In the vast, scorched plains of Venezuela, where the oil flows-as if by some divine or perhaps mischievous miracle-there emerges a new religion: the worship of stablecoins, especially USDT. Truly, the world is turned upside down, and the mighty oil titans now barter in digital tokens, as if the ancient gods of commerce themselves had traded their chariots for cryptocurrencies. And oh, what a spectacle it is-an economic ballet danced amidst sanctions and seizing tankers, with a touch of humor for those who dare to observe! 💸🤡

How Venezuela Is Turning Oil into Digital Laughs

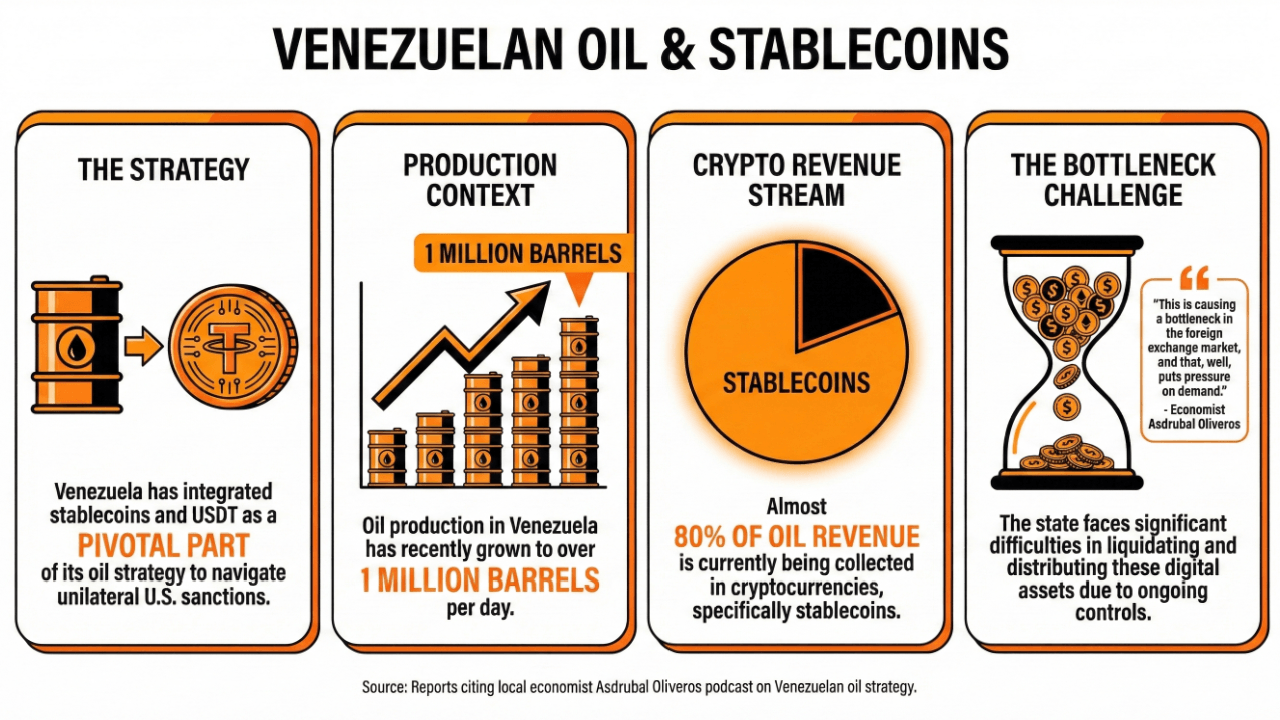

It is, perhaps, a comedy of errors-or a tragedy-when a nation, once wealthy in black gold, now tries to sell its riches in bits and bytes. The clever economist Asdrubal Oliveros, with a twinkle in his eye and a shrug, proclaims that nearly 80% of all the Venezuelan oil-yes, the stuff that once fueled the world-is now paid for with USDT. Who needs the old-fashioned dollar or euro when one can settle debts with a stablecoin that’s perhaps more stable than the government itself?

Riddle Me This: Stablecoins & Venezuelan Oil

The facts are as juicy as a ripe avocado, though perhaps a little less wholesome. Venezuela, under the watchful eyes (and sanctions) of Uncle Sam, has woven stablecoins and USDT into its oil fabric, making it as essential as bread and circuses in ancient Rome. The country’s oil production, now climbing past a million barrels a day, is caught in this digital tide-like a boat trying to row against a storm of sanctions and controls.

Oliveros, with the wisdom of a seasoned storyteller, states:

The connection to the crypto world is as direct as a slap across the face. Nearly 80% of our precious oil revenue is now dancing in the realm of cryptocurrencies, specifically in stablecoins. A triumph of modern finance or a tragedy of trust? You decide! 🎭

But beware, dear reader-this miracle has its costs. The Venezuelan government, like a cat chasing its tail, finds it difficult to liquidate these digital assets, creating a bottleneck that would make even the most patient saint sigh. The foreign exchange market, already as fickle as a weather-vane, is now pressed tighter than a drum, pushing prices higher. Who knew that digital coins could cause such chaos? 🥁

Why Is This a Big Deal (Besides the Comedy)?

Annually, the Venezuelan oil sector rakes in over $12 billion-an amount that could make even a billionaire blush. Most of this wealth journeys eastward to China, like a modern Silk Road in reverse. The fact that much of this is now settled in stablecoins underscores just how mature and daring these digital assets have become. It suggests that cryptocurrencies are no longer fringe chatter but players in serious business-perhaps even actors in a tragicomedy of global finance. 🌎💰

Recently, the headlines have screamed about the ongoing “blockade”-a term that makes one think of pirates rather than diplomats-imposed by Uncle Sam. Venezuela screams piracy, and perhaps rightly so, as they try desperately to sell their black gold amidst a sea of sanctions. The story keeps unfolding, like a never-ending telenovela.

What lies ahead? A Stablecoin-led Venezuela? 🤔

If sanctions persist longer than a bad soap opera, expect even more of Venezuela’s oil sales to be paid in USDT. The country might very well become the poster child for an economy driven by stablecoin income, proving that in troubled waters, digital gold may rival actual black gold. The comedy-and tragedy-continues. 🎬💥

FAQ (Because Even in Tragedy, We Need Answers)

-

How does Venezuela use stablecoins in its oil economy?

By turning a blind eye or a mischievous smile, Venezuela has embraced stablecoins, especially USDT, making nearly 80% of its oil revenue dance in digital currency. Who needs physical cash when you have virtual wealth? 💸 -

What problems stalk Venezuela’s crypto payments?

Aha! The government’s difficulty in liquidating and spreading these digital assets is as evident as a cat in a birdcage. It causes a bottleneck in the foreign exchange market-imagine trying to pour honey through a funnel clogged with red tape. 🍯🚫 -

How big is Venezuela’s oil revenue in relation to stablecoin payments?

Over $12 billion per year, much of it headed to China. As the world watches, Venezuela relies more and more on stablecoins, like a magician pulling a rabbit-or in this case, digital cash-from a hat. 🎩✨ -

And what does all this portend for Venezuela’s future?

If the sanctions remain, Venezuela might grow into a stablecoin economy, proving that even in chaos, digital currencies can find a foothold-perhaps more stable than the government itself. A new chapter in the long, sometimes humorous, story of this troubled land.

Read More

- USD JPY PREDICTION

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- USD MYR PREDICTION

- EUR THB PREDICTION

- Silver Rate Forecast

- USD INR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2025-12-22 15:00