ASIC, in a moment of unexpected leniency, has loosened its grip on the once-restricted realm of stablecoins and wrapped tokens. 🧠💰

Australia’s securities regulator (ASIC) has unveiled new rules that, in a rare act of mercy, aim to simplify the labyrinthine processes for companies dealing with stablecoins and wrapped tokens. 🚨

ASIC claims this is a “simpler path” for businesses, though one might wonder if it’s merely a more efficient way to tighten the noose. 🕵️♂️

The previous rules, it seems, were a veritable gauntlet of bureaucratic hurdles, with costs soaring like a crypto bubble and compliance demands stifling innovation. 📉

In other words, the latest announcement is a thinly veiled attempt to let firms grow while still keeping users in a state of perpetual vigilance. 🧍♂️

Why ASIC Removed Separate Licensing Requirements

ASIC, ever the master of bureaucratic sleight of hand, declared that intermediaries no longer need separate licenses for these “products.” 🧩

The old rules, they argue, overlapped with existing licenses, creating delays and costs that were, ironically, “frequent.” 🔄

One can only imagine the relief of operators who now face fewer obstacles-though the price of progress is always steep. 🧨

🚨BREAKING: 🇦🇺Australia now classifies stablecoins and wrapped tokens as financial products, requiring providers to obtain a license.

– Coin Bureau (@coinbureau)

Australia introduces new stablecoin and wrapped token rules. The new update reduces barriers, but only for those who can afford the “cost of freedom.” 💸

Companies can now add services or support new tokens without enduring the “joy” of long approval periods. 🚀

ASIC claims this is part of its plan to “guide” the sector with “clearer rules”-a phrase that now carries the weight of a thousand unspoken caveats. 📜

Omnibus Accounts Now Allowed for Stablecoin Services

ASIC approved the use of omnibus accounts, provided intermediaries maintain “accurate records.” A noble goal, if one ignores the irony of trusting corporations with such tasks. 🧾

These accounts allow companies to group customer holdings, reducing costs and increasing speed. A win for efficiency, a loss for transparency. 📈

ASIC notes that omnibus accounts are “common across global markets,” though one might question how “common” the trust in these systems truly is. 🌍

Companies can now manage reserves more efficiently-assuming they don’t accidentally lose them in the process. 🧨

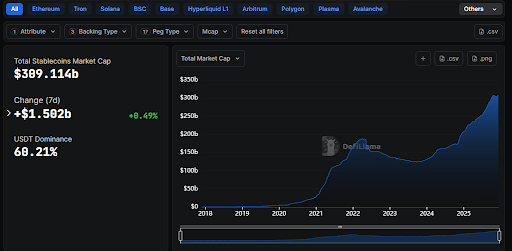

Stablecoin Demand Rises Worldwide

Total global stablecoin supply has surpassed $300 billion. A testament to human ingenuity… or perhaps desperation. 💸

Tether remains the titan of the market, dominating with a 60% share. A digital colossus, towering over the rest. 🏺

Australia’s update arrives as governments worldwide tighten their grip, demanding “strong oversight” and “transparent reporting.” A curious paradox, given the lack of transparency in the system itself. 🧩

ASIC claims the new exemptions align with their goal of “responsible growth,” a term that now feels as hollow as a cryptocurrency wallet. 💸

Related Reading: Australia Moves to Require Licenses for Crypto Platforms

How the New Bill Expands Oversight of Crypto Companies

Australia introduced the Corporations Amendment Digital Assets Framework Bill, a document so dense it could double as a doorstop. 📚

The bill sets new standards for digital asset platforms, requiring them to obtain licenses. A step toward “clarity,” though clarity often comes at the cost of freedom. 🚧

ASIC will oversee these platforms, ensuring they adhere to the “rules of the game.” A game where the rules are written by those who profit from the chaos. 🎯

The proposal, moving through Parliament, includes two new license classes. A bureaucratic feast for the initiated. 🍽️

Lawmakers claim this will create billions in productivity gains. A promise as empty as a crypto exchange’s promises. 💸

Supporters say this improves trust, though trust in this sector is as fragile as a house of cards in a hurricane. 🧱

Together, these changes form a “modern structure”-a structure that, ironically, feels more like a cage. 🧩

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Silver Rate Forecast

- CNY JPY PREDICTION

- GBP CNY PREDICTION

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- USD KZT PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

2025-12-11 18:37