So, Bitcoin is playing a bit of hide-and-seek with the $90,000 mark-again. There you have it, folks. That golden number so rejected, it might as well be the height of discrimination in financial circles. After weeks of…well, let’s call it “dynamic” price action, everyone’s mood has taken a disconcerting turn.

Fear and apathy have taken center stage, with the hive mind of crypto analysts doing a collective mea culpa. Investment narratives have shifted-a Dante-esque journey from “Dip, schmip! Buy it all!” to a bar stool philosopher’s musing: “Has this peak overstayed its welcome?” If this were a weather forecast, it’d definitely be “Look out below!”

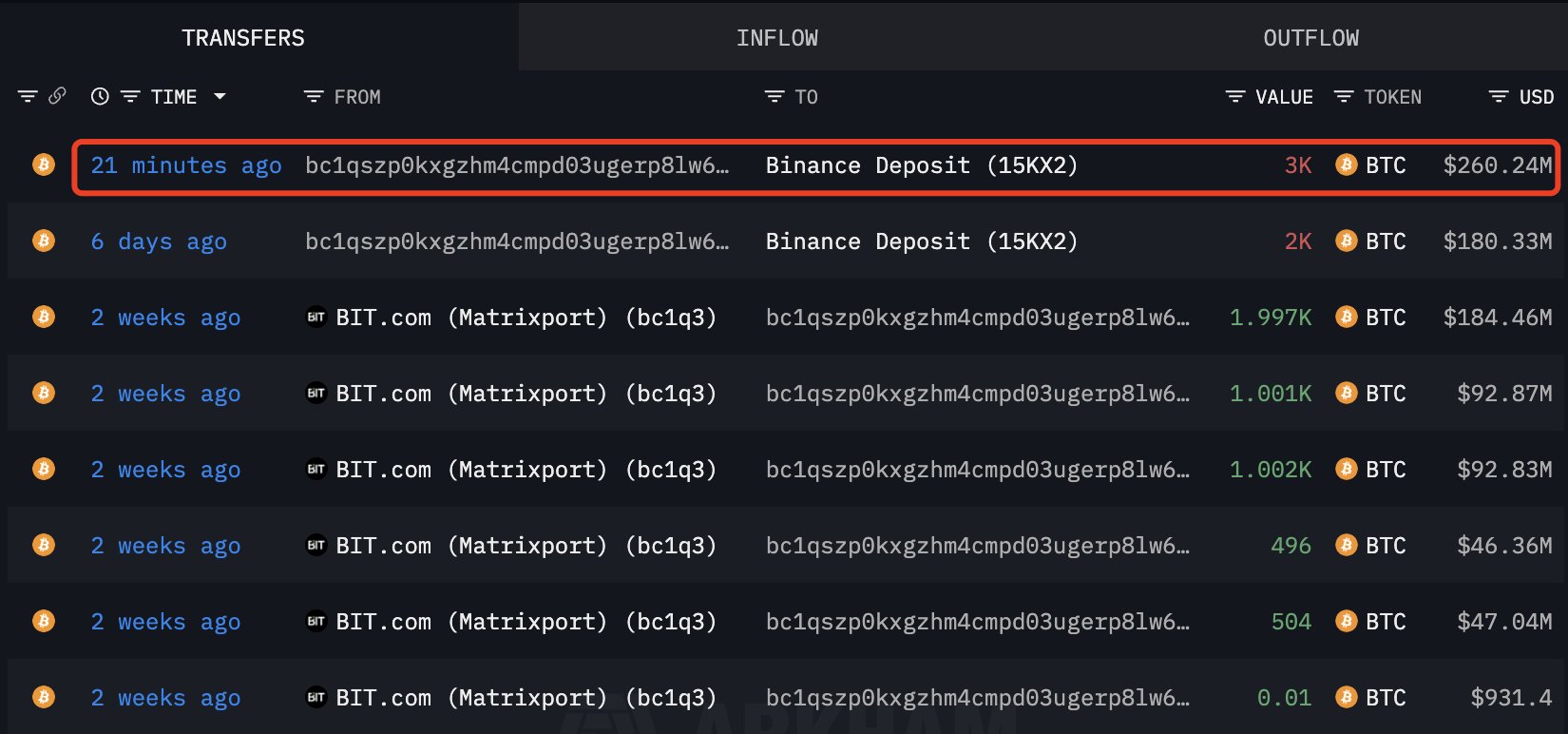

If there’s one thing even more predictable than human nature, it’s how these large, well-coiffed suits shuffle bitcoins around. By the way, two wallets linked to the fancy Matrixport-because why not have a financial platform that wants to be a startup naming convention?-just unloaded an entire battalion of 4,000 Bitcoins (worth about $347.56 million) onto Binance today. Of course, anyone who knows Arkham knows all about this.

Matrixport, known as that Valley startup vibe entity revved up by some former Bitmain executives, dabbles in everything from crypto lending to asset management-all while looking impossibly trendy. Now, why should we care about 4,000 bitcoin transferring to an exchange? Hint: It’s never just for giggles.

Large Bitcoin deposits to exchanges are practically the online equivalent of someone giving you a knowing look and saying, “Something just went sideways.” Yes, this often signals that whales are prepping their dolphins in anticipation of a courtship dance called distribution or hedging. Although, not every deposit is truly a sale. Some people are just moving things around like chess pieces.

What happens next? Only time-or Bitcoin’s demand-will tell. If Bitcoin can absorb this seemingly enormous inflow, we might witness nothing but a garden party. But let’s be real: If exchanges continue to bulge and spot demand crumbles, we might find ourselves rediscovering old friends like “liquidity” and “bearish regimes.”

Exchange Inflows: A Love/Hate Relationship

Give Bitcoin a big flip of the mattress when it makes grandiose transfers to exchanges-that’s classic bearish signal, right? Historically, these moves have been like a weird kiss before a breakup. Indeed, cashing out seems almost inevitable. But here’s that elephant in the room: Not every transfer means your Bitcoin is immediately heading down the sales pipeline.

You see, sometimes these inflows are more about internal busy-bee work-managing treasuries, covering insurance for some far-off derivatives position, or preparing for a basically benign cross-exchange love-fest. That’s how civilized people hedge against risk-by not actually selling, thank goodness.

Looking forward, Bitcoin’s dance card over the next tasty lockdown-erm, I mean, months-will depend on whether these new arrivals stick around. If they can indeed cozy up to the $85K-$86K zone, there might be a tranquil spell ahead. But that’s the market for you, inherently brutal and whimsically lovely.

Price: A Critical Detour

Bitcoin’s trying to keep up with the Joneses above at $90K, but has unfortunately hit the brakes on momentum. On a chart that somehow manages to squeeze a saga into a single glance, BTC is now just ambling aimlessly between $86,000 and $87,000-after a gut punch from the high-unreachable rapture of $110,000 to $120,000. This new nook? A critical demand zone, where Bitcoin loves to linger. Still, they’re trying to rally concerns near the 200-day moving average-a trend filter that’s a bit like the boss at a coffee shop, deciding when it’s time for a coffee break.

And, oh, the short-term vibes, my friends. Bitcoin is now below the 50-week moving average, which is starting to do a casual tumble, signaling waning enthusiasm. Meanwhile, the 100-week moving average looks a little more confident, still trending up -the kind that might just break its arm offering encouragement despite being under heaps of stress.

From a more “beautiful” price-action perspective, BTC seems to have become the younger sibling forming a lower high relative to the previous peak it can never quite live up to. Volatility seems to be taking a nap… which typically means someone’s about to wake up with a start. If Bitcoin can’t even stick to the $85,000 support, it might head to runaround time-$78,000 to $80,000 zone, where it’s rummaging through memories.

But hey, optimism isn’t lost if Bitcoin decides to charm everyone again. A bona fide comeback would first need a $90,000 win, and then hold a weekly stance above with poise, before kissing the 50-week average, I mean average investor, goodbye.

Read More

- GBP CHF PREDICTION

- EUR USD PREDICTION

- USD MYR PREDICTION

- CNY JPY PREDICTION

- USD VND PREDICTION

- EUR BRL PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- GBP CNY PREDICTION

2025-12-18 05:15