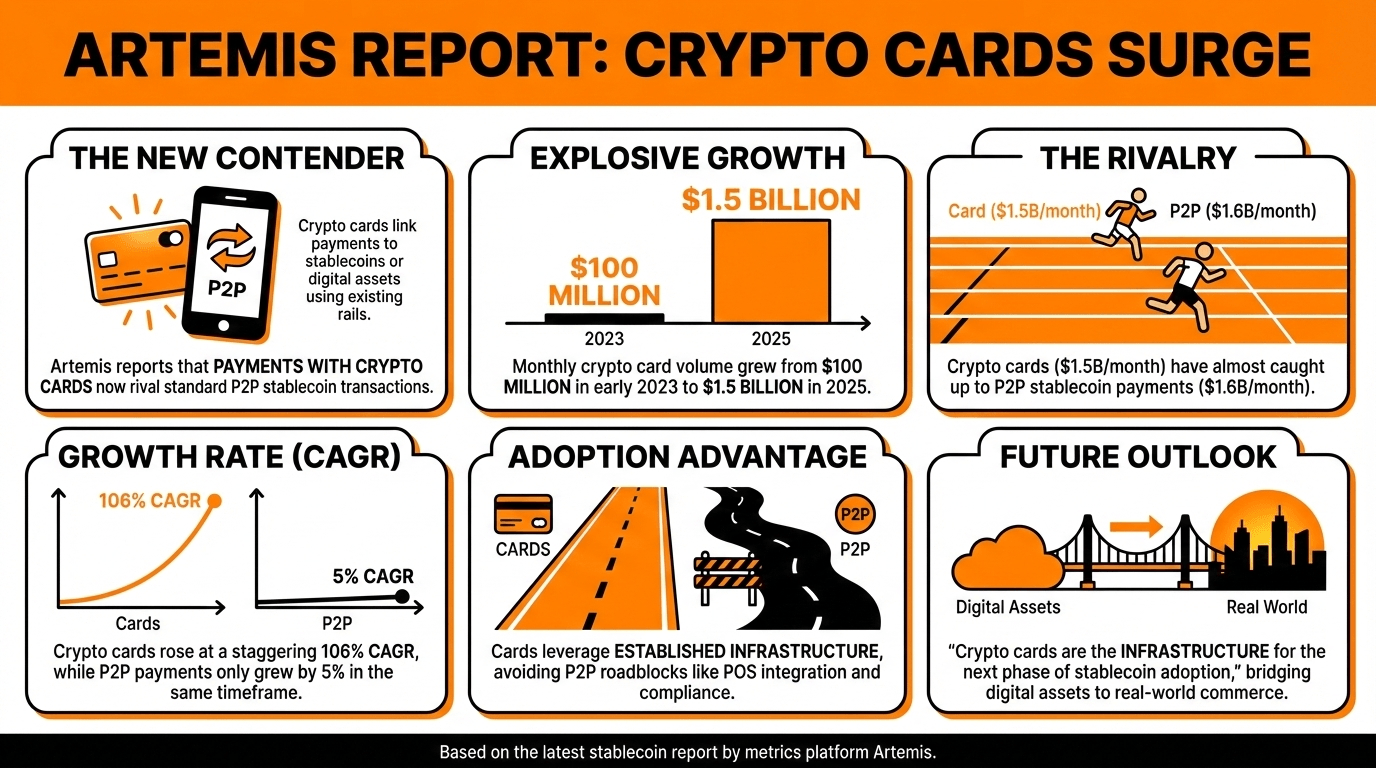

According to Artemis’ stablecoin report, crypto cards have grown from being a niche product in the cryptocurrency payments market to becoming a bridge between crypto natives and global commerce. The report states that now, crypto card payments rival P2P stablecoin payments in volumes settled. 🤯

Artemis: Crypto Cards Now Widely Used, Rival Stablecoin P2P Transaction Numbers 🎉

Artemis, a cryptocurrency metrics platform, has issued its latest stablecoin report, describing the rise of crypto cards in the payments arena. 🧠

Crypto cards, credit or debit cards that link payments to stablecoin or other digital assets, have become a notable participant in the crypto arena. Artemis found that payments with crypto cards now rival standard peer-to-peer (P2P) stablecoin transactions, growing from a $100 million monthly amount settled in early 2023 to $1.5 billion in 2025, almost reaching stablecoin P2P payments -$1.6 billion. 💸

Per Artemis numbers, crypto card payment figures rose at 106% compound annual growth rate (CAGR), reaching over $18 billion yearly, while stablecoin P2P payments reached $19 billion, growing only 5% in the same timeframe. 📈

Artemis believes that this trend will continue in the future, as native stablecoin payments face several roadblocks that will continue to affect their adoption, including a lack of infrastructure, problems with merchant integration, accounting considerations, and the implementation of new compliance measures. 🚧

Instead, crypto cards, like regular credit cards, can enjoy the benefits of an already established system and leverage the same fiat-backed rails that other cards also use, sending fiat to merchants in a seamless way and avoiding adoption pitfalls. 🚀

Artemis explained that, while stablecoin-native P2P and business-to-business (B2B) payments will continue to expand, “direct acceptance fully replacing card networks in the near term is unlikely, as seen by their slow relative growth in volume in comparison to cards.” 🧐

“ Crypto cards will continue to scale alongside stablecoin adoption, leveraging existing merchant networks, and bridging digital asset holdings into real-world commerce. Crypto cards are the infrastructure for the next phase of stablecoin adoption,” the report concluded. 🤝

FAQ

-

What recent findings did Artemis report regarding crypto card usage? Artemis noted that crypto card payments have surged, growing from $100 million monthly in early 2023 to $1.5 billion by 2025. 🚀

-

How do crypto card payments compare to stablecoin P2P transactions? Crypto card payments are nearly catching up to stablecoin P2P payments, which totaled $1.6 billion in the same timeframe. 💸

-

What growth rate are crypto card payments experiencing? Artemis reported a 106% compound annual growth rate (CAGR) for crypto card payments, projecting annual figures to exceed $18 billion. 📈

-

What advantages do crypto cards have over stablecoin-native payments? Crypto cards leverage existing payment infrastructure, providing seamless fiat transactions, while stablecoin adoption faces obstacles like POS integration and compliance challenges. 🛡️

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- CNY JPY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XMR PREDICTION. XMR cryptocurrency

- EUR RUB PREDICTION

- USD VND PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- EUR ARS PREDICTION

2026-01-16 16:30