In an unexpected twist that could send shockwaves through the world of Bitcoin, a tiny experiment in Prague might actually matter more than the usual ETF numbers that everyone pretends to care about.

On December 10th, during an appearance on “Crypto In America,” Coinbase’s Head of Institutional John D’Agostino gave the world something to think about. The Czech National Bank is testing Bitcoin in its national treasury and for payments. Yep, you read that right – Bitcoin. And D’Agostino believes this could spread like wildfire across the Eurozone. Hold on to your wallets!

Could the Czech Republic Be the First Domino in a Bitcoin Eurozone?

“The Czech national bank really knows how to pick their partners,” D’Agostino quipped, adding that they’re not just messing around with pocket change here – they’re experimenting with Bitcoin for real. And this is no half-baked venture – they’re playing with real dollars (well, a million of them, but who’s counting?)

Now, for those of you who were hoping for some world-shaking plot twist, hold on. D’Agostino was quick to clarify: this isn’t some last-ditch attempt by a struggling nation to get its economy back on track. “No disrespect to El Salvador,” he said, “but this isn’t a ‘I’m going to shake things up because I’m in deep trouble’ move.” This is more like, “Hey, we’re stable, and we don’t need to do this – but we’re doing it anyway.” Major flex.

And the way they’re doing it? Not some fly-by-night crypto experiment, folks. It’s all formal – RFPs, vendor selection, adoption into policy. A textbook case of “How to Make Crypto Look Boring and Totally Legit.” The kind of move that has the potential to make the status quo break into a cold sweat. “This kind of thing is contagious,” D’Agostino said, with a sly smile. And you know what? I could totally see more Eurozone countries hopping on the Bitcoin bandwagon.

Throughout the interview, D’Agostino kept hammering his point – institutional adoption of Bitcoin isn’t about having everything perfectly regulated (don’t get your hopes up about clarity, folks). It’s about liquidity, market structure, and getting the right players in the game. Basically, if you’ve got money and you’re looking for a way to make more, forget about the red tape. People will find a way.

He even took a shot at the whole “lack of regulatory clarity” excuse. “Clarity’s important, sure, but it’s not the only thing that matters,” he said. The real magic happens when you’ve got liquidity and a “solid” market behind you. But don’t worry, Bitcoin’s got that covered. Those shiny new spot ETFs are doing all the heavy lifting. Forget the wild ride of volatility – they’re here to stay.

And let’s talk about that central bank again. What’s it doing putting Bitcoin on its balance sheet? It’s not a reckless gamble – it’s more like a sneaky little test to see if it could be the next big thing in the financial world. And when a Eurozone central bank starts playing with Bitcoin like it’s Monopoly money? That’s when the rest of the financial world starts to sit up and take notice.

As D’Agostino put it, the crypto world’s reputation has taken a hit, but it’s no worse than any other market. “We have jokers, they have jokers,” he said. “The difference is that in traditional finance, they’re better at hiding their clowns.” Touché, Mr. D’Agostino. Touché.

So, what does this all mean? According to D’Agostino, institutional adoption isn’t about some big, dramatic crash – it’s more like a slow erosion. No tidal wave of crypto adoption is coming. Instead, we’re looking at a steady creep, bit by bit, until one day it’s just… normal. So don’t expect the Bitcoin revolution to happen overnight – but do expect the Eurozone to quietly start buying up Bitcoin like it’s going out of style.

If the Czech experiment catches on, we might soon see Bitcoin as a real fixture in the heart of Europe’s financial system. And that, my friends, is a game-changer.

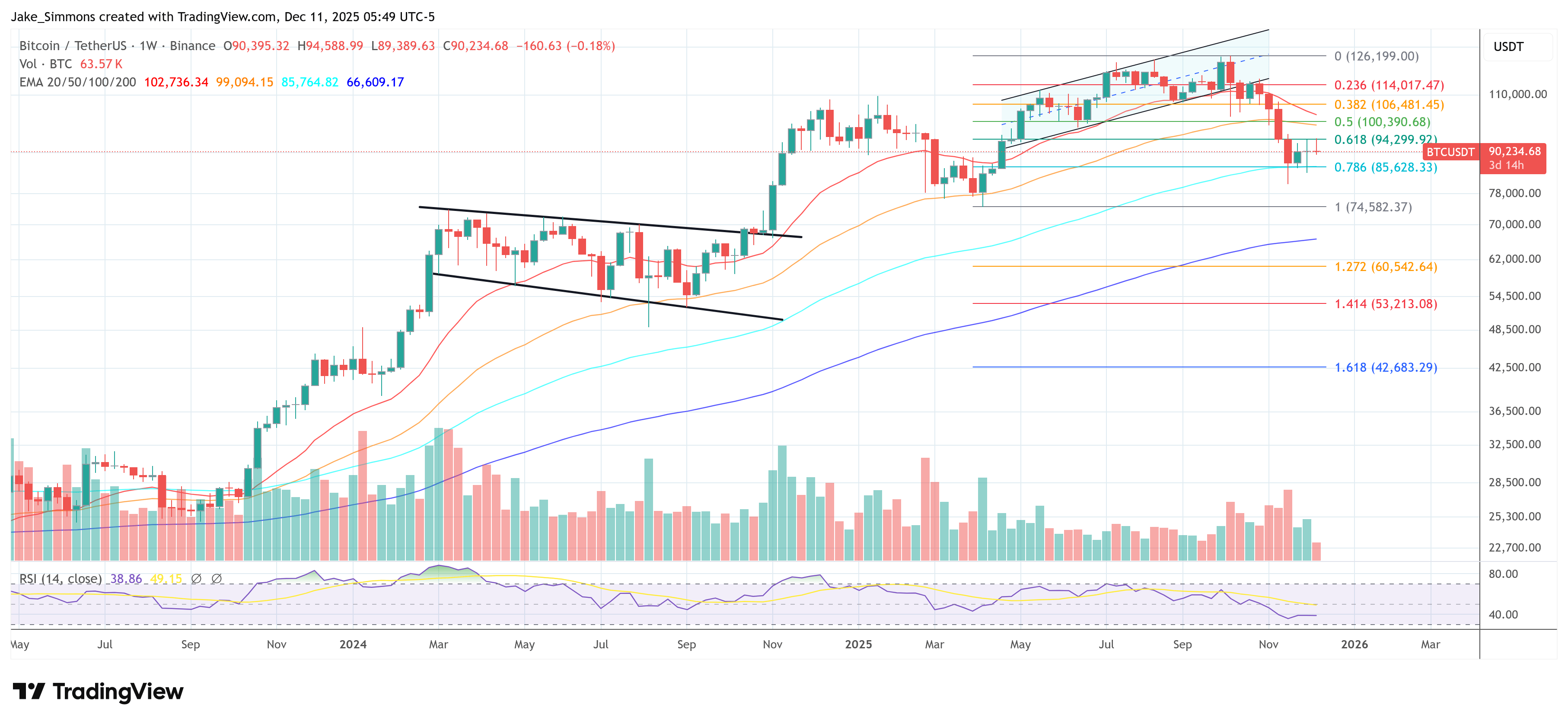

At press time, BTC was trading at $90,234. So, you know, not bad for a “volatile” asset.

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- CNY JPY PREDICTION

- GBP CNY PREDICTION

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- USD KZT PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

2025-12-11 14:23