It seems that GameStop’s daring Bitcoin bet, made earlier this year, is starting to feel the effects of Bitcoin’s infamous mood swings. The retailer’s Q3 report shows that their $500 million BTC purchase from May now sits at a modest $519.4 million-after briefly flirting with $528.6 million back at the end of Q2. A rollercoaster, no doubt, but one with a very expensive ticket. 🎢

To add some drama to the mix, the unrealized profit of a mere $19 million comes after the company took a hit of $9.4 million when Bitcoin’s value plummeted to a meager $80K. Oh, the thrill of investing in a volatile asset. GameStop, however, confirmed that it didn’t make any further buys or sales during Q3. Maybe they were too busy playing Call of Duty to bother with Bitcoin. 🎮

BREAKING🚨 GameStop Posts $77.1M Q3 Profit On $821M Revenue

Bitcoin Holdings Reach $519.4M $GME

– X Market News🚨 (@xMarketNews) December 9, 2025

Bitcoin’s Rally and GameStop’s Bold Bet

Bitcoin’s surge in 2025? Oh, that’s all thanks to President Donald Trump’s surprise love affair with crypto and a significantly lighter regulatory leash. GameStop, always eager to join the fray, has partnered with some pretty big names, including MetaPlanet, Trump Media & Technology Group, and Strategy. We’re not saying they’re riding the crypto wave, but it sure looks like they’re trying to surf it like pro’s on their first lesson. 🏄

Let’s not forget that the largest DAT company, Strategy, is now worth less than its own Bitcoin holdings. Which is, well, slightly ironic, don’t you think?

In a delicious twist, GameStop’s BTC position took a hit after the October 10 crypto crash wiped out a staggering $19 billion in leveraged trades. Oops. 💸

Despite all that, GameStop posted adjusted earnings of $0.24 per share, comfortably beating expectations of $0.20 and a far cry from last year’s $0.06. But the revenue? Let’s just say it didn’t quite hit the mark, coming in at $821 million instead of the anticipated $987.3 million, a 4.6% year-over-year decline. Oh dear.

On the bright side, cost-cutting did wonders, with SG&A expenses dropping from $282 million to $221.4 million. This helped the company land a neat $52.1 million in adjusted operating income. So, maybe there’s hope for GameStop after all! 😅

The Short-Term Holders Are Definitely Not Having a Great Time

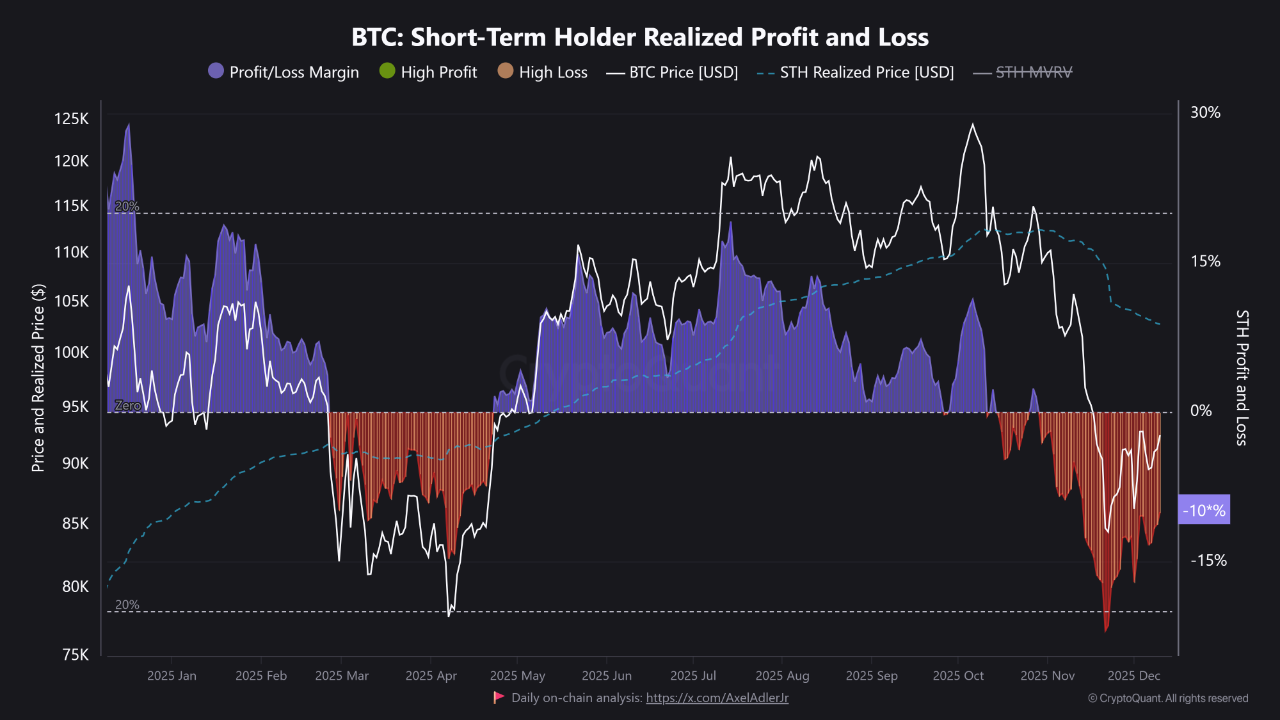

Now, it’s time to talk about the poor souls holding onto Bitcoin in the short term. According to CryptoQuant data, they’re sitting on some of the worst losses of 2025. Many of the recent buyers are feeling the pain, with the average recent buyer now watching their investment slowly sink below its cost basis. Ouch! 😬

Bitcoin short-term holder realized profit and loss. | Source: CryptoQuant

And let’s not forget that this short-term pain is keeping the selling pressure high, which, in turn, is preventing Bitcoin from breaking cleanly above the $90,000 mark. Analysts suggest that these deep-loss phases tend to happen in the later stages of corrections. So, buckle up, folks! 🏎️

Will traders back off and reduce their risk, or will they dive back in and build new positions? The answer, it seems, depends on how much risk one can stomach. But don’t worry-there’s always that institutional interest to keep things interesting, with $151 million in BTC spot ETF inflows continuing to roll in. 💰

Read More

- EUR USD PREDICTION

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- USD MYR PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- USD KZT PREDICTION

- EUR RUB PREDICTION

2025-12-10 23:59