The once-mighty Bitcoin, having soared to recent pinnacles, now finds itself in a most unseemly descent, prompting a chorus of doomsayers to clutch their pearls. Yet, amidst the clamor, a curious spectacle unfolds: the long-term holders, those paragons of patience, remain resolutely unmoved, as if the market’s tempest were but a breeze to their steadfast resolve. 🧠

Though the price has slipped below its former glory, the on-chain data whispers a tale of quiet defiance. The older coins, like seasoned aristocrats, remain tucked away, their owners uninterested in the chaos of short-term traders and leveraged whims. A most refreshing contrast to the tumultuous antics of the speculative lot! 😏

This divergence, dear reader, is no trifling matter. It suggests a market engaged in a delicate dance of cooling and rebalancing, not a desperate attempt to flee the scene. A most sensible approach, if one may say so. 🚪

What the On-Chain Data Is Saying

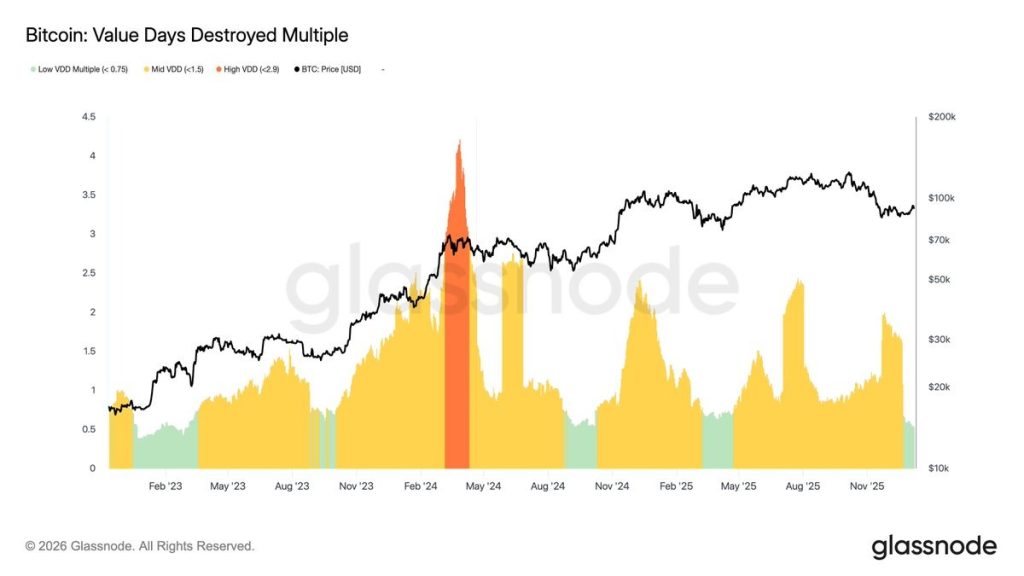

The Value Days Destroyed (VDD) Multiple, that most enigmatic of metrics, reveals a dearth of long-term selling. One might expect a flurry of activity at the ball, yet the long-term holders remain as reserved as a well-bred lady. A sharp spike, indicative of a market top, is conspicuously absent, leaving us to ponder the true intentions of the crowd. 🕵️♀️

Recent readings from Glassnode, ever the vigilant observer, linger in the low-to-mid VDD range, suggesting:

- The long-term holders, ever the prudent, are not in a hurry to part with their treasures.

- The BTC being moved belongs to the fickle-minded, those who chase the latest fad. 🎭

- Selling pressure, though present, is but a passing fancy, not a permanent fixture. 🌦️

This behavior, while unremarkable to the untrained eye, is a most reassuring sign of consolidation. A delightful prospect for those who value stability over chaos. 🧡

Bitcoin Long-Term Holders Remain Optimistic

The price chart, that most capricious of companions, has rejected higher supply zones with the grace of a seasoned dancer, only to tumble below mid-range support. A most dramatic turn, yet the price has not descended into freefall. Instead, it dances around established demand zones, a testament to the resilience of the market. 🕺

The combined charts, ever the eloquent narrators, point to three possible outcomes. Firstly, no mass distribution from the long-term holders, a most welcome sight. Secondly, distribution occurs at higher levels, followed by a controlled reset-a most orderly affair. Thirdly, short-term traders, those eternal harbingers of volatility, drive the chaos, not the wise and the discerning. A most typical mid-cycle correction, where leverage and latecomers are flushed out, while long-term conviction remains unshaken. 🧑⚖️

What’s Next for the BTC Price Rally?

Bitcoin’s price, that most mercurial of entities, faces notable upward pressure, yet continues to trade within a demand zone. Should it reclaim the range between $98,000 and $102,000, it may signal absorption and open the door for continuation-a most promising prospect. An invalidation, however, could drag the price close to $82,000, a scenario that would weaken the broader bullish thesis. 🧨

Yet, despite the sharp pullback, on-chain data does not support a cycle-top narrative. The long-term holders, ever the paragons of calm, remain unshaken, while price action reflects a market resetting excess, not unwinding conviction. For now, the BTC price appears to be digesting gains, not ending the trend. Direction will be decided not by fear, but by how price reacts at key levels in the days ahead. A most thrilling prospect, indeed! 🎭

Read More

- EUR PHP PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- EUR THB PREDICTION

- Gold Rate Forecast

- USD INR PREDICTION

- USD MYR PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- USD PLN PREDICTION

2026-01-09 19:02