My dear, what a curious tangle of red tape and financial theatrics! Nubank, that cheeky fintech prodigy, now finds itself in a rather awkward waltz with Brazilian regulators. Why? Because, apparently, calling oneself a “bank” without the proper credentials is now a faux pas of the highest order. One might say it’s a bureaucratic ballet, and Nubank is twirling on the edge of a regulatory precipice. 🕺

Nubank’s Bank Acquisition Gambit: A Regulatory Pas de Deux?

The Facts

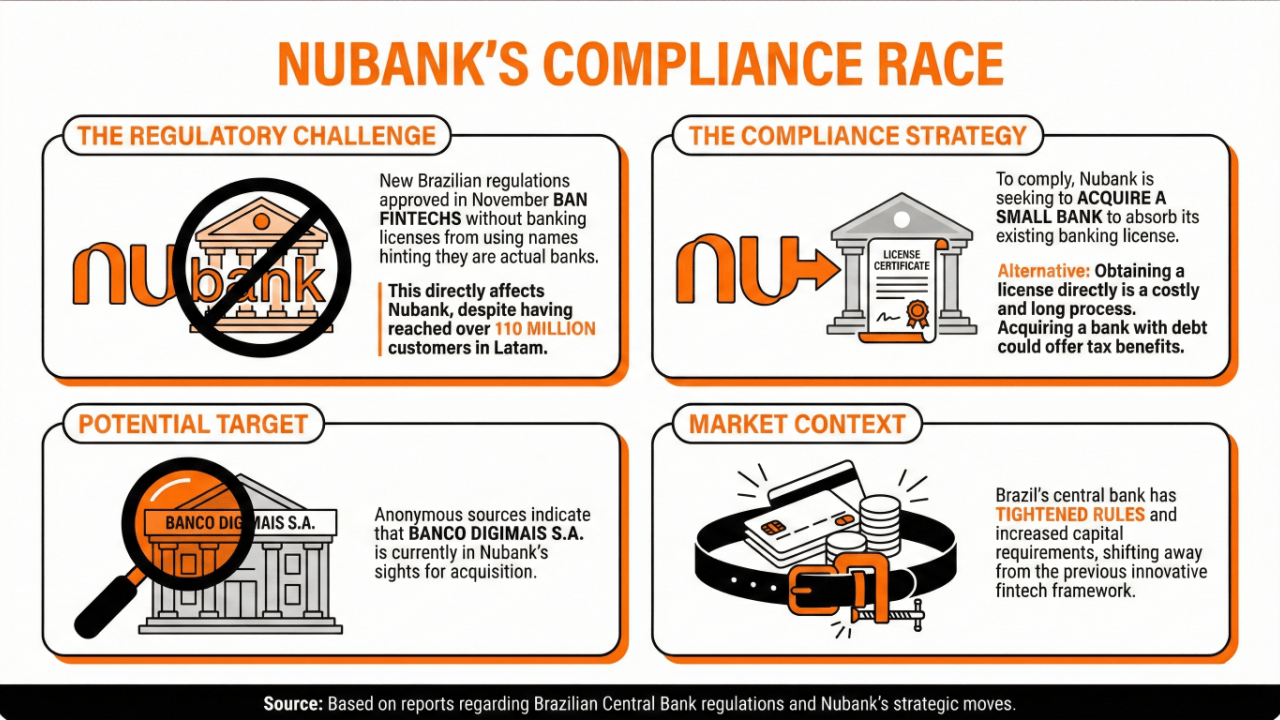

Nubank, Brazil’s fintech darling with 110 million customers (and a penchant for dramatic flair), now faces a new challenge: its name. You see, the Central Bank has decreed that fintechs may no longer masquerade as banks without a license. A rule that, one suspects, was written specifically with Nubank in mind. 😏

According to reports from last week, Nubank is now eyeing a small bank acquisition-not out of altruism, but to secure that elusive banking license. Imagine the audacity of it all! A fintech buying a bank to prove it’s a bank. Shakespeare would weep. 🎭

These new regulations, enacted in November, are as clear as mud. They prohibit fintechs from using names that “hint” at banking. A rule that, if taken literally, would require Nubank to rename itself “Nubank: Not a Bank, Really!” But perhaps the real joke is on the regulators. After all, who needs a license when you’ve got 110 million customers? 🤷♂️

Acquiring a bank, particularly one with debt, could be a tax-efficient romp for Nubank. But let’s not forget the alternative: obtaining a license directly. A process that could cost a small fortune and take years. A test of patience for a company used to moving at the speed of lightning. ⚡

Banco Digimais S.A., a financial institution with more drama than a telenovela, is rumored to be Nubank’s target. One can only imagine the boardroom conversations: “Shall we sell to Nubank or not? The stakes are high, my friends.” 🎲

Why It Is Relevant

This little regulatory kerfuffle isn’t just Nubank’s problem. It’s a domino effect waiting to happen. Smaller fintechs, lacking Nubank’s resources, may be forced to either change their names (a fate worse than death) or exit the market entirely. A consolidation play, perhaps? Only the financially robust will survive. 💼

Looking Forward

Brazil’s regulatory tightening is a masterclass in overcorrection. While it may protect consumers from confusion, it also risks stifling innovation. After all, who wants to spend years and millions just to prove they’re a “real” bank when they’re already running circles around traditional institutions? 🏃♂️💨

FAQ

-

Why is Nubank looking to purchase a small bank?

To obtain a banking license, of course! Or, as I’d call it, a bureaucratic loophole closer. 🚪 -

What do the recent regulations in Brazil entail for fintech companies?

They’re now banned from using names that “suggest” banking services. A rule that seems to have been written with a quill and a sense of irony. 🖋️ -

What potential benefits does Nubank see in acquiring a bank?

A license, tax advantages, and perhaps a bit of poetic justice. After all, who better to buy a bank than a fintech? 🔄 -

How might these regulations affect other fintech companies in Brazil?

They’ll either need to change their names (a fate akin to being uninvited from a party) or merge with giants like Nubank. The latter option, one suspects, is less popular. 🤝

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- CNY JPY PREDICTION

- EUR USD PREDICTION

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- POL PREDICTION. POL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- EUR BRL PREDICTION

2025-12-15 15:59