Ah, the fickle dance of Bitcoin, that digital phantom, has left the world teetering on the edge of financial absurdity this week! As the Bank of Japan, that grand maestro of monetary policy, prepares to wave its wand on December 19th, investors are clutching their ledgers like nervous debutantes at a ball. Will the price soar to the heavens or plunge into the abyss? Only the gods of finance-and perhaps a tipsy clerk in Tokyo-know for certain. 🌪️💸

- Bitcoin, that capricious creature, has retreated this week, its tail between its legs, as traders await the BoJ’s verdict with bated breath. 📉

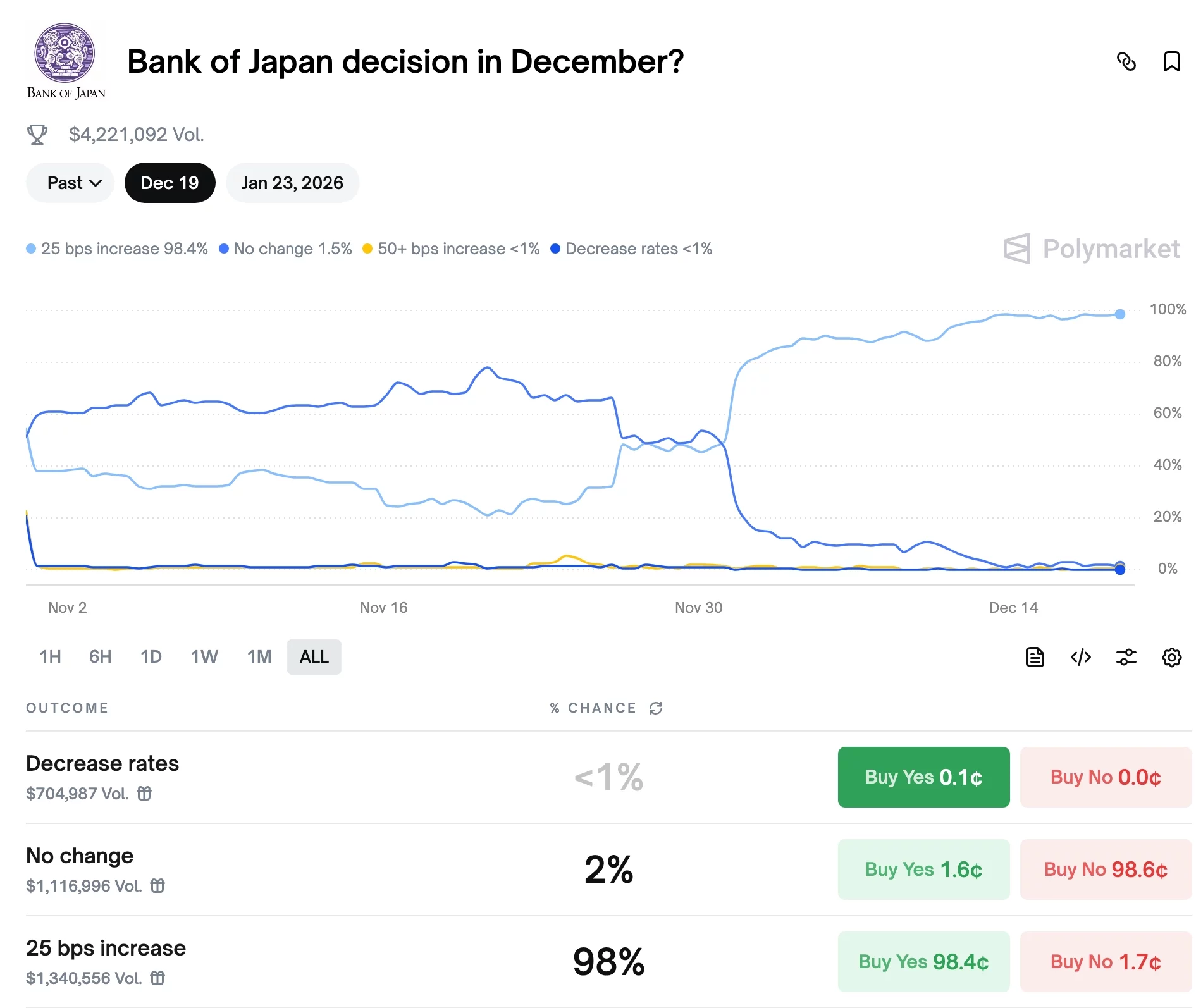

- Polymarket, that oracle of odds, declares a 99% chance of a rate cut-or is it a hike? Oh, the drama! 🎭

- Behold! A bearish flag pattern flutters on the daily chart, a harbinger of doom or merely a trick of the light? 🚩

At the stroke of the pen, Bitcoin (BTC) was trading at $87,700, a sum that leaves it 7.47% shy of its monthly peak and a full 30% below its all-time glory. Alas, the fickle hand of fate! 😢

The BoJ’s Rate Hike: A Financial Farce?

Bitcoin, its altcoin cousins, and the stock market have all taken a step back, like wallflowers at a party, as the odds of a BoJ rate hike swell to a staggering 98%. Polymarket, ever the pessimist, nods gravely. 📈

Ah, the BoJ, with its $4.48 trillion in assets and its hoard of US government bonds-a financial behemoth whose every sneeze sends ripples across the globe. But will this hike be a thunderclap or a mere hiccup? 🌍💼

The specter of a BoJ hike, coming as it does while the Fed trims its sails, threatens to unravel the carry trades-those delicate financial tapestries woven by investors borrowing from low-interest lands to gamble on higher yields. Japan, with its decades of low rates, has been the loom upon which these trades are spun. But now, as the spread narrows, will the weavers cut their threads and flee? 🧵✂️

Yet, fear not, dear reader! For even if the BoJ raises its rates, Bitcoin may yet defy the odds. With a 99% chance priced into the market, the coin could rebound like a rubber ball, as investors embrace the new normal with open arms. Or will it? The plot thickens! 🎢

Bitcoin’s Technical Tango: A Chart of Woes

Gaze upon the daily chart, a canvas of despair, where Bitcoin traces a bearish flag pattern-a flag of surrender or a banner of defiance? The inverted flagpole stands tall, while the flag itself flutters in the wind. 🏳️

Below the Supertrend indicator it lingers, and the 100-day Exponential Moving Average looms like a specter. The 78.6% Fibonacci Retracement level beckons, a siren calling sailors to their doom. Will Bitcoin plunge to its year-to-date low of $74,423, a 15% descent into the abyss? Or will it defy the stars and rebound to $94,500, only to resume its tragic fall? 🌊⚓

In this grand farce of finance, the most likely outcome is bearish-a tale as old as time. Yet, in the theater of the absurd, anything is possible. So, grab your popcorn, dear reader, and watch as Bitcoin dances to the tune of the BoJ’s rate roulette! 🎭🍿

Read More

- EUR USD PREDICTION

- GBP CHF PREDICTION

- CNY JPY PREDICTION

- USD VND PREDICTION

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR RUB PREDICTION

- GBP CNY PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR AUD PREDICTION

2025-12-18 20:36