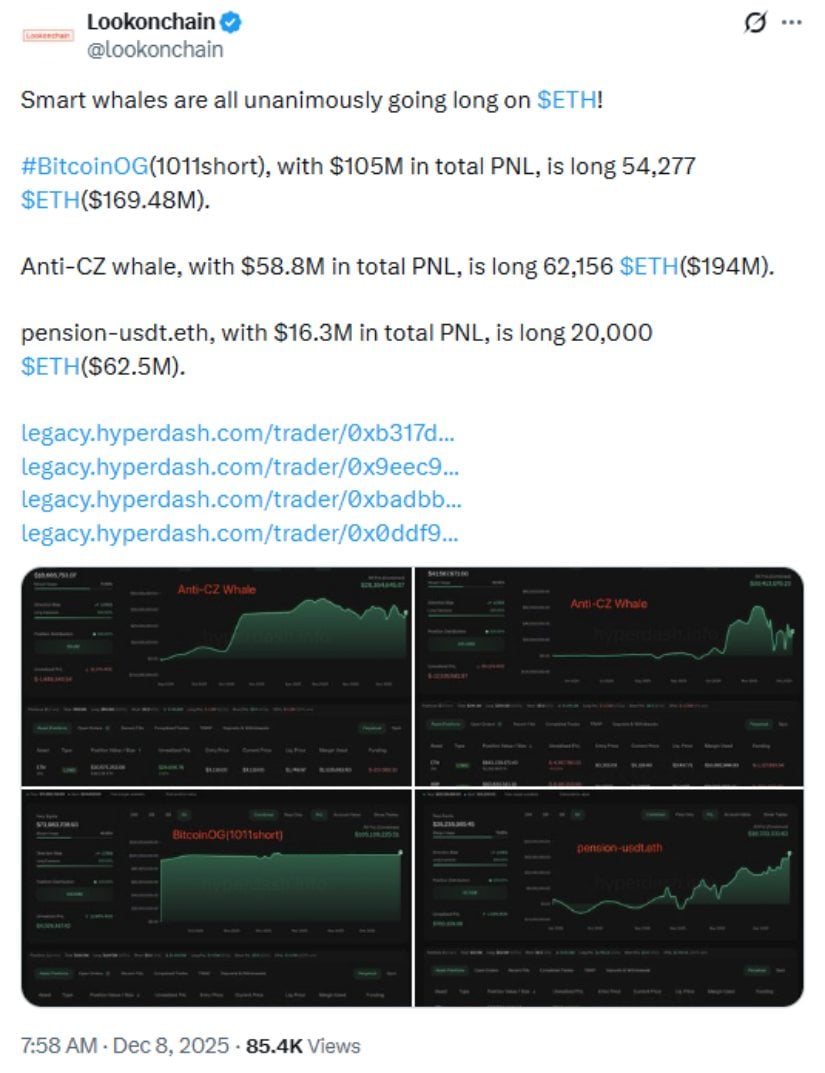

Out there in the digital dust, where fortunes rise and fall like the wind over the prairie, Ethereum clings to $3,100 like a stubborn tumbleweed. The charts whisper tales of Head-and-Shoulders patterns and Fair Value Gaps, while whales-great digital leviathans-swoop in to hoard ETH like it’s the last drop of water in a drought. BitMine, that modern-day prospector, scooped up 138,452 ETH last week, now clutching 3.86 million tokens. That’s 3.2% of the circulating supply, folks-enough to make even Michael Saylor raise an eyebrow. 🐋💸

Institutional Cowboys Stake Their Claim

Thomas Lee, BitMine’s chairman, claims they’re buying because “catalysts” are coming. Sure, Tom. We’ve heard that one before. Ethereum’s Fusaka upgrade, Fed rate cuts, and “adoption trends” are the holy trinity here. Meanwhile, SharpLink Gaming and The Ether Machine sit on their hoards like dragons guarding gold. On-chain analytics? More like digital crystal balls. 📊🔮

“Our hearts are full of confidence,” Lee declared, which is just Wall Street code for “we’re gambling too.” But hey, when you control 3% of the supply, maybe you’ve got a right to be cocky. Or maybe you’re just the first to fall when the music stops. 🎼📉

The Great Chart Circus: H&S and FVGs

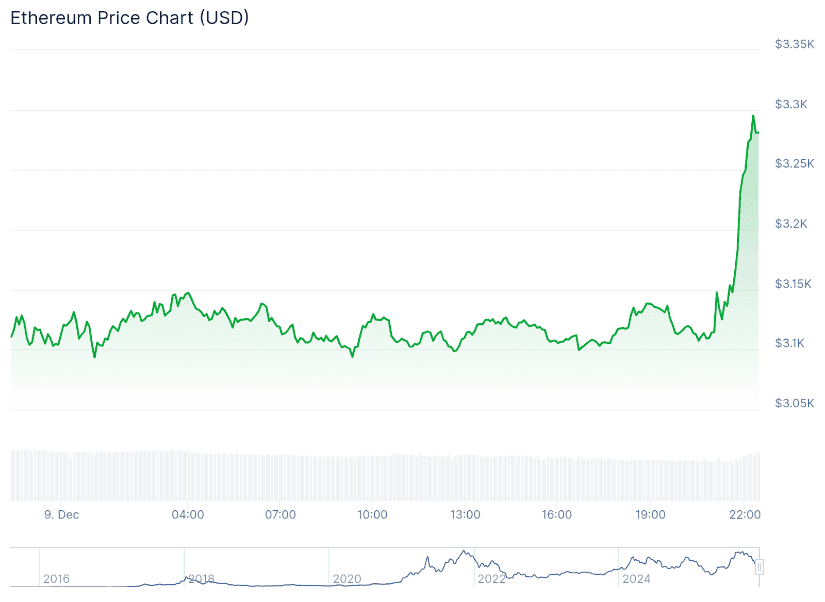

On the 4-hour chart, Ethereum’s Head-and-Shoulders pattern looms like a ghost town showdown. The right shoulder grazes $3,100, while the neckline plummets to $2,500. Analyst Pepesso warns: break below, and it’s a 40% drop to $2,000. But crypto markets aren’t the NYSE-they’re more like a saloon brawl, where technical patterns get shot before they can speak. 🔫📉

Yet hope flickers in the Fair Value Gap ($2,600-$2,800), a zone where buyers once rallied like farmers rushing to save a barn in a storm. Crypto educator Ali Charts calls it a “potential floor,” though floors have a habit of collapsing when you lean on ’em. 🏚️📉

-

RSI: Testing neutrality. If it rises, maybe bullish? Maybe.

-

Stochastic oscillator: Nears overbought. Cross it, and recovery might accelerate. Or not.

-

Moving Averages: Resistance at $3,250-$3,470. Classic.

Swing-Trading for the Apocalypse 🌪️📉

Swing traders eye $3,100-$3,150 like it’s a mirage in the desert. “Buy dips,” they say, “but only if RSI stabilizes!” Intraday? Retests of $3,150 might signal momentum. Or it might signal a trap. Scalpers watch $3,100-$3,110 for “reversals.” Translation: pray for a miracle. 🙏📉

2025: The Year of the ETH Gamble 🎲

Analysts call the outlook “cautiously optimistic,” which is finance-speak for “we have no idea.” Bulls dream of $3,470 or even $4,800. Bears? They’re packing parachutes for $2,000. Key risks: the Fed, volatility, and the fact that technical patterns are about as reliable as a screen door on a submarine. 🐠🚪

Final Verdict: Don’t Trip on the Moon 🚀🌕

Ethereum hovers near $3,100, a tightrope walker juggling whale orders and technical witchcraft. Buy the dip? Sell the rip? Just don’t trip on the moon, partner. 🤠💔

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD MYR PREDICTION

- CNY JPY PREDICTION

- EUR RUB PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- PI PREDICTION. PI cryptocurrency

2025-12-09 22:10