One could hardly overlook the erratic movements of B-money that very morning, on the eighteenth of January in the year 2026. It fluttered most nervously between the figures of ninety-four thousand eight hundred and sixty-nine to ninety-five thousand one hundred and fifteen shillings per coin. While the glass-wearing spectacles of derivatives traders, scrutinizing their papers with feverish anticipation, revealed an intriguing picture. There existed a considerable throng in the futures and options markets, a swelling tide of interest, and an almost perverse affection for a narrow sliver of price levels, coyly skulking just beneath the illustrious one hundred thousand.

Derivatives Data, Much like a Tennis Ball

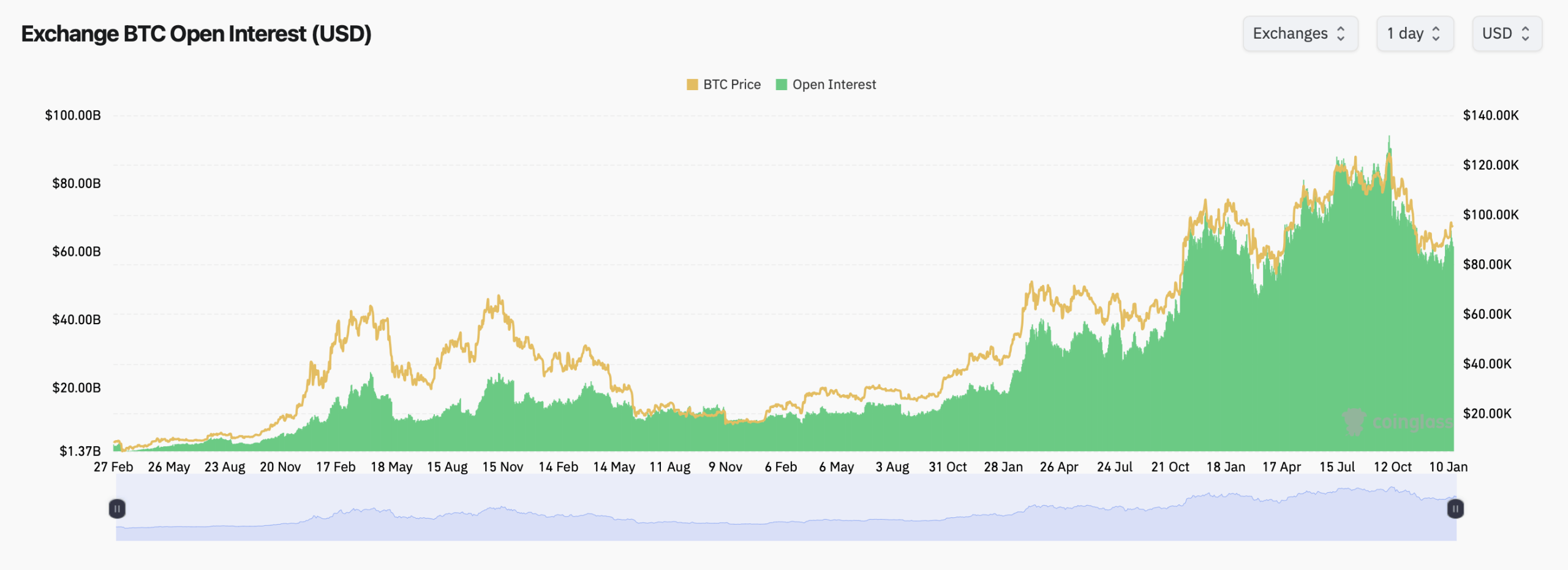

The remarkable compendium of aggregate Bitcoin futures open interest currently proclaims itself at roughly an astounding six hundred and forty-six thousand eight hundred and fifty little eagles, which amounts to near sixty-one point forty-eight billion of notional value, as the esteemed figures from coinglass.com so eloquently attest. Despite witnessing a slight hourly and quartet-hour increase in open interest, the readings from the yesteryear slipped subtly by nearly two percent, an indication, perhaps, of a refined reduction in embrace rather than a collective flight from the grace of leverage.

Amongst the venues of speculative futures, Binance appears as if to lead a ball on the lawn, with an open interest approaching one hundred and twenty-nine thousand five hundred and forty pretty little bitcoins. Ah, this number represents a nearly twentieth share of the global sum. In a close second, one observes the CME, with an interest holding its own at one hundred and twenty-two thousand six hundred and forty, thus propelling its reputation as the choice of the institutions with whom it so delights. Let us not forget the respectable OKX, Bybit, Gate, and MEXC, each boasting significant titre, with their tactical arrangements as varied as the personalities within a drawing room.

Should one gaze upon the bustling scene across the exchanges, it presents a curious tableau. Binance and OKX, having seen their open interest modestly swell within the last day, contrast with CME and Bybit, who witnessed mild contractions. Thus, the dancers appear poised to reassess their partners, keeping their investments as elevated as the spirits of a thoroughly entertained party, all the while anticipating the familiar embraces of familiar quarters.

Opsitication Sentiment: A Whiff of Spring Amidst the Gloom

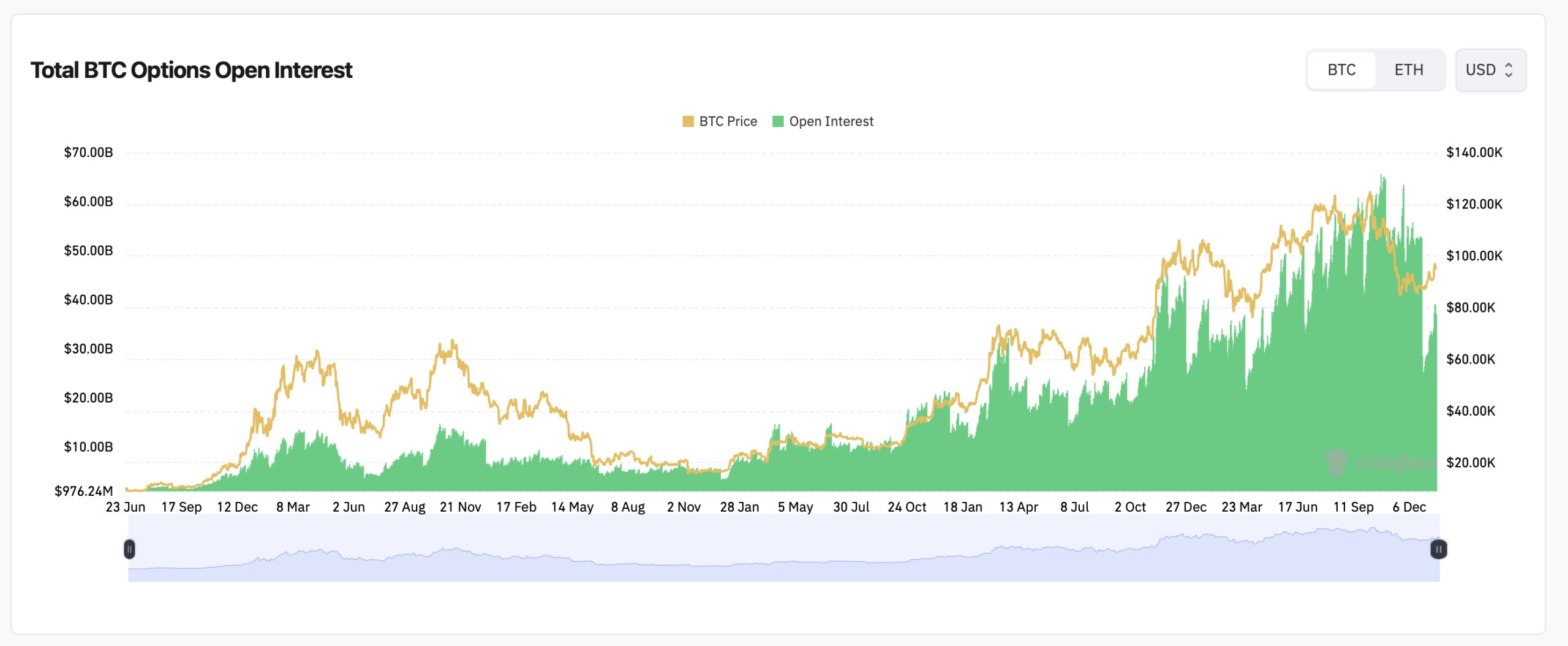

In the domain of options, one might say, the markets inflate voluminously. The sum of options open interest is nearing the enviable number of thirty-six point eighty-eight billion, mirroring the current price as traders lay claim to contracts upon multiple expiries. Behold, Deribit presides with unmatched gravitas as host of the largest repository of contracts, along with the most fervidly traded strikes.

Despite the hegemony of puts, calls maintain a comfortable lead within the options arena, representing more than fifty-seven percent of total open interest, a figure suggestive of dreams not detached from victory, even if, for now, a modicum of circumspection persists. Yet, a twist befalls as the loquacious day unspools; within the past day, it is the puts that have edged slightly ahead in volume, indicating an appetite for the prudent shielding of investments against the winds of upcoming expirations.

An intriguing plot emerges within the Maxwell pain realms to provide further enlightenment. In terms of Deribit, many a notional value is heavily punctuated near the enigmatic range betwixt ninety and ninety-three thousand pennies for the late January expirations. Here, we encounter further points of tension cloaked in the lullaby of ninety-five thousand shillings. Such zones, much to the exasperation of overly assertive speculators, become the sirens’ call as expiry looms nigh.

The sphere of Binance’s options market details a distinct flavor. Their maximum point of ecstasy burrows nearer the lofty point of one hundred thousand, with the addition of significant notional value clustered around the gates of ninety-five to one hundred and five thousand – a cue to the jesters and jestresses togged as traders upon Binance, who show a daring, a readiness for a dance of greater range than of mere consolidation.

Surely on OKX, the tale turns a hint more gradualist, with maximum pain gliding lazily towards the demure low nineties for several expirations heretofore. When considered alongside a burgeoning notional sum at select defensive strikes, the narrative unfurls, signalling an optimism layered with a discerning measure of prudence.

In summation, the world of Bitcoin’s derivatives markets narrates an episode marked by steadfast resolve yet devoid of the stale air of complacency. Here, the proprietors of futures maintain their engagement, the sculptors of options carve their risks with precision, and the price cavorts within a realm where both leverage and patience coalesce, provoking the keenest of emotions.

FAQ 🕛

- What does high B-moneys futures open interest intimate?

Indubitably, it betokens robust trader participation along with an aura of engineered leverage across the dominions of derivatives. - Why indeed do calls cast such a long shadow over Bitcoin options open interest?

Call-favouring postures hint at trader convictions, those holding gaze towards laurels rather than laments in distant futures. - Pray, what does this term ‘max pain’ connote in the milieu of Bitcoin options?

Max pain does reference a price where most options, in a spectacle of despair, expire bereft of worth, often settling as a temporary gravitational pull. - Which distinguished exchanges hold sway over Bitcoin derivatives trading?

Do permit the introduction of Binance, CME, OKX, Bybit, and Deribit, each constructing a grand tapestry with both futures and options with vigor.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- Is XRP About to Soar or Crash? The $3.27 Dilemma Explained!

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- DOGE PREDICTION. DOGE cryptocurrency

2026-01-18 17:58