Imagine a year where Bitcoin finally decided to behave like a grown-up. I guess 2025 was its swan song as the world’s most temperamental asset, settling down with the calm demeanor of a retiree content with afternoon naps and crossword puzzles. Market maturity, regulatory developments, and a bunch of uptight institutions decided it was high time Bitcoin got a grip on its frenetic youth. The result? The least volatile year ever in Bitcoin’s storied existence. Who knew maturity could look so boring?

Bitcoin Says, “Chill Out, Folks”

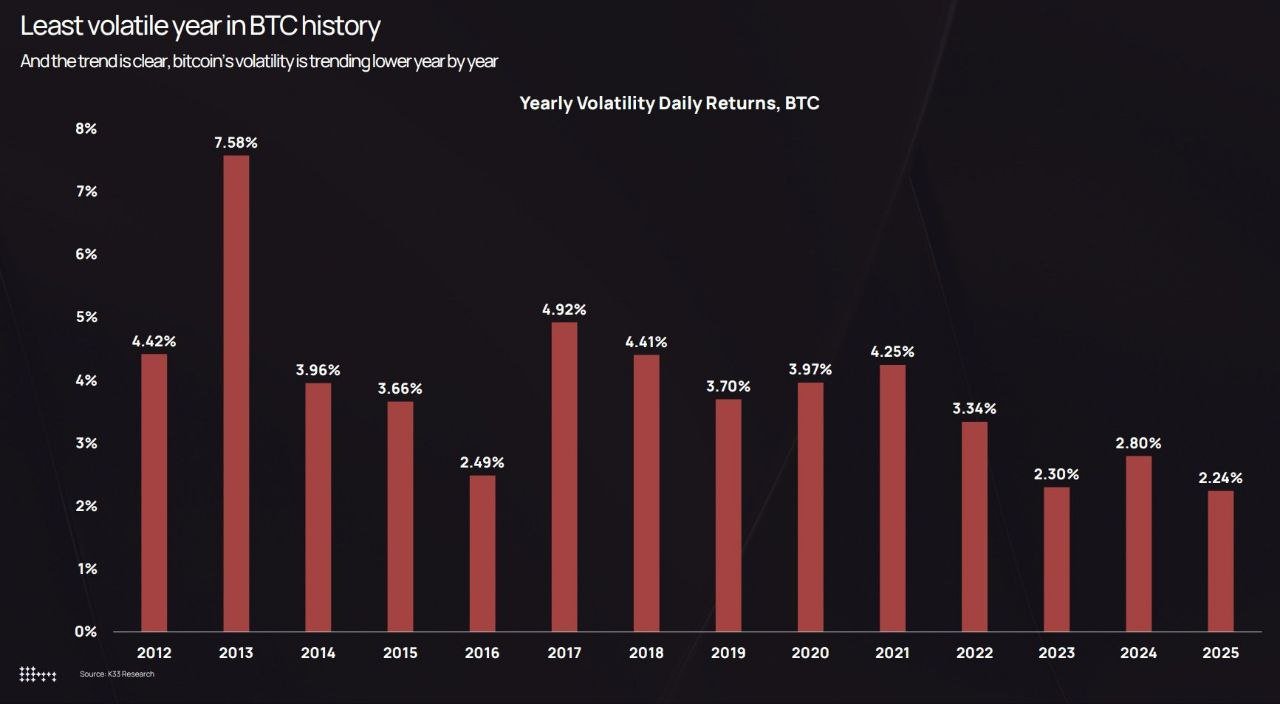

Friday rolled in with K33 Research’s data, though I wish they’d presented it with a sizzle. Turns out Bitcoin wrapped up 2025 as the least erratic it’s ever been. Imagine, just 2.24% average deviation in daily returns. Last year’s bad-tempered tantrums look like those annoying little outbursts your toddler throws when they learn to walk. In 2023, by comparison, that figure slunk up to 2.30%. You can practically hear the collective sigh of relief from Wall Street analysts everywhere!

It seems Bitcoin might finally be shedding that “wild west” reputation for a touch more sophistication. “The chill vibes are here to stay,” proclaimed K33 Research, while crypto traders like Niels noted, “FINALLY-we’ve entered a new, less volatile chapter!” Sure, the mercurial Bitcoin had its moments in Q4, fluttering about in a 16% retrace, but come on, what was supposed to happen when it finally got a real job and a 401(k)?

The biggest “OH NO!” of 2025 was something called a 36% dip in two months. Sounds painful, but not as painful as previous cycles that plunged over 50%. It’s akin to dropping a pie on your head instead of a cake. “Boring,” cryptographers cried. Nic Carter quipped that the once chaotic crypto space is now akin to an office Christmas party with less spilled eggnog-more boardroom and less boardwalk shenanigans.

The Calendar Says YEARNING FOR THE INSTITUTIONAL EPOCH

And Niels! Such a thoughtful chap, pointing out that the reliable monotony came courtesy of institutional investors playing the market like a finely tuned grand piano. “More capital, fewer panic attacks!” they cheered.

Borrowing from Bitwise’s CEO, Hunter Horsley, the crypto world is morphing, catalyzed by a blob of decreasing regulatory risk and a notable uptick in institutional enthusiasm. Crypto ETFs stepped into the limelight, buckling under the weight of popularity. Digital Asset Treasurers jumped on this newfound, steady train, stuffing billions of dollars into crypto wallets.

Then, of course, there’s Cathie Wood, always eager to forecast a techy paradise, who predicted long-term bonanzas from institutional foot-taps into crypto soils. Meanwhile, Grayscale’s projectnik Zach Pandl teased, “2026 could be crypto’s glorious coronation,” hinting at soaring Bitcoin rallies as if the cryptocurrency world were awaiting a royal wedding.

To wrap it up for today, Bitcoin rests at $90,240, a tad 1.54% happier than yesterday. Well, til next meltdown, we’ll bask in this glow of stability. 🙃

Read More

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- EUR THB PREDICTION

- USD INR PREDICTION

- Gold Rate Forecast

- USD MYR PREDICTION

- Silver Rate Forecast

- USD PLN PREDICTION

- USD JPY PREDICTION

2026-01-03 09:07