Markets

What to know:

- Binance has opened up ether options to all users, allowing them to earn passive income, expanding a strategy previously limited to professional traders. 🎯💸

- The exchange’s move responds to growing demand for advanced derivative tools from both retail and institutional investors. Because who doesn’t want to feel like a Wall Street pro? 🤑

- Binance has upgraded its options platform to offer faster execution and greater flexibility, aiming to dominate the competitive crypto options market. Because nothing says “I’m serious” like having your orders execute faster than your coffee cools. ☕⚡

Binance, the leading crypto exchange by trading volume, has just made it possible for everyone to earn a passive-like income through ether options, opening up a strategy once limited to pros. 🙌

The exchange announced in a press release shared with CoinDesk that it is allowing users to write (sell) ether options, helping them effectively manage risk and generate extra income. This decision responds to increasing demand from both retail and institutional investors for advanced derivative trading tools. Because why let the pros have all the fun? 😏

The announcement builds on Binance’s move to democratize bitcoin options writing and mirrors the explosive demand for BTC, ETH, and ETF-based instruments. 🚀

The institutional appetite for these products is undeniable; earlier this year, BlackRock’s IBIT options notably eclipsed Deribit’s native BTC options in volume, marking a pivotal moment for the crypto derivatives landscape. Because nothing says “I’m a big shot” like out-trading the competition. 🏆

“Binance remains committed to delivering innovative tools that meet the evolving needs of our users,” Jeff Li, VP of Product at Binance, said. “The introduction of ETH Options writing and our Options platform upgrade will empower traders with faster execution, greater flexibility, and richer market data to support more advanced and strategic trading approaches in the growing crypto derivatives space.” 🤓

Options are derivative contracts that provide the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. These contracts pay out at a later date, depending on whether the asset’s price rises above or falls below a designated level. 📈📉

While the call buyer profits from price rallies, the seller (writer) takes the opposing view, essentially providing insurance against bullish moves in exchange for an upfront premium. This premium serves as immediate income. Or, as we like to call it, the only thing you’ll get immediately. 😏

Savvy traders have increasingly used this strategy over the past couple of years, writing calls or puts on Deribit, often against their coin holdings, to generate income. Because why hold coins when you can turn them into cash? 💸

Binance users can now do the same with ether options by posting margin to collateralize their obligations, with access contingent on a mandatory suitability assessment to ensure responsible trading. Because nothing says “responsible” like risking your life savings on a bet. 🤝

To incentivize immediate liquidity, Binance is also rolling out a steep 20% discount on both Taker and Maker fees for VIP users across its newly listed ETH, BTC, BNB, and SOL contracts-a move aimed at cementing its dominance in the competitive crypto options space. Because nothing says “I’m the king” like giving discounts to your most loyal subjects. 👑

Platform upgrade

In a bid to capture a larger share of the derivatives market, Binance has overhauled its options platform with a suite of infrastructure upgrades designed for high-frequency traders and institutional players. Because who doesn’t want to trade faster than their neighbor? ⚡

The revamped ecosystem boasts significantly higher API throughput and lower latency, enabling faster order execution during periods of high market volatility. Because nothing says “I’m a pro” like executing trades before the market even knows what hit it. 🚀

Beyond speed, the exchange has expanded its available strike prices across multiple assets, offering traders the granularity needed for complex hedging and speculative strategies. Because why settle for simple when you can complicate things? 🧠

To bolster market transparency, the platform now integrates advanced WebSocket streams, providing the deep-tier market data essential for sophisticated technical analysis. Because nothing says “I’m a genius” like staring at charts until your eyes bleed. 🧪

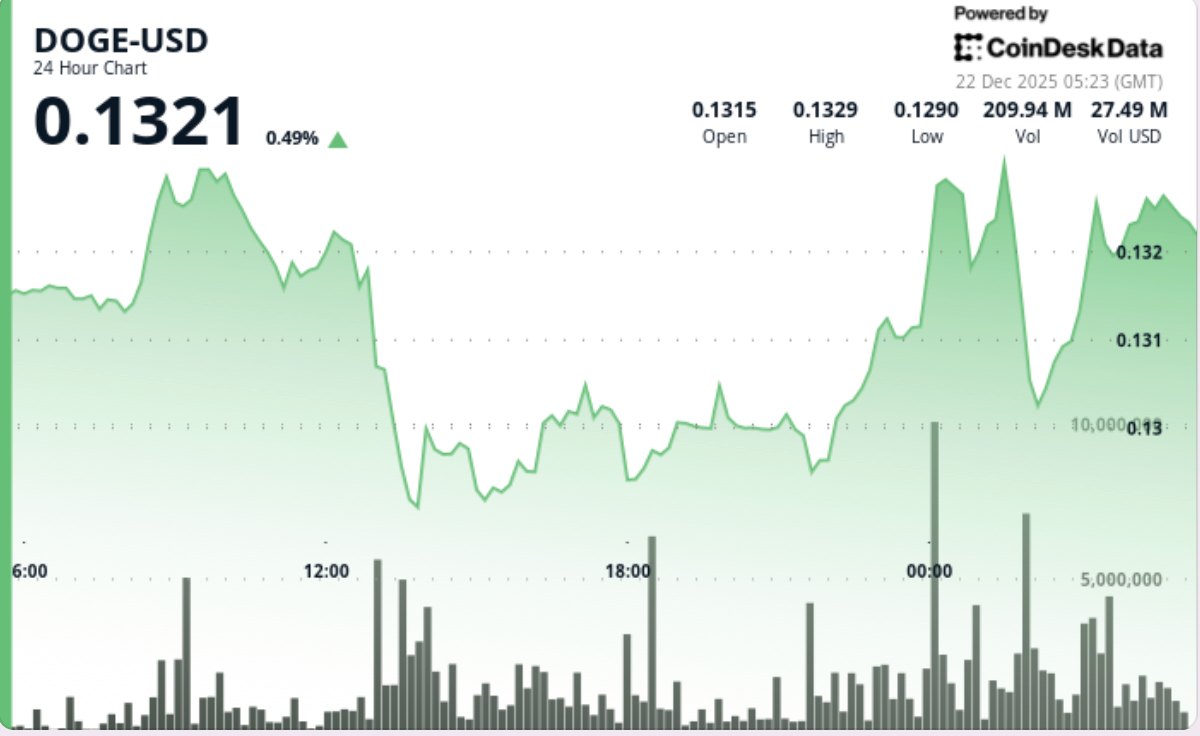

Dogecoin slips below $0.129 as range support gives way

50 minutes ago

XRP weakens after repeated price-action failures near $1.95

1 hour ago

Bitcoin steadies near $89,000 as gold hits record and Asia stocks rise

1 hour ago

Galaxy Digital’s head of research explains why bitcoin’s outlook is so uncertain in 2026

9 hours ago

Fed’s Hammack tilts hawkish on rates, questions CPI drop as distorted

15 hours ago

‘DeFi is dead’: Maple Finance’s CEO says onchain markets will swallow Wall Street

16 hours ago

Bitcoin steadies near $89,000 as gold hits record and Asia stocks rise

1 hour ago

Tom Lee responds to controversy surrounding Fundstrat’s differing bitcoin outlooks

Dec 20, 2025

‘DeFi is dead’: Maple Finance’s CEO says onchain markets will swallow Wall Street

16 hours ago

Bitcoin’s quantum debate is resurfacing, and markets are starting to notice

Dec 20, 2025

Galaxy Digital’s head of research explains why bitcoin’s outlook is so uncertain in 2026

9 hours ago

XRP weakens after repeated price-action failures near $1.95

1 hour ago

Read More

- USD JPY PREDICTION

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- USD MYR PREDICTION

- EUR THB PREDICTION

- Silver Rate Forecast

- USD INR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2025-12-22 09:32