Ah, the crypto market-a theater of human folly where fortunes are made and lost faster than a Dostoevsky character can contemplate existential despair. Recent on-chain data reveals that the Unrealized Loss in this digital circus has ballooned to a staggering $350 billion, with Bitcoin, the prodigal son of cryptocurrencies, contributing a hefty $85 billion to this tragicomedy.

The Bearish Descent into Unrealized Loss

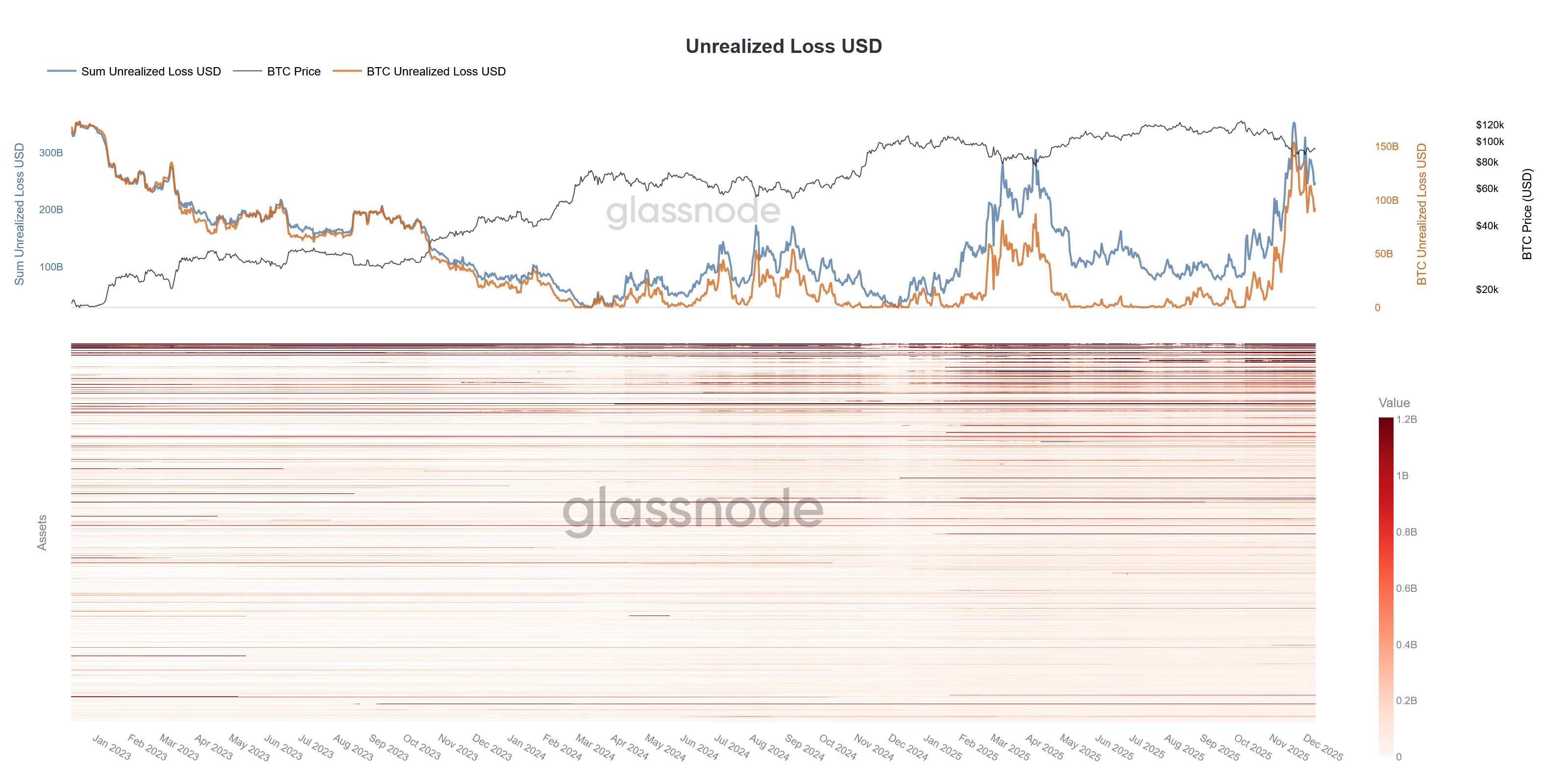

In a post on X (formerly Twitter, before it became a cesspool of memes and conspiracy theories), Glassnode, an on-chain analytics firm, shared the grim statistics of Unrealized Loss in the crypto sector. This indicator, as poetic as it is painful, measures the total loss investors are clutching onto like a drowning sailor clings to a plank.

The metric operates by delving into the transaction history of each token, uncovering the price at which it was last moved. If this price is lower than the current spot price, the token is deemed “underwater”-a term that conjures images of drowning investors flailing amidst a sea of red candles.

The Unrealized Loss sums up the collective misery of all coins held at a loss, while its counterpart, the Unrealized Profit, tracks the coins that have not yet betrayed their holders. Ah, duality-the eternal struggle of profit and loss, hope and despair, Svidrigailov and Raskolnikov.

Behold, a chart that captures the tragic trajectory of the Unrealized Loss for the crypto market and Bitcoin over the past few years:

As the chart eloquently illustrates, the Unrealized Loss surged dramatically following the market downturn since October. At its zenith, the indicator reached $350 billion for the entire market, with Bitcoin alone accounting for $85 billion. Such elevated levels of suffering could only be rivaled by the lamentations of Dostoevsky’s tortured souls.

With multiple on-chain indicators signaling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead.

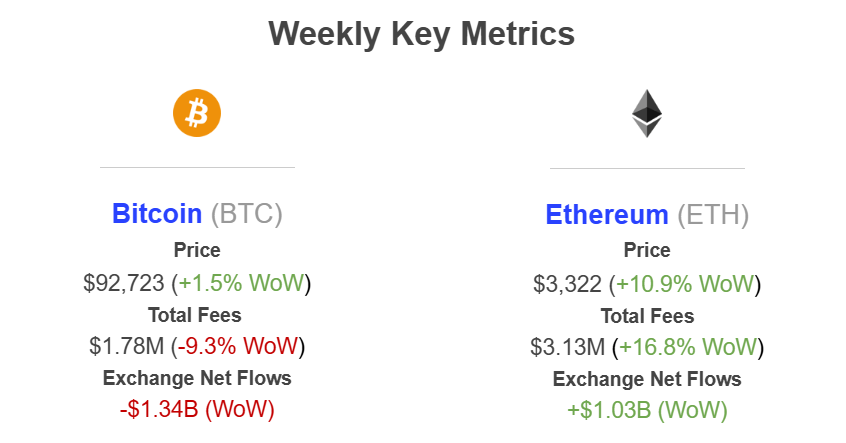

In other news, Bitcoin and Ethereum have displayed a curious divergence in their Exchange Netflow trends, as noted by Sentora, a provider of institutional DeFi solutions. A post on X revealed:

As depicted above, Bitcoin’s Exchange Netflow registered a significant value of -$1.34 billion over the past week-a negative figure indicating net withdrawals from centralized exchanges. Ethereum, on the other hand, saw a sharp positive value of $1.03 billion. Large inflows to exchanges often signal impending doom, as investors prepare to sell their digital treasures.

BTC Price: The Eternal Rollercoaster

Bitcoin, ever the mercurial protagonist, has once again failed to sustain its recovery above $92,000, retreating to the more modest $90,000. Such is the nature of this digital drama-hope, despair, and a touch of absurdity.

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- USD MYR PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-12-13 07:14