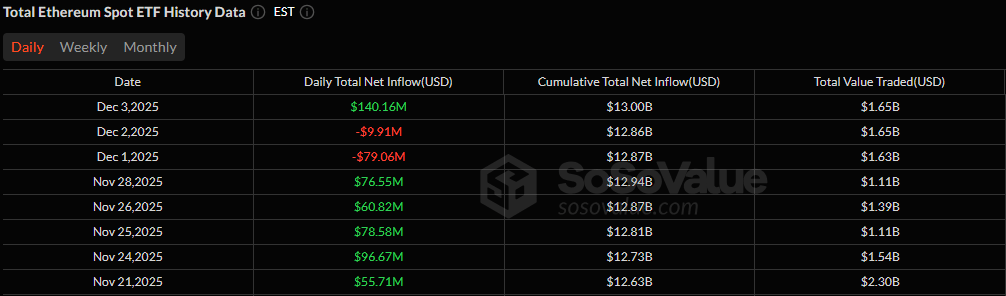

In the grand theater of cryptocurrency, the curtain rose on Dec. 3 to reveal a tempestuous resurgence of Ether exchange-traded funds (ETFs), which swelled by $140 million in a single day-a veritable feast for investors-while Bitcoin and Solana, once the darlings of the market, found themselves cast in the role of tragic heroes, their fortunes ebbing like the tide. The dance of capital had turned into a waltz of withdrawal, and the audience, ever fickle, applauded the new star.

Bitcoin and Solana Turn Red as Ether Roars Back

Some days in the ETF market feel as though the heavens have decreed a cosmic reset, and Wednesday, Dec. 3, was such a day. After nearly a week of harmonious inflows, the crypto symphony fractured into dissonance. Bitcoin, the old lion, found its paws tangled in the rug of misfortune, while ether, the nimble fox, darted forward with unbridled vigor. Solana, once the golden child, stumbled like a drunkard after weeks of unbroken triumph-a rare and mortifying spectacle.

Bitcoin ETFs, which had stubbornly clung to five consecutive days of inflows like a miser to his gold, finally succumbed to the inevitable with a $14.90 million outflow. The culprit? A $37.09 million exodus from ARK & 21Shares’ ARKB, a $19.64 million retreat from Grayscale’s GBTC, and a paltry $411.53K from the Bitcoin Mini Trust. Blackrock’s IBIT, the market’s feeble knight, valiantly countered with $42.24 million, but even this chivalry could not rescue the category from the abyss. Trading activity, however, remained a healthy $4.22 billion, and net assets held firm at $121.96 billion-proof that the market, like a drunkard’s walk, stumbles but never falls.

If Bitcoin paused, ether leapt forward like a hare from a fox’s path. The category delivered a forceful $140.16 million inflow, a crescendo of capital that would make even Beethoven weep. Blackrock’s ETHA led the charge with $53.01 million, while Fidelity’s FETH added $34.38 million. Grayscale’s ETHE and its Mini Trust contributed $27.57 million and $20.72 million respectively, and Bitwise’s ETHW, the smallest of the pack, chipped in $4.48 million. With $1.65 billion in trading volume and net assets soaring to $19.70 billion, ether basked in the glory of its unassailable reign. 🚀

Solana ETFs, however, faced a reckoning. What began as a modest $5.57 million inflow into Bitwise’s BSOL, $1.66 million into Fidelity’s FSOL, and $1.55 million into Grayscale’s GSOL was undone by a catastrophic $41.79 million exodus from 21Shares’ TSOL. The result? A $32.19 million net outflow that shattered Solana’s streak of good fortune. Yet, trading volume remained lively at $32.72 million, and net assets clung to $915.08 million-proof that investor conviction, like a moth, flutters toward the flame but dares not burn. 🔥

FAQ📊

- Why did Ether ETFs surge while others fell?

Investors, with the fickleness of a summer breeze, rotated back into ETH, bestowing it with one of the strongest inflow days in weeks. 🌬️ - What caused Bitcoin ETFs to slip into outflows?

ARKB and GBTC, the market’s traitors, drained $37.09 million and $19.64 million respectively, leaving even IBIT’s $42.24 million inflow to feel like a pebble in the ocean. 🌊 - Why did Solana ETFs turn negative after weeks of gains?

TSOL, the black sheep of the family, orchestrated a $41.79 million exodus that drowned out the smaller inflows of its cousins. 🐑 - Does this shift signal a change in market sentiment?

Indeed! Investors, ever the dramatists, have temporarily cast ETH in the leading role while BTC and SOL take a bow in the shadows. 🎭

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR AUD PREDICTION

- Silver Rate Forecast

- POL PREDICTION. POL cryptocurrency

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- EUR RUB PREDICTION

2025-12-04 22:14