Behold, the crypto exchange-traded fund (ETF) spectacle! As if summoned by some diabolical ledger, Bitcoin and Ether funds witnessed a grand exodus of capital midweek. Even XRP and Solana, those noblest of altcoins, offered but a flicker of hope amid the chaos.

ETF Capitulation Continues With Bitcoin, Ether Hit by Massive Outflows

The sell-off, once a timid whisper of post-holiday caution, now roared like a Cossack horde. Investors, with the grace of a drunkard fleeing a wedding, abandoned ship. The crypto ETFs, poor darlings, were left gasping in the wake of this financial tempest.

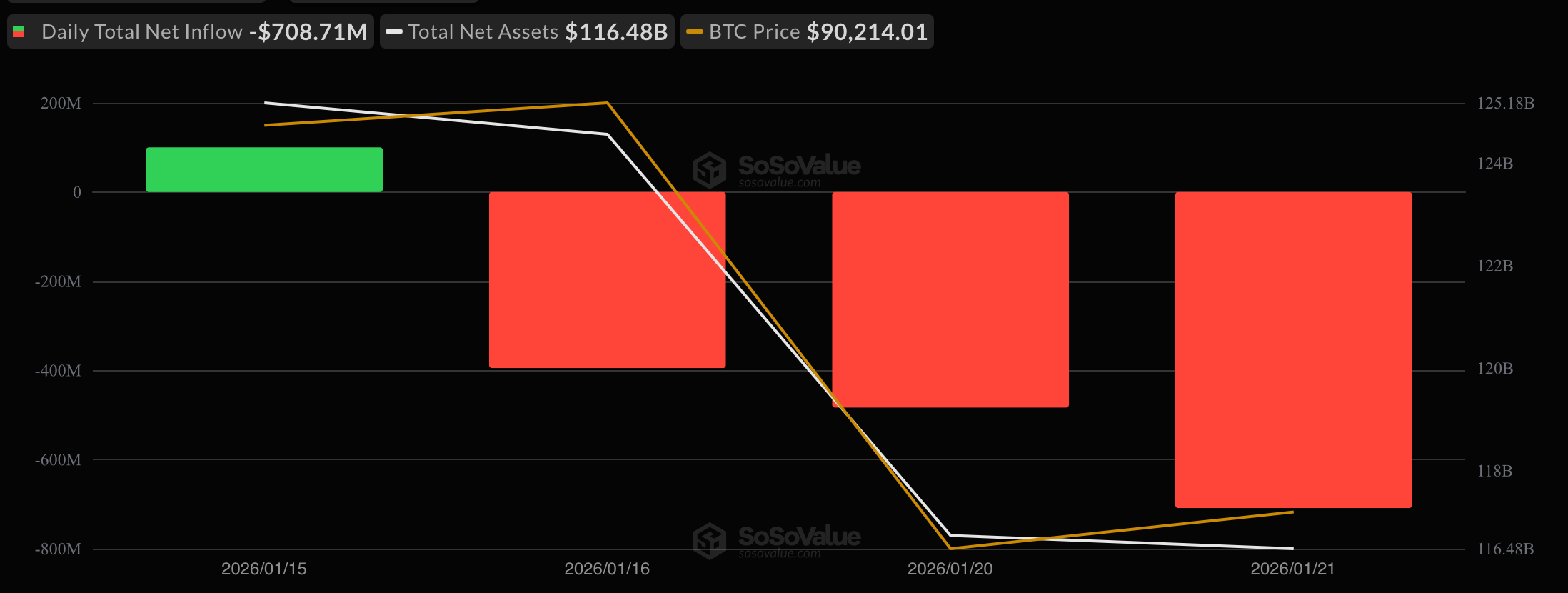

Bitcoin ETFs bore the brunt of this madness, hemorrhaging $708.71 million. Six funds, like six cursed souls, closed in the red. Blackrock’s IBIT and Fidelity’s FBTC led the charge, shedding $356.64 million and $287.67 million respectively-enough to fund a dozen opera houses, or perhaps a single competent investment strategy.

ARKB, that glimmer of false hope, lost $29.83 million. Bitwise’s BITB, with all its hubris, coughed up $25.87 million. Grayscale’s GBTC and Valkyrie’s BRRR, those relics of a bygone era, limped away with losses of $11.25 million and $3.80 million. Trading activity? A paltry $5.51 billion. Net assets? A mere $116.48 billion. One might call it a “modest portfolio.”

Ether ETFs, ever the faithful sidekick, followed suit with a $297.51 million outflow. Blackrock’s ETHA, the undisputed champion of despair, lost $250.27 million. Fidelity’s FETH, Grayscale’s ETHE, and others played their parts in this ballet of financial self-destruction. Total volume? $2.20 billion. Assets? A pitiful $18.28 billion. One might say the market is… resilient. If by resilient you mean “collapsing under the weight of its own hubris.”

XRP ETFs, those underdogs of the crypto world, managed a $7.16 million inflow. Bitwise’s XRP led the charge, while Franklin’s XRPZ and Canary’s XRPC added their humble contributions. Trading volume reached $29.94 million. Net assets? A modest $1.39 billion. A triumph, perhaps, if one defines triumph as “not losing everything.”

Solana ETFs, with all their Solana-like optimism, pulled in $2.92 million. Vaneck’s VSOL, Fidelity’s FSOL, and Grayscale’s GSOL each contributed their pennies to the pot. Total volume? $45.68 million. Assets? $1.10 billion. A glimmer of hope, or merely the delusion of a man staring into the abyss?

Alas, the day’s lesson was clear: Bitcoin and Ether ETFs remain under siege, while XRP and Solana cling to life like a drowning man to a bottle of champagne. Investors, it seems, have the attention span of a goldfish on acid-scattering to smaller altcoins with the desperation of a gambler chasing his last dime.

FAQ 📉

- Why did crypto ETF selling intensify midweek?

Investors, having presumably read the tea leaves, decided that holding Bitcoin and Ether was akin to inviting a bear into one’s parlor. Thus, they fled, leaving chaos in their wake. - How large were Bitcoin and Ether ETF outflows?

Bitcoin ETFs lost $709 million; Ether ETFs, $298 million. A total of $1 billion-enough to buy a small country, or perhaps a single competent financial advisor. - Did any crypto ETFs see inflows despite the selloff?

Indeed! XRP and Solana ETFs attracted modest sums, suggesting investors have developed the wisdom of a squirrel deciding whether to bury an acorn. - What does this mean for near-term market sentiment?

Confidence, it seems, has taken a vacation to a tropical island, leaving only the faintest traces in XRP and Solana. The rest? A wasteland of uncertainty and bad decisions.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- OP PREDICTION. OP cryptocurrency

- EUR ARS PREDICTION

2026-01-22 17:42