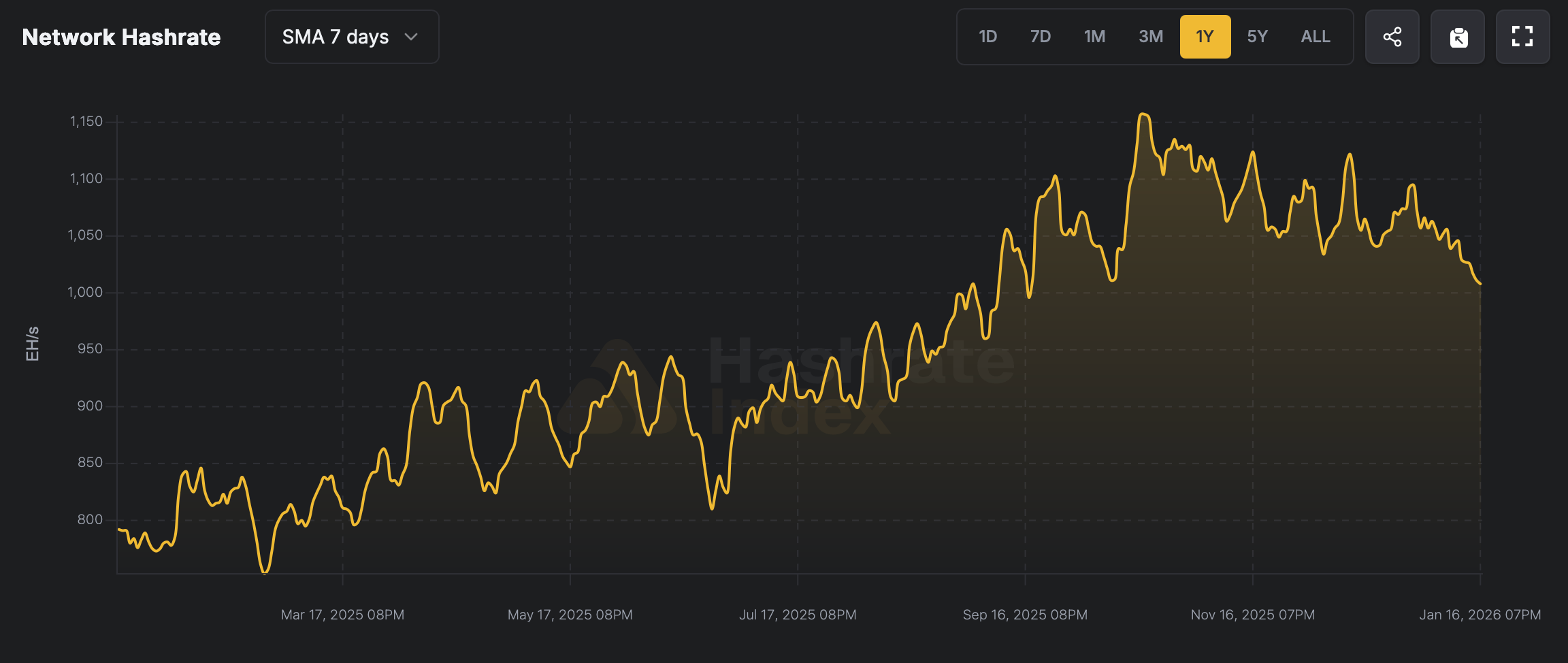

After a steady stretch of flexing above the 1,000 exahash per second (EH/s) – a clean 1 zettahash per second (ZH/s) – line, Bitcoin’s network hashpower has dipped back under the 1 ZH/s bar and is now clocking in at 988 EH/s.

Hashpower Pulls Back From Highs as Difficulty Relief Looms

Bitcoin’s overall hashrate slipped beneath the 1 ZH/s zone on Saturday, Jan. 17, snapping a streak that had held firm above that mark since mid-September 2025. During that stretch, on Oct. 19, 2025, Bitcoin’s hashpower climbed to 1,162 EH/s-equal to 1.162 ZH/s-based on the seven-day simple moving average, according to hashrateindex.com data.

At press time at 9 a.m. Eastern on Jan. 17, data from hashrateindex.com and mempool.space shows the hashrate sitting at 988 EH/s, or 0.988 ZH/s. In practical terms, that puts roughly 174 EH/s out the door since the Oct. 19 peak, spread across a 90-day stretch. During that window, the hashprice-defined as the estimated revenue for a single petahash per second (PH/s) of hashpower-climbed to $49.79 on Oct. 27, only to tumble to a bruising low of $34.55 by Nov. 21.

Since that Nov. 21 trough, the figure has rebounded 19.3%, landing at a Saturday reading of $41.22 per PH/s. As far as 2026 is concerned, the network has logged just one difficulty adjustment this year, and miners caught a small break as it eased by 1.2%. Miners have also navigated roughly four difficulty declines since the Oct. 29 epoch, when difficulty sat at a lifetime high of 155.97 trillion that day and across the two weeks that followed.

Miners notched an almost blink-and-you’ll-miss-it uptick of 0.04% just before the new year, and following the 1.2% pullback on Jan. 8, difficulty now sits 9.5 trillion lower at 146.47 trillion. That shift has worked in bitcoin miners’ favor, smoothing the path to block rewards, and as things stand ahead of the estimated Jan. 22 epoch, difficulty is projected to dip again based on the current tempo of block subsidies being found. For now, block times are running slower than the textbook 10-minute pace, averaging 10 minutes and 34 seconds as of Jan. 17.

As of 9 a.m. Eastern, the estimated difficulty adjustment points to a decline of roughly 5.45%, though that figure could still shift in the days ahead. Miners remain closely tied to bitcoin’s price, holding this range-or pushing higher-to keep revenue on a solid footing. Revenue per PH/s is stronger than it was 30 days ago, when it came in at $37.07 per PH/s on Dec. 17, 2025. Fees, meanwhile, are offering little help, accounting for less than 1% of the block reward and totaling just 0.72% of the aggregate over the past day.

This weekend, the latest numbers paint a network easing off its recent highs while quietly resetting the table for miners, with lower difficulty and steadier hashprice offering some relief even as revenue stays stubbornly thin. Whether this recalibration sticks will hinge less on hashrate theatrics and more on bitcoin’s ability to hold its ground, as miners wait to see if the next epoch brings further breathing room-or a reminder that the network never sits still for long.

FAQ ⏱️

- Why did Bitcoin’s hashrate drop below 1 ZH/s in January 2026?

The decline reflects miners powering down after record highs, influenced by lower profitability, shifting difficulty, and slower block times. 🧠💸 - How does the current difficulty adjustment affect Bitcoin miners?

The projected difficulty drop could make block discovery easier, offering miners temporary relief on operating costs. 🚪✨ - What is Bitcoin’s current mining revenue per PH/s?

As of Jan. 17, 2026, mining revenue stands at about $41.22 per PH/s, up from levels seen in mid-December. 💰📈 - Are transaction fees helping Bitcoin miners right now?

No, fees remain minimal, contributing less than 1% of total block rewards. 🧼📉

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD MYR PREDICTION

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

2026-01-17 20:07