of Bitcoin and Ethereum that has soared past $40 billion. A clear sign, dear reader, that some are betting on a vibrant market-or on chaos itself.

Judging by the graph, it’s obvious these deposits played a hand in the recent market downturn-some would say they helped fuel the crash, while others might suggest it’s just the season for a good old-fashioned shake-up.

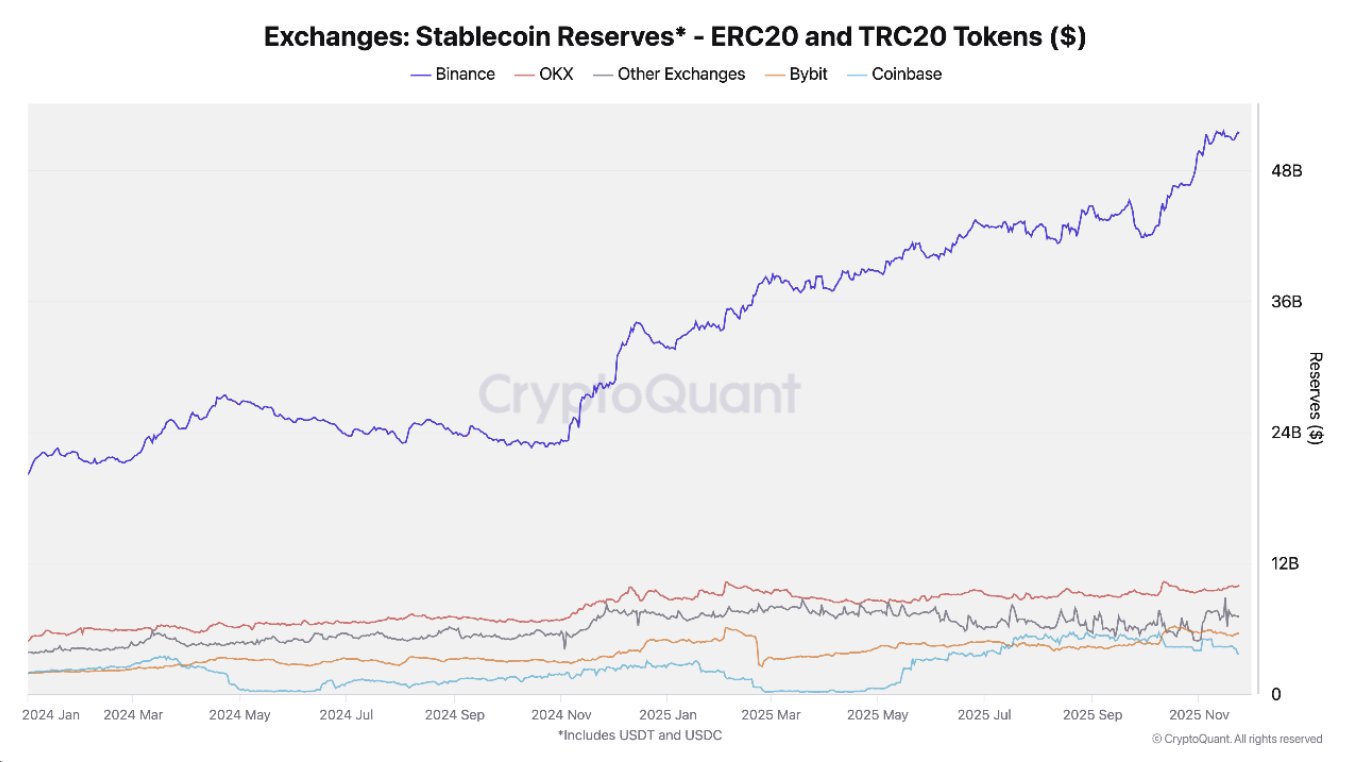

Stablecoins Join the Circus, but with a Flair

Not to be outdone, stablecoins-those supposed bastions of stability-have also entered the fray. However, unlike Bitcoin and Ethereum, their movement across exchanges is about as consistent as a drunken sailor. Binance, in particular, seems to have taken the lead with stablecoin reserves hitting a new high of $51.1 billion-history in the making, or perhaps just a testament to traders’ indecision.

This influx of stablecoins might seem like a sign of market hesitance; many traders deploy these tokens to swap for the more volatile counterparts-Bitcoin, for example-when they’re feeling particularly brave or reckless.

So, while Bitcoin and Ethereum’s inflows suggest a market in distress, the stablecoin deposits could be an optimistic-if cautious-gesture towards future volatility.

Bitcoin’s Steady Rise: The Digital Gold Keeps Climbing

As we speak, Bitcoin is lounging comfortably at around $90,000-up over 2% in a week, proving once again that in crypto, what goes down must come up, or at least have a good bounce.

In sum, whether this frenzy portends another epic rollercoaster ride or a fleeting blip, only time will tell. But one thing remains certain: in the world of crypto, patience is a virtue, and panic is a profitable distraction. Stay tuned-this show is far from over.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- GBP CNY PREDICTION

- USD VND PREDICTION

- Brent Oil Forecast

- POL PREDICTION. POL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- EUR KRW PREDICTION

2025-11-27 12:34