Well, darlings, hold onto your hats, because the crypto market is strutting its stuff once again! 🎩 With Bitcoin and a gaggle of altcoins donning their best green attire, it seems the metrics have decided to pop the champagne. 🥂

- Ah, the crypto market rally is still very much in vogue this Monday.

- Bitcoin has leapt to a staggering $92,500 – a 15% rise from its rather gloomy November lows. Talk about a glow-up!

- Ethereum, that ever-reliable darling, is keeping its head above water at a respectable $3,000.

Bitcoin (BTC) has flung itself to $92,500, which is quite the spectacle, wouldn’t you agree? Ethereum (ETH) is comfortably perched above the all-important resistance point of $3,000, while the entire token ensemble is basking in a market cap that has gracefully surpassed $3.25 billion. 💃

Crypto Market Rally: Fear and Greed Take a Little Trip

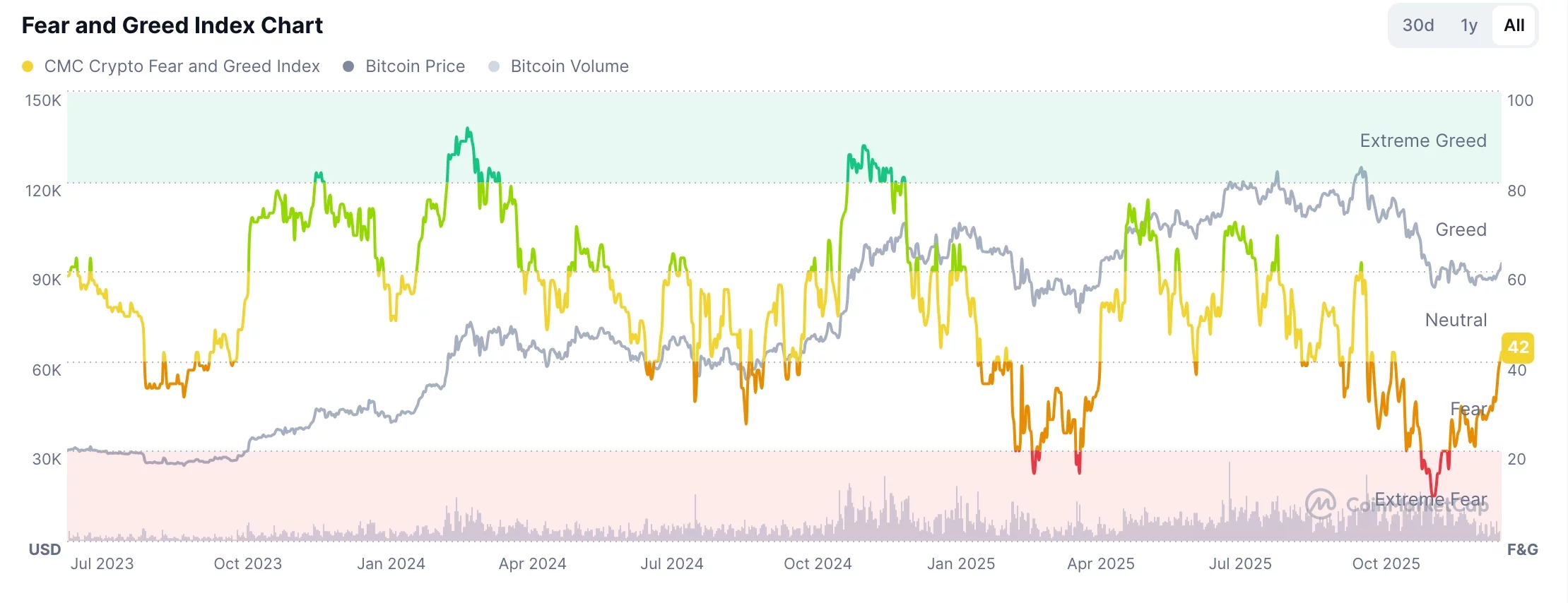

This delightful price rally has decided to coincide with the Fear and Greed Index finally emerging from its overly dramatic extreme greed phase. According to the fine folks at CoinMarketCap, our little index has bounced from a woeful 10 in November to a cheery 42. It’s practically prancing around like it’s the belle of the ball since September! 🎉

Now, this Crypto Fear and Greed Index has quite the eye for industry sentiment. It examines a plethora of gauges, checking in on Bitcoin’s price momentum, volatility, derivative market antics, and Bitcoin’s relative market charm. How positively splendid!

It was inspired by a rather similar contraption from CNN Money, which also probes into stock price strengths and market volatility. This clever little index has waltzed from a paltry 5 in the depths of fear to a rather sprightly 45 today. Bravo! 👏

Futures Open Interest: A Dazzling Comeback

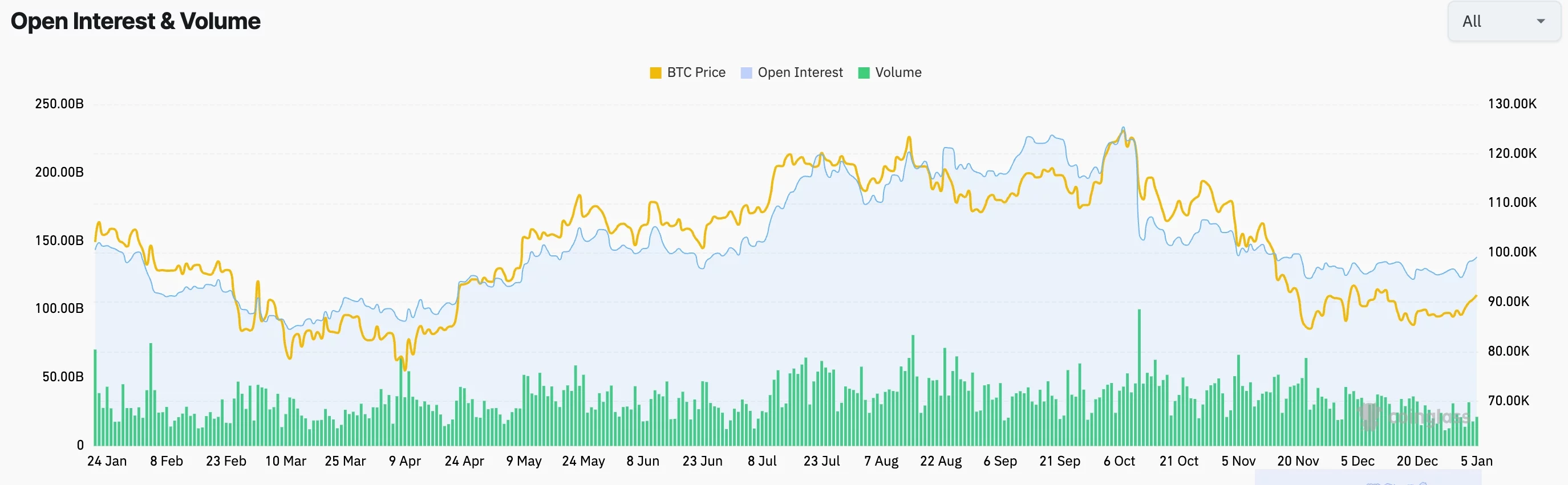

Oh, but wait! The crypto market’s revival isn’t just a one-trick pony; it’s also accompanied by a robust rebound in futures open interest. Coinglass reports a charming 1.433% increase over the past 24 hours, pushing us beyond the $140 billion mark – the highest we’ve seen in over a month. Quite the renaissance! 🌟

This rising open interest is positively bullish for cryptocurrencies, suggesting that investors are feeling rather adventurous with their leverage. And we all know that more leverage often leads to delightful upsides! Who doesn’t love a little thrill?

However, let’s not forget the turbulent times of October 10, when over 1.6 million traders found themselves liquidated, losing a staggering $20 billion after President Trump fancied a bit of tariff drama regarding Chinese gains. Oh, the irony! 😅

Read More

- EUR PHP PREDICTION

- EUR USD PREDICTION

- Brent Oil Forecast

- USD MYR PREDICTION

- Gold Rate Forecast

- EUR THB PREDICTION

- USD INR PREDICTION

- USD PLN PREDICTION

- USD JPY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2026-01-05 19:33