The market’s exhalation of breath held too long echoed through the halls of Bitcoin and Ether, their once-bright candles now guttering in the frost of post-holiday despair. Only Solana, that sly survivor, flickered faintly in the dark, a ghostly ember in a graveyard of red.

A tranquil interlude, the holiday reprieve, proved as soothing as a lullaby before a thunderclap. When U.S. markets yawned open, crypto ETFs were not met with applause but with a chorus of sell orders, erasing gains like a child’s scribbles wiped from a window. Sentiment, that fickle lover, had abandoned its throne.

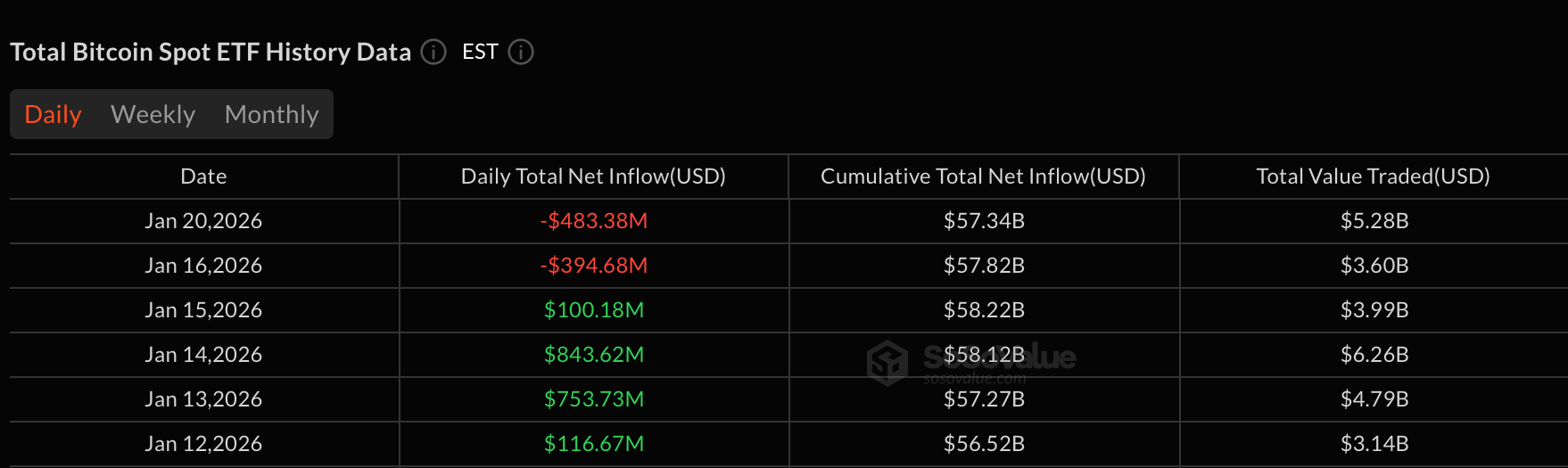

Bitcoin’s ETFs led the retreat, hemorrhaging $483.38 million as if the very concept of digital gold had lost its luster. Grayscale’s GBTC and Fidelity’s FBTC, those titans of trust, crumbled under $160 million and $152 million exits, their reputations as sturdy as a sandcastle in a storm.

Even Blackrock’s IBIT, that self-proclaimed titan of stability, buckled, shedding $56.87 million. ARKB and BITB, once proud steeds, limped away with $46 million and $40 million of their coin, while HODL, EZBC, and BRRR-names that once inspired hope-faded into obscurity. Trading surged to $5.27 billion, yet assets dwindled to $116.73 billion, a paradox as absurd as a desert oasis vanishing mid-sip.

Ether’s ETFs, that eternal sidekick, fared no better, bleeding $229.95 million. Blackrock’s ETHA, the golden goose, laid eggs of ash-$92.3 million lost-while Fidelity’s FETH, Grayscale’s ETHE, and their ilk joined the funeral procession. Trading volume hit $2.23 billion, a grand spectacle with the dull thud of a deflating balloon.

XRP’s ETFs, once the market’s hopeful upstart, now choked on a $53.32 million outflow. Grayscale’s GXRP, the prodigal son, fled with $55.39 million, while Franklin’s XRPZ, in a feeble attempt at heroism, offered a paltry $2.07 million inflow. Total value traded? A mere $34.74 million-a whisper in the wind of capital’s indifference.

Solana, that elusive siren of the crypto seas, managed to lure a few droplets of capital: $3.08 million, powered by Fidelity’s FSOL and Franklin’s SOEZ. A Pyrrhic victory, perhaps, but enough to mock the red tide sweeping all else into oblivion.

In sum, the market’s first post-holiday gasp was a masterclass in de-risking. Bitcoin and Ether, stripped of their gilded cloaks, stood bare in the cold, while XRP shivered beside them. Only Solana, that cheeky trickster, smirked in green, a reminder that even in winter, some seeds lie in wait.

FAQ📉

- What transpired upon the reopening of markets?

Crypto ETFs faced a tempest of selling, Bitcoin and Ether leading the charge into the abyss as investors fled like moths from a flame. - To what extent did Bitcoin and Ether ETFs suffer?

Bitcoin’s coffers wept $483 million; Ether’s, $230 million-all in one session, a financial requiem for the overconfident. - Who danced in the green while others drowned?

Solana’s ETFs, that lone wolf, sipped from the fountain of inflows, a mockery of the market’s despair. - What does this portend for crypto’s near future?

A season of caution, where volatility reigns and investors huddle close to the fire, whispering tales of lessons learned-and forgotten.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- CNY JPY PREDICTION

- OP PREDICTION. OP cryptocurrency

- USD COP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

2026-01-21 16:13