\nMarkets

\n

A fleeting observation:

\n

- \n

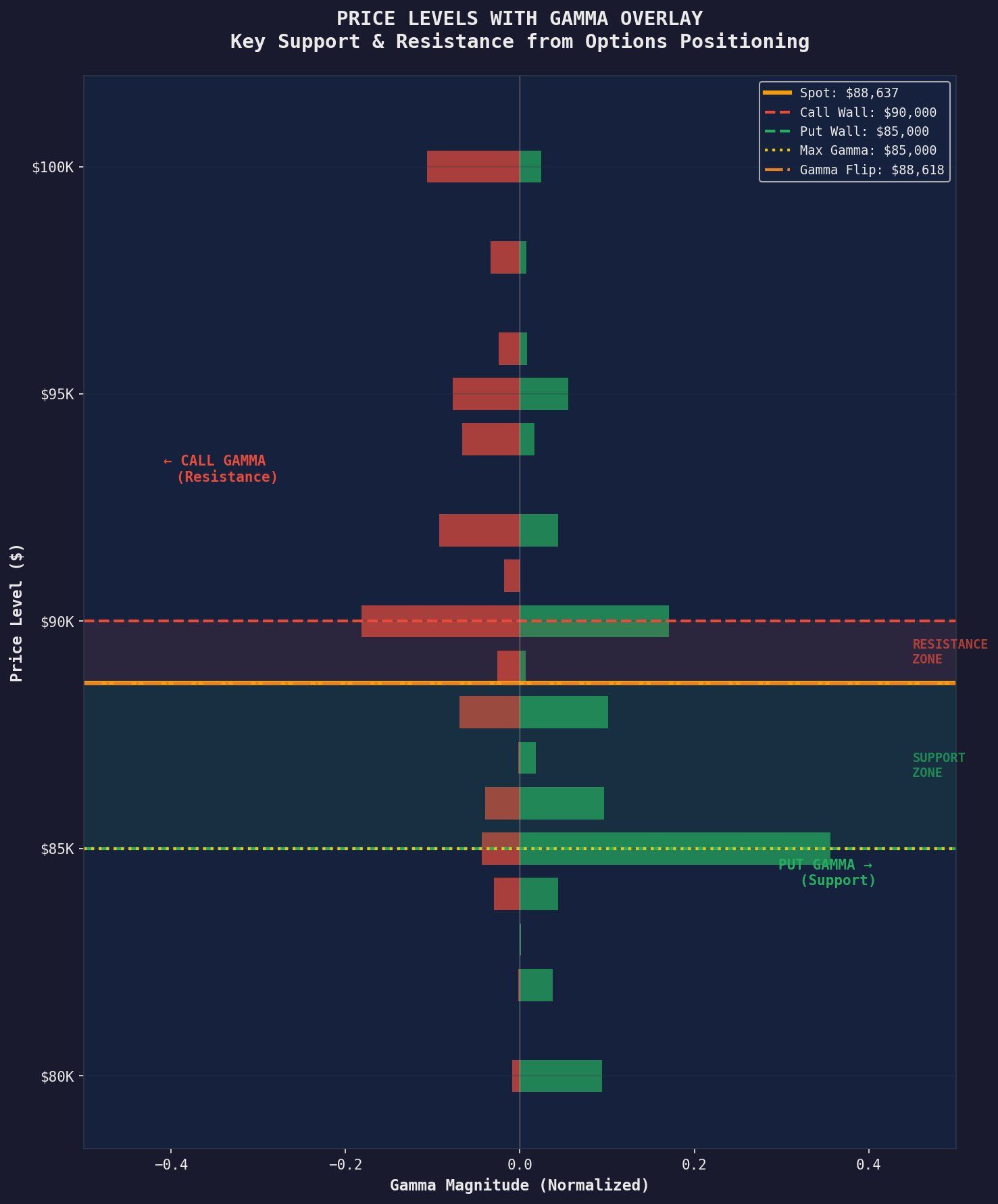

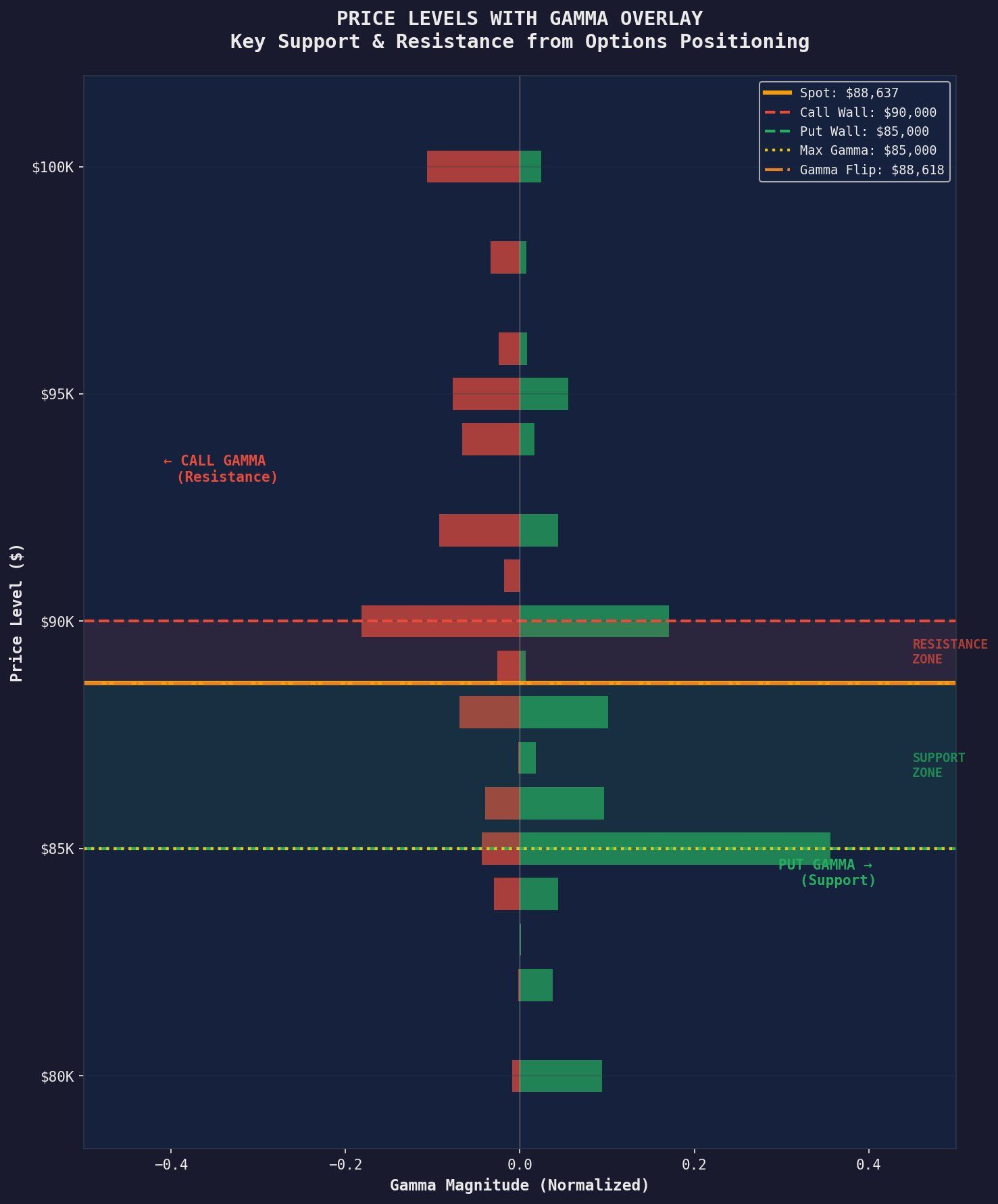

- Bitcoin, caught in a December dither, oscillating between $85,000 and $90,000-a most tiresome preoccupation.

- A cage of one\’s own making, enforced by the anxieties of those who deal in shadows-options, naturally. Buying where it dips, selling where it dares to rise. Such drama!

- Twenty-seven billion whispers of potential expiring on Deribit, most yearning for the heights. A bullish breeze, perhaps?

\n

\n

\n

\n

\n

December, it seems, has been a month of rigid captivity for Bitcoin, tethered between the comfortable confines of $85,000 and $90,000. Meanwhile, the Americans frolic with their equities and gold crests its waves of ambition. A curious indifference, isn’t it? Frustration among the believers, a palpable tension… all stemming, predictably, from the labyrinthine world of derivatives. It\’s like watching a caged bird pace 🪶.

\n

And now, those very mechanisms that imprisoned it suggest a tentative escape – a lean toward the higher realms. An upward resolution, toward the mid $90,000s, feels more… plausible. A sustained descent below $85,000? Unlikely, wouldn’t you agree? It lacks a certain… poetic justice.

\n

These ‘options’-contracts offering the right to buy or sell (but never the obligation! Such delicate instruments!), influencing the market. A delicate balance. If the price ascends, those holding the ‘call’ options rejoice. Should it falter, the ‘put’ option holders reap the benefit. A grand gamble, really. 🎲

\n

On the other side stand the ‘writers’ of these contracts, burdened with the responsibility of honoring their commitments. They dabble in hedging, a frantic dance in the spot and futures markets, all guided by mysterious forces-\’gamma\’ and \’delta,\’ they call them. Oh, the jargon! It’s enough to make one long for simpler times…like counting pebbles.

\n

’Delta’ measures the sensitivity of an option’s price to the Bitcoin’s fluctuations. ‘Gamma,’ then, measures how quickly that sensitivity changes. When ‘gamma’ is high, and clings tightly to the current price, the dealers are forced into a relentless cycle of buying and selling, suppressing any semblance of true volatility. A Sisyphean task, truly.

\n

According to one ‘David’ (whose wisdom is shared through the digital pronouncements of ‘X’-a modern-day oracle, no doubt), large ‘put’ gamma near $85,000 acted as a firm foundation, compelling dealers to acquire Bitcoin during any momentary lapse. Simultaneously, heavy ‘call’ gamma near $90,000 served as an invisible ceiling, prompting them to release their grip. A self-perpetuating cycle, born not of belief but of sheer necessity. What a ridiculous world. 😂

\n

\n

Now, with $27 billion worth of options nearing their expiry date on December 26th, this stabilizing influence begins to wane, as \’gamma\’ and \’delta\’ fade into the ether. It’s all so… temporary.

\n

This expiration is grand in scale, and tilted toward optimism. More than half of the Deribit congregation departs, with a scant 0.38 ratio of ‘puts’ to ‘calls’ (nearly three calls for every put!). And the majority of these intentions hover around prices between $100,000 and $116,000 – audacious, wouldn’t you say?

\n

The ‘max pain point’-the price at which option buyers suffer the greatest loss, and sellers (the dealers) reap the greatest gain-rests at $96,000, further confirming this upward bias. Such a clever game. 😈

\n

Furthermore, ‘implied volatility’-the market’s expectation of future fluctuations-trundles along near a month-long low of 45, implying that traders aren’t anticipating any immediate turbulence. They are either blissfully ignorant or simply master poker players. Perhaps both. 🤷

\n

Markets

A fleeting observation:

- Bitcoin, caught in a December dither, oscillating between $85,000 and $90,000-a most tiresome preoccupation.

- A cage of one’s own making, enforced by the anxieties of those who deal in shadows-options, naturally. Buying where it dips, selling where it dares to rise. Such drama!

- Twenty-seven billion whispers of potential expiring on Deribit, most yearning for the heights. A bullish breeze, perhaps?

December, it seems, has been a month of rigid captivity for Bitcoin, tethered between the comfortable confines of $85,000 and $90,000. Meanwhile, the Americans frolic with their equities and gold crests its waves of ambition. A curious indifference, isn’t it? Frustration among the believers, a palpable tension… all stemming, predictably, from the labyrinthine world of derivatives. It’s like watching a caged bird pace 🪶.

And now, those very mechanisms that imprisoned it suggest a tentative escape – a lean toward the higher realms. An upward resolution, toward the mid $90,000s, feels more… plausible. A sustained descent below $85,000? Unlikely, wouldn’t you agree? It lacks a certain… poetic justice.

These ‘options’-contracts offering the right to buy or sell (but never the obligation! Such delicate instruments!), influencing the market. A delicate balance. If the price ascends, those holding the ‘call’ options rejoice. Should it falter, the ‘put’ option holders reap the benefit. A grand gamble, really. 🎲

On the other side stand the ‘writers’ of these contracts, burdened with the responsibility of honoring their commitments. They dabble in hedging, a frantic dance in the spot and futures markets, all guided by mysterious forces-‘gamma’ and ‘delta,’ they call them. Oh, the jargon! It’s enough to make one long for simpler times…like counting pebbles.

’Delta’ measures the sensitivity of an option’s price to the Bitcoin’s fluctuations. ‘Gamma,’ then, measures how quickly that sensitivity changes. When ‘gamma’ is high, and clings tightly to the current price, the dealers are forced into a relentless cycle of buying and selling, suppressing any semblance of true volatility. A Sisyphean task, truly.

According to one ‘David’ (whose wisdom is shared through the digital pronouncements of ‘X’-a modern-day oracle, no doubt), large ‘put’ gamma near $85,000 acted as a firm foundation, compelling dealers to acquire Bitcoin during any momentary lapse. Simultaneously, heavy ‘call’ gamma near $90,000 served as an invisible ceiling, prompting them to release their grip. A self-perpetuating cycle, born not of belief but of sheer necessity. What a ridiculous world. 😂

Now, with $27 billion worth of options nearing their expiry date on December 26th, this stabilizing influence begins to wane, as ‘gamma’ and ‘delta’ fade into the ether. It’s all so… temporary.

This expiration is grand in scale, and tilted toward optimism. More than half of the Deribit congregation departs, with a scant 0.38 ratio of ‘puts’ to ‘calls’ (nearly three calls for every put!). And the majority of these intentions hover around prices between $100,000 and $116,000 – audacious, wouldn’t you say?

The ‘max pain point’-the price at which option buyers suffer the greatest loss, and sellers (the dealers) reap the greatest gain-rests at $96,000, further confirming this upward bias. Such a clever game. 😈

Furthermore, ‘implied volatility’-the market’s expectation of future fluctuations-trundles along near a month-long low of 45, implying that traders aren’t anticipating any immediate turbulence. They are either blissfully ignorant or simply master poker players. Perhaps both. 🤷

Read More

- EUR PHP PREDICTION

- USD JPY PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- EUR THB PREDICTION

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

- USD INR PREDICTION

2025-12-24 13:10