SDEX jumped more than 160% after Smardex announced its shift to the unified protocol, which merges a DEX, lending market and perpetual-style trading into a single smart contract and liquidity pool. 🧙♂️✨

A Unified Architecture for Capital Efficiency 🧾

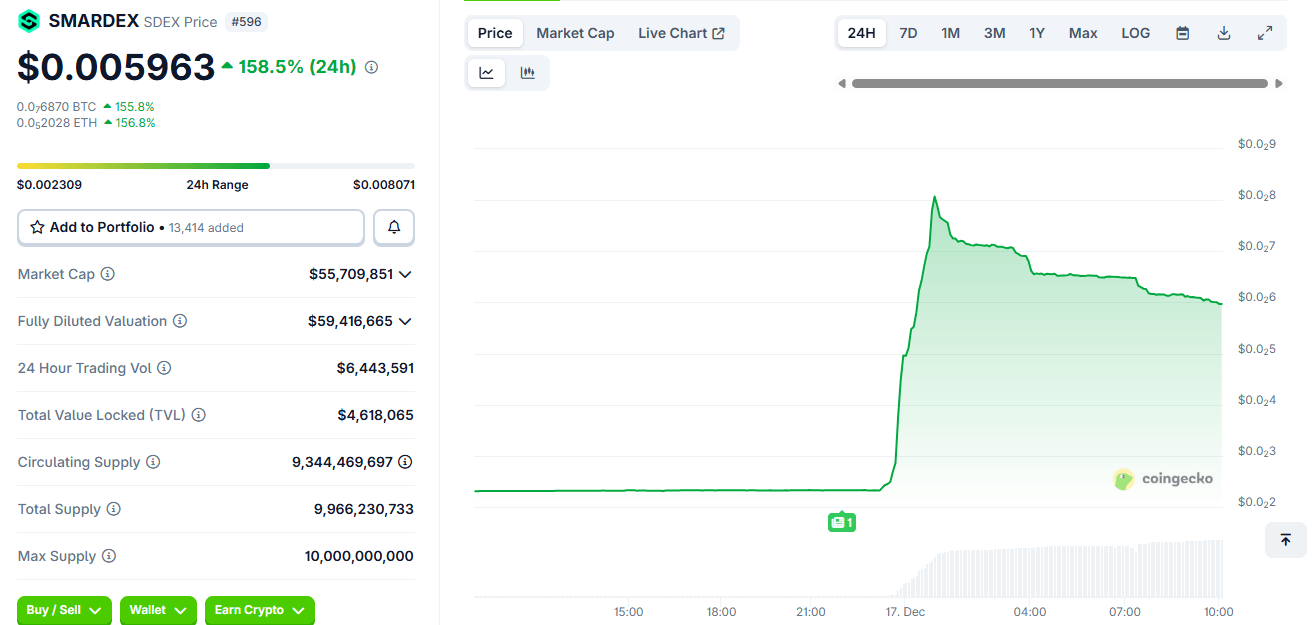

The native token of the decentralized finance (DeFi) platform Smardex (SDEX) surged by over 160% on Dec. 17, following the announcement of its transition to a unified protocol that integrates a decentralized exchange (DEX), a lending market, and a perpetual-style trading system into a single smart contract. Market data shows the token rallied from approximately $0.002 to a brief peak above $0.008 before settling near $0.006. 📈💸

The rally pushed SDEX’s market capitalization from $21 million to over $56 million, securing its place as one of the day’s top market gainers. Reacting to the token’s surge, Jean Rausis, a co-founder at Everything, said the price action shows that its community “didn’t just show up-it went wild.” Rausis added that the surge is “a testament to the strength of our platform and the massive anticipation for our upcoming evolution.” 🤯🚀

According to a media statement, the unified protocol also known as the Everything protocol represents a fundamental shift away from fragmented DeFi primitives. Unlike traditional ecosystems where users must navigate separate platforms for swapping, borrowing, and leveraged trading, Everything executes all core functions through a single smart contract. 🧙♂️🔮

This architecture utilizes an oracle-less leverage engine to execute trades atomically and a tick-based borrowing model designed to limit bad debt through deterministic collateral requirements. By housing all operations in a single pair, the system removes the need for fragile integrations and external price feeds. 🧠💥

“Our goal with Everything is not only to improve DeFi mechanics but to redefine how teams build financial infrastructure on-chain,” said Rausis. “We designed this protocol so new projects can launch markets and liquidity layers without relying on fragmented integrations. This shift provides a foundation that supports real scale and1 long-term stability.” 🌍💰

Scheduled for an official launch in February 2026, Everything layers permissionless lending and borrowing atop the classic xy = k AMM model. Unutilized collateral within the system is repurposed through a shared vault, which deploys idle funds into approved external yield strategies to reduce borrowing costs for users. 🧾📉

To further boost capital efficiency, Everything pairs liquidity with USDNr, a decentralized synthetic stable asset that offers a sustainable yield of approximately 16% APR. Liquidity providers (LPs) can earn this yield alongside swap fees, borrowing interest, funding rates, and liquidation penalties, creating a multi-layered revenue stream within a self-balancing system. 🧮💸

Looking ahead, the protocol has already teased the “Geneve” upgrade planned for summer 2026. This major release aims to achieve “100% capital efficiency” by introducing yield-bearing collateral and native limit orders. Under the new model, even idle waiting orders will generate yield, ensuring that every dollar within the ecosystem is constantly productive. 🔄⚡

FAQ ❓

- Why did SDEX surge more than 160%? The token jumped after Smardex announced its unified “Everything” protocol combining DEX, lending and perpetual trading in one contract. 🧙♂️

- What makes the Everything protocol different? It replaces fragmented DeFi platforms with a single smart contract and unified liquidity pool for all core functions. 🧠

- How does the system improve stability and efficiency? It uses an oracle‑less leverage engine, deterministic collateral rules and a shared vault that deploys idle collateral into yield strategies. 📦

- What upgrades are planned next? The 2026 “Geneve” release aims for full capital efficiency by adding yield‑bearing collateral and native limit orders. 📆

Read More

- Gold Rate Forecast

- GBP CHF PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- EUR USD PREDICTION

- USD MYR PREDICTION

- CNY JPY PREDICTION

- USD VND PREDICTION

- PI PREDICTION. PI cryptocurrency

- GBP CNY PREDICTION

2025-12-17 13:13