Ah, cryptocurrencies—a domain where the pulse of the market resembles not the quiet heartbeat of the steppe, but a Moscow traffic jam in June. Here, in a landscape less romantic than Turgenev’s meadows yet no less treacherous, tranquility remains always slightly out of reach, usually hiding behind a new coin or headline.

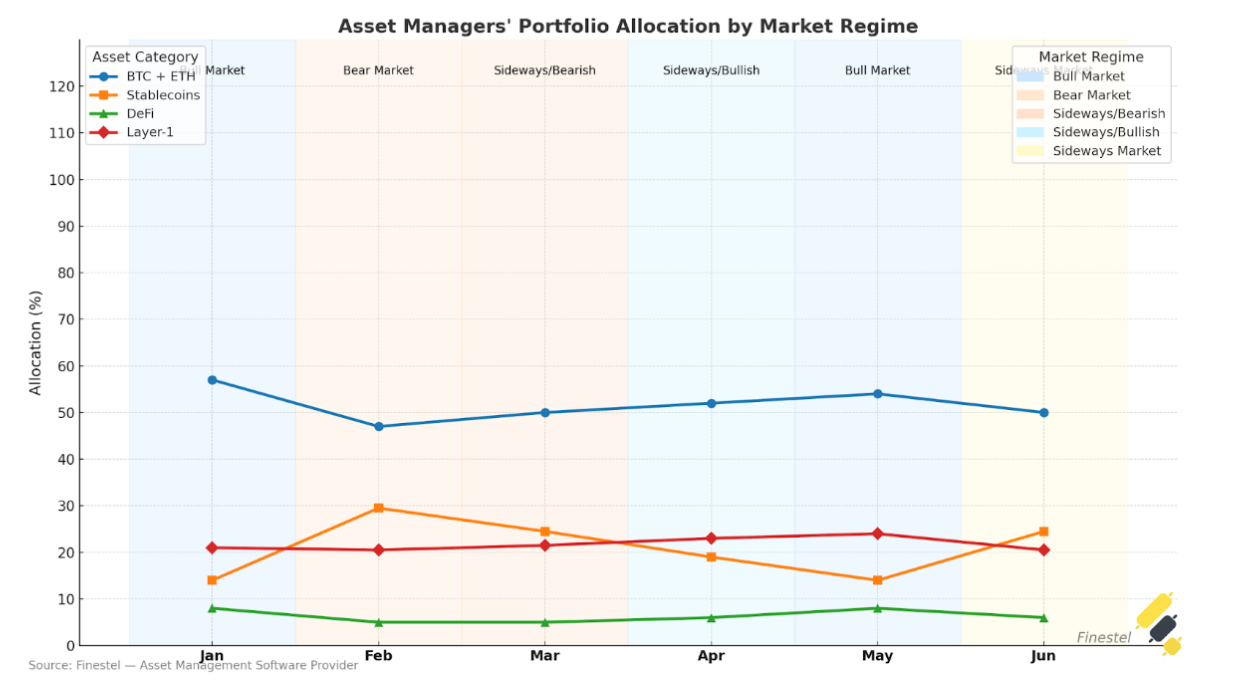

Imagine the contemporary trader: a modern Bazarov, though instead of botany, he obsesses over allocation charts. With every market swoon, the so-called “stablecoins” balloon like an aunt on her fourth serving of vareniki, reaching nearly 30% of portfolios in a sell-off. Meanwhile, crypto’s old souls—Bitcoin and Ethereum—maintain their stolid vigil at the 50% mark, come rain, shine, or total Twitter meltdown. One almost expects an NFT of Arkady to appear, quietly reading allocation breakdowns.

In those rare moments when the market grows bullish and the air brims with optimism (or is it just hot air?), appetites sharpen. Data—unfurled by that relentless chronicler, Finestel—whispers that managers, ever prudent, rush into Bitcoin and Ethereum as if afraid of catching cold. Core tokens, they call them, perhaps to conceal their folly when things turn sideways.

January’s thaw saw Bitcoin vaulting toward mythical heights—$73,000!—with Ethereum not far behind, heady on the Pectra upgrade. The two behemoths made up 57% of portfolios, with Solana and Avalanche scampering up to 21%. Stablecoins, sensing that parties are rarely for them, slunk to 14%. A true “risk-on” stance, as the scholars of crypto-slang might claim.

But by May, despite the spring breezes, little had changed—BTC and ETH accounted for 54%, the other upstarts huddled at 24%, DeFi assets with 8%, and stablecoins still whispering at 14%. Spill your vodka, adjust your portfolio, hope for the best.

Yet the true Russian knows winter returns. In February, as moods soured and winds howled, managers scurried behind the icy citadels of Tether and USD Coin, doubling stablecoin holdings to nearly 30%. The high spirits of DeFi, once 8%, were banished down to 5%. Layer-1s retreated as well. “Dry powder,” they call it—though it may as well be cold borscht, waiting for the next thaw.

Risk-managed baseline

When spring lingers indecisively—March, April, June—the portfolio seems to mirror the sky: neither storm nor sun, just a cautious gray. In March, BTC and ETH clung to 50%, stablecoins at 24.5%. DeFi and layer-1s loitered at 5% and 21.5%. The mood: carefully optimistic, like a nobleman awaiting a letter he suspects will never arrive.

April offered a whisper of adventure: BTC and ETH ticked up, DeFi feigned importance by rising a bit, and layer-1 tokens scuttled upwards. Stablecoins made a graceful exit, preparing for their eventual resurgence. Then, come June and its inevitable market headache, the portfolios circled back, the numbers echoing March—bitcoin and Ethereum at 50%, stablecoins at 24.5%. Old habits and old lovers return whether you want them or not.

Finestel’s rather dramatic treatise boils down to three themes (for drama, always three):

- Core Consistency. Bitcoin and Ethereum persist, an ever-present background hum, like inexplicable melancholy or a samovar left brewing overnight.

- Dynamic Dry Powder. Stablecoins billow between 14% and 30%, always ready for a rainy day or the next round of speculative tea leaves.

- Selective Growth. DeFi and layer-1: the side dishes at this cryptic banquet. Increase in festive moods, vanish in times of doubt. Like pickles—when in doubt, less is more.

Still, these numbers are not a prescription. The report is vague about who exactly is winning (or losing), and nobody has found a recipe for reliable returns—except, perhaps, for persistent anxiety. Every investor is left to stew in their own porridge. Do not attempt at home! Unless home is already mortgaged for dogecoin.

Meanwhile, Bybit’s research suggests—surprise, surprise—the crowds keep clinging to Bitcoin, whose share in portfolios has crept to nearly 31%. One would think it a warm hearth in a St. Petersburg drawing room. Younger coins, like Solana, have slipped out into the cold, replaced by upstart tokens like XRP.

Institutions, by the way, seem to have taken the point: 40% of their assets tucked into Bitcoin, while retail types lag at 12%, distracted perhaps by shiny new tokens or, more likely, the endless meme wars. No matter—the thrill is there for both the professionals in tall hats and the cheerful peasants with Twitter accounts.

🍷🐻 “To Bitcoin: the drink of the bold, the pillow of the fearful!”

Read More

- EUR PHP PREDICTION

- USD JPY PREDICTION

- USD MYR PREDICTION

- EUR RUB PREDICTION

- EUR USD PREDICTION

- Binance & Trump’s USD1: A Stablecoin Love Story 💸✨

- Gold Rate Forecast

- ETH Price Stalls at $3K Amid $19M ETF Exodus!

- BTC PREDICTION. BTC cryptocurrency

- SUI’s Surprising Rise: The Saga of a Blockchain That Smirks at the Rest

2025-06-29 13:48