Ah, the crypto circus! A spectacle of such exquisite absurdity, where Bitcoin, that darling of digital decadence, pirouettes precariously above the abyss of a crucial support zone. Behold, as skeptics and scalpers alike gather, their breath bated, to witness whether this prima donna of the markets shall bounce or break. Let us, with a touch of Wildean wit, dissect this drama where technicals twirl and signals flirt with chaos.

Bitcoin Chart Outlook

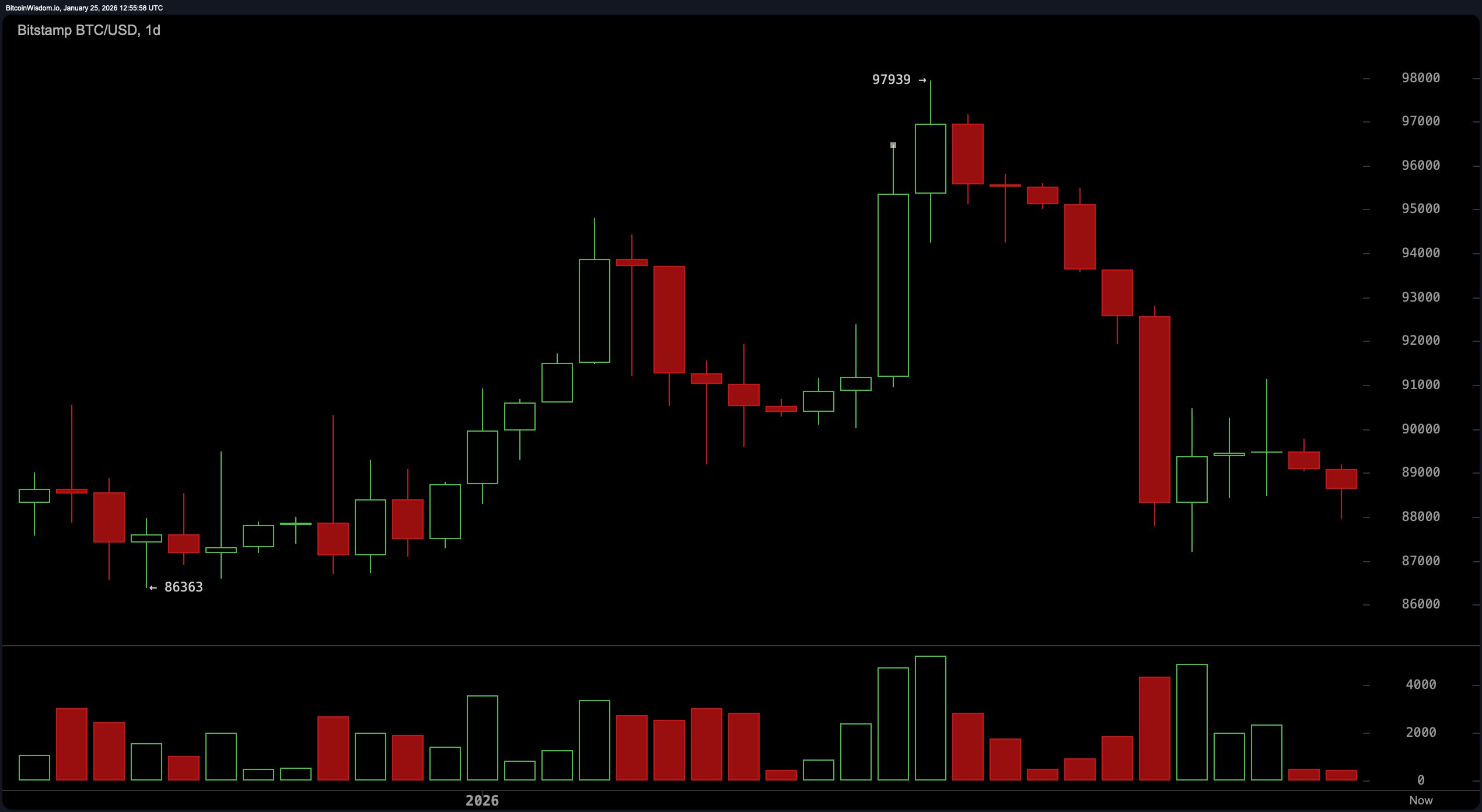

On the daily chart, our dear Bitcoin has donned its bear costume, stomping with such conviction one might mistake it for a performance art piece. After a fleeting flirtation with $97,939, it plummeted with all the grace of a fallen aristocrat, leaving behind a trail of red candles and the wails of panic sellers. Truly, a spectacle worthy of a Victorian melodrama.

At present, it lingers near $88,000, a key support level, yet without the vigor of a convincing bounce or high-volume reversal. The script, alas, remains skewed toward the bearish. Volume surges on the downside suggest institutional offloading-a grand exodus of the elite, leaving retail enthusiasts to ponder their fate. This, my dear reader, is no mere dip; it is a structural unraveling, a tragedy in three acts.

Zooming in to the 4-hour chart, the price action resembles a sulky debutante stuck in a sideways shuffle between $87,193 and $89,500. A short-term downtrend masquerading as consolidation-perhaps a bearish flag waving in slow motion. The market, indecisive and apathetic, fades like a forgotten guest at a ball. Should it break above $89,500 with conviction, a relief rally might ensue. But hesitation, ah, hesitation could spell another descent toward $85,000. Such is the fickle nature of our digital darling.

On the 1-hour chart, a glimmer of defiance emerges as Bitcoin weakly bounces from $87,957 toward $88,500. Yet, the intraday trend remains a sinking ship, with lower highs and lingering seller dominance. Volume, ever the traitor, skews heavily in favor of the bears. Rejection near $88,800 to $89,000 would keep the downtrend intact, while a clean break might allow a quick ascent to $89,700-$90,000-assuming, of course, Bitcoin remembers its former glory.

From a technical indicator perspective, the oscillators present a gallery of neutrality tinged with indecision. The RSI at 41, Stochastic at 17, and CCI at −102-all signal a lack of momentum, much like a society ball where no one dares to lead. The ADX at 25 reinforces this low-trend strength environment, while the Awesome Oscillator at −1,417 and Momentum at −7,002 add bearish undertones. The MACD at −351 provides a final, dramatic punctuation mark, contradicting the oscillators’ mixed cues. A true Wildean drama, if ever there was one.

As for the moving averages, they form a red carpet of resistance, each one a stern chaperone at a debutante ball. All major short- and long-term moving averages-exponential and simple alike-trail above the current price, flashing downside bias. The 10-day EMA at $90,406 and 20-day SMA at $91,900 are but distant memories, and even the 200-day SMA at $105,133 offers no support. Bitcoin, it seems, is swimming upstream in a market that has lost all interest in its antics.

So, while the chart may whisper of a bounce, the broader technical narrative mutters caution. Whether Bitcoin claws its way back into bullish territory or tumbles further into correction depends on its ability to reclaim key levels-and shake off the bearish weight that sits so heavily upon its digital shoulders.

Bull Verdict:

If Bitcoin can break decisively above $89,000 with volume to match and reclaim the $90,000 level, it might signal the early stages of a recovery rally. A higher low formation near $88,000 would further strengthen the bullish case, turning short-term sentiment from cautious to optimistic. A true Cinderella moment, if you will.

Bear Verdict:

As long as Bitcoin remains pinned below key moving averages and fails to sustain a breakout above $89,500, bearish momentum remains in control. A break below $87,000 would likely confirm further downside pressure, dragging price action toward $85,000 and possibly lower. A tragic end, but one befitting this digital drama.

FAQ ❓

- Where is Bitcoin trading now?

Bitcoin is currently trading around $88,636, hovering near a key support zone. A precarious position, much like a tightrope walker without a net. - Is Bitcoin in a bullish or bearish trend?

The trend remains bearish across daily and 4-hour charts, with weak recovery signs. A tragic hero, if ever there was one. - What price levels should traders watch?

Key support is between $86,000 and $88,000, with resistance at $89,500 to $90,000. A drama unfolding in three acts. - What’s driving Bitcoin’s current movement?

Institutional selling pressure and failed resistance retests are fueling bearish momentum. A grand exodus, leaving behind a trail of digital tears.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR ARS PREDICTION

- CNY JPY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

2026-01-25 17:42