It is a truth universally acknowledged, that a stablecoin in possession of a good circulation must be in want of a lending application.

Thus, World Liberty Financial has unveiled World Liberty Markets, a web-based contraption for the genteel practice of lending and borrowing-though one wonders if Mr. Darcy would approve of such Dolomite-assisted entanglements. The platform invites users to supply their USD1 stablecoin (or post collateral of acceptable pedigree) to partake in this most modern of financial dalliances.

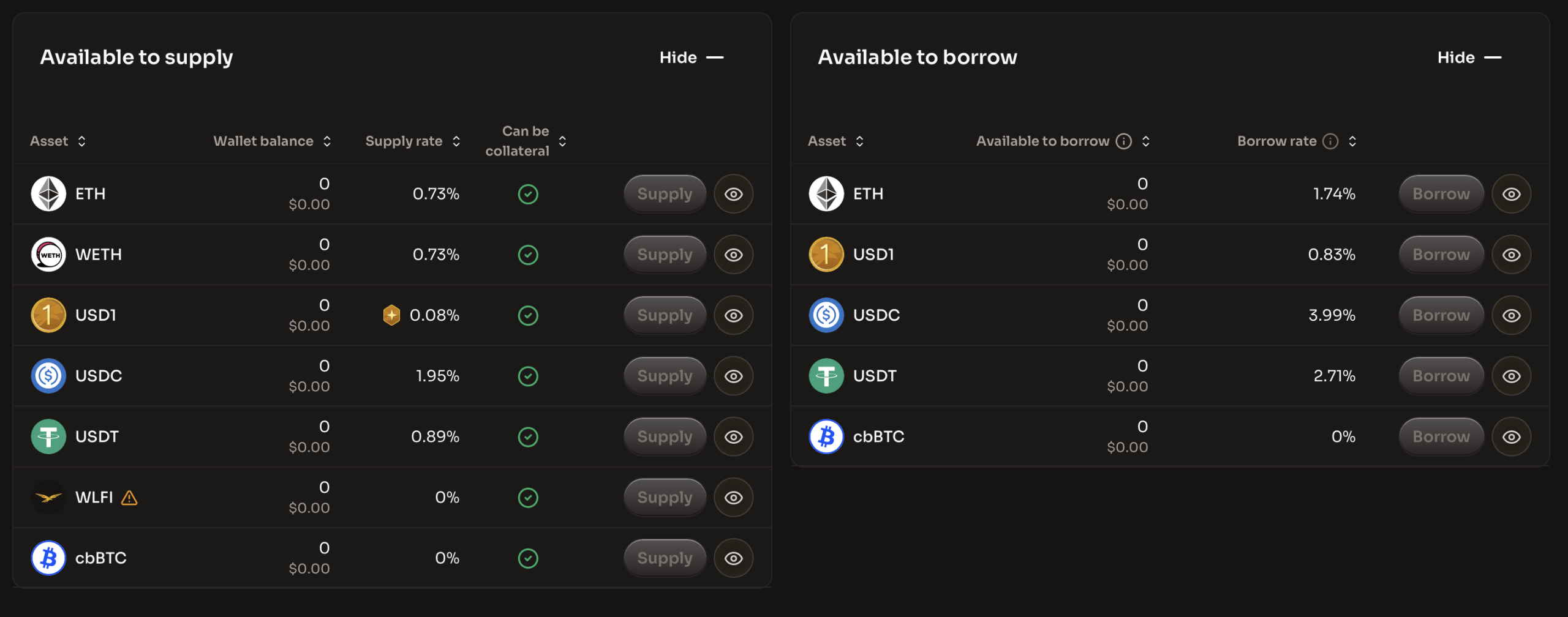

The collateral deemed worthy at present includes WLFI, Ethereum’s ether (a most volatile suitor), cbBTC, USDC, and Tether’s USDT. One might say USD1 now rubs shoulders with the ton’s established stablecoins-a comparison as bold as Mr. Collins at a ball. 🤭

With USD1 recently boasting a circulation exceeding $3 billion (trading briskly at major exchanges), the launch of this platform poses a question: Will users find USD1 a worthy partner in commerce, or shall it prove all style and no substance? 🎭

The application is now live for your perusal via desktop, with a mobile edition promised ere long. Participants may earn rewards through the USD1 Points Program, because what is finance without a dash of gamification? 💸

Company principals hint at grander schemes: tokenized real-world assets, card-based spending, and other whimsies. For now, however, World Liberty Markets stands as a testament to their ambition-or perhaps their audacity. 😉

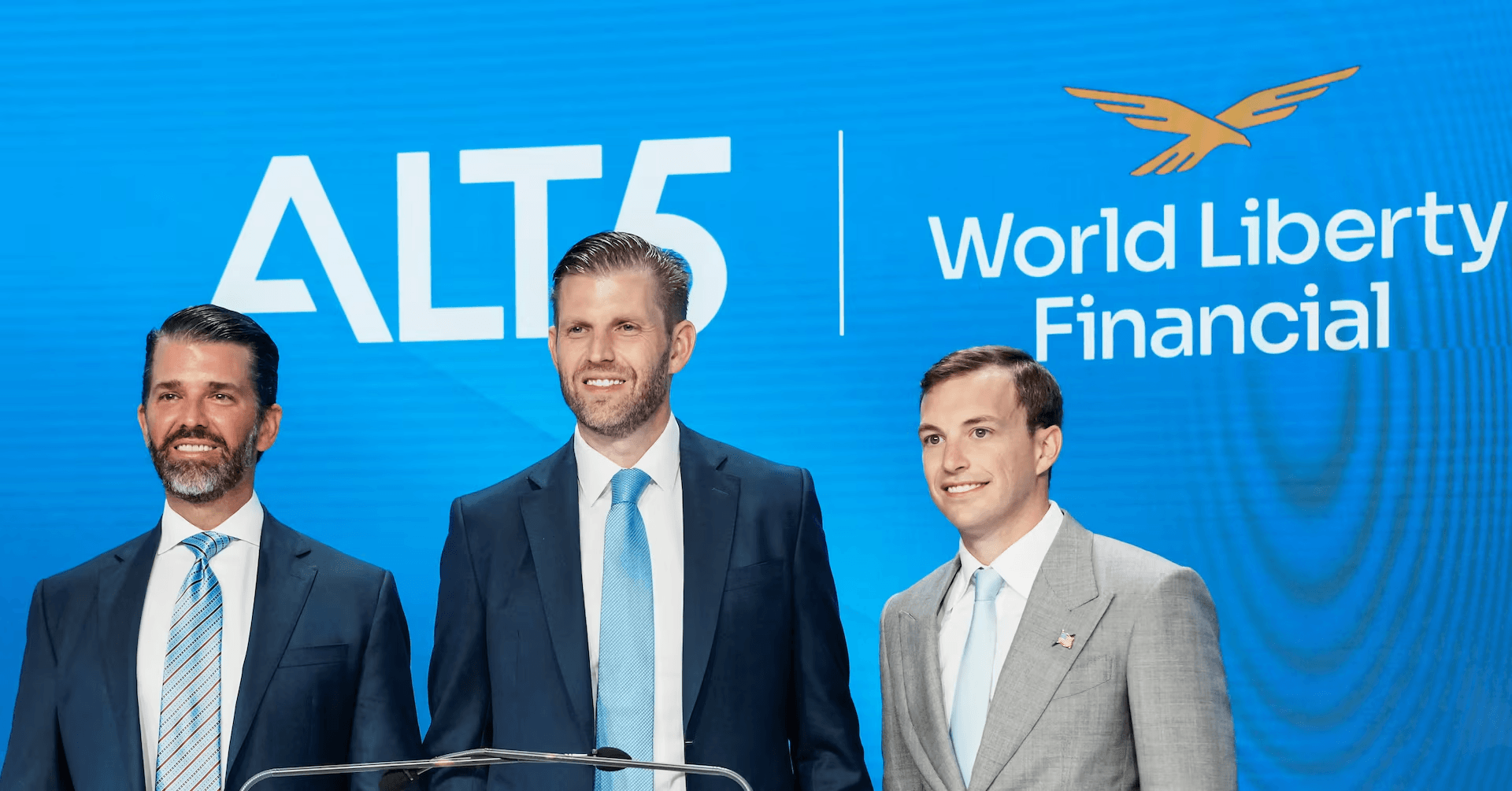

“A year past, we embarked upon the task of crafting a stablecoin to rival the great houses of crypto,” declared Zak Folkman, COO and co-founder. “USD1 has exceeded expectations-now let us see if it thrives when put to work, rather than merely admired.” 🏛️

“World Liberty Markets is but the first step. Many more innovations shall follow, as we dance ever closer to financial utopia.”

In the cutthroat world of decentralized finance-where scrutiny is as swift as a scandal at Netherfield-the true test lies ahead: Can USD1 hold its own when the music stops and the ledgers are balanced? 🎻

FAQ ❓

- What is World Liberty Markets?

A web-based arena for lending and borrowing, where USD1 takes center stage. 🎭 - How does USD1 work here?

Via Dolomite’s infrastructure-think of it as a financial chaperone. 👩💼 - Which collaterals are accepted?

WLFI, ETH, cbBTC, USDC, and USDT. A most eclectic guest list! 🎪 - Is it available?

Indeed, sir! Though the mobile version remains a future promise. 📲

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XMR PREDICTION. XMR cryptocurrency

- EUR RUB PREDICTION

- USD VND PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- EUR ARS PREDICTION

2026-01-12 22:13