As the sun rose and cast its weary light upon the digital marketplace, the LINK price lingered like a ghost at $11.95, quietly lamenting its fate while ETFs quietly gulped down supply like a hungry man at a buffet. Institutions poured their money into this cryptic entity, yet the market seemed to yawn, leaving many to ponder whether Chainlink might need to drop its price even lower before anyone would care to join the dance again.

ETFs: The Silent Vacuum Cleaners of Supply

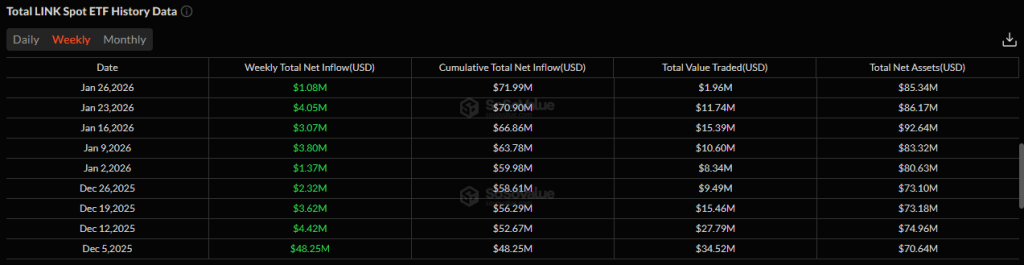

Data from the shimmering vaults of the blockchain suggests that spot LINK ETFs have managed to hoard more than 1% of Chainlink’s total circulating supply, which, if we squint hard enough, amounts to a hefty market cap of $8.42 billion. This minuscule percentage translates to about $85.34 million in total net assets, which sounds impressive until you realize it’s just two sponsors, Grayscale and Bitwise, doing all the heavy lifting, like a couple of overachieving siblings at a family reunion.

Meanwhile, ETF flow data stands proudly with no outflows recorded since its inception, as if the market were a well-behaved child refusing to leave the playground. This steadfast accumulation hints at a long-term demand base, even if the price seems to be on a gentle downward slope, much like a leisurely stroll down a steep hill.

Reserves and Accumulation: A Tale of Growth

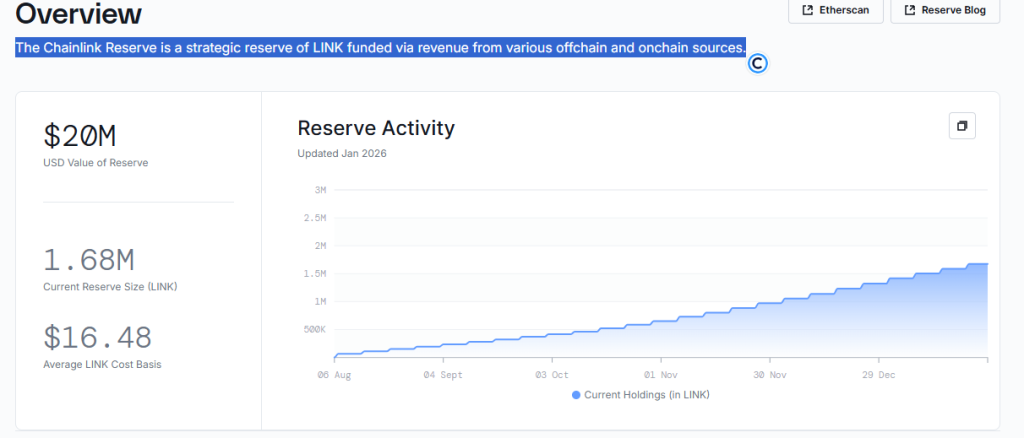

In the background, Chainlink’s internal reserves swell like a proud parent boasting about their child’s achievements. The Chainlink Reserve now holds around 1.68 million LINK tokens, lovingly nurtured through a mixture of on-chain and off-chain revenue streams. This expansion is a testament to the protocol’s grand ambition of long-term sustainability, or at least it hopes to be.

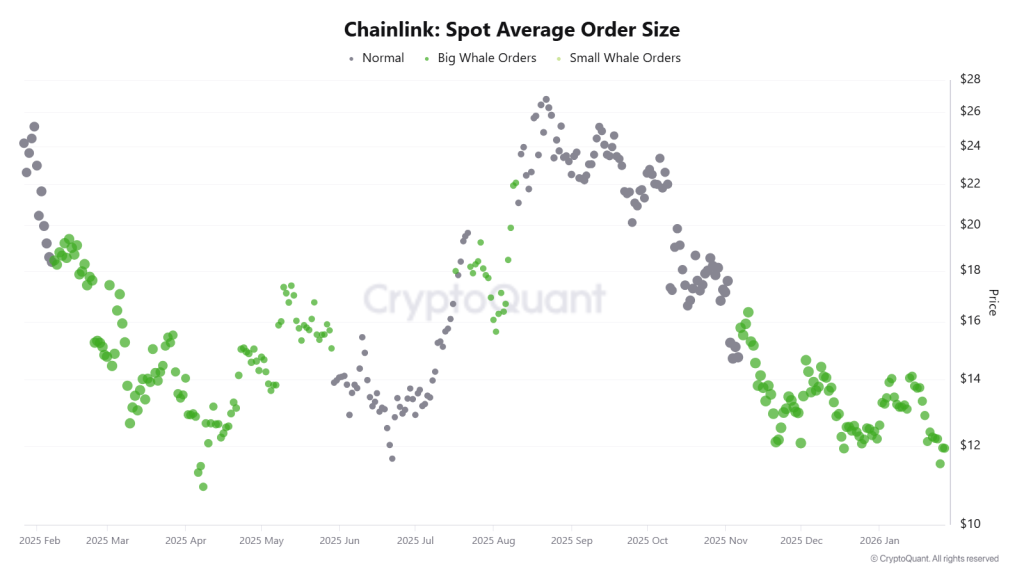

But wait! There’s more! On-chain metrics add a layer of intrigue, revealing rising exchange reserves and whale activity. It appears the big fish are not swimming away but rather feasting on the banquet laid out before them, signaling accumulation instead of distribution.

All these factors paint a rosy picture for LINK in the long run-even as it stumbles about like a toddler learning to walk in the short term.

Institutions: Waiting for a Bargain

However, our institutional friends seem to be lurking in the shadows, hoping for a chance to pounce on lower prices, or as they might put it, “dirt cheap prices.” Despite showing signs of accumulation, the price action suggests they are still not ready to dive in, perhaps waiting for an even deeper dip to satisfy their thirst for a bargain.

Historically, these large entities prefer to build their positions when the market is down, and the current LINK price chart seems to comply with their preferences, like a well-trained dog fetching a stick.

From a broader technical perspective, LINK’s monthly structure indicates that major uptrends typically ignite only after a confident closing candle on its long-term ascending trendline. Alas, such a confirmation has eluded us since 2023, leading some to wonder if the current decline is merely the prelude to the institutions’ fabled re-engagement.

The Charts Whisper of Further Declines

Turning our gaze to the technical realm, several indicators continue to groan ominously. The monthly Bollinger Bands suggest there’s room to tumble toward the lower band, while the MACD has crafted a bearish cross, as if it were painting a gloomy portrait of LINK’s future. The RSI, slipping below the 50 mark, adds to the sense that bullish momentum is losing its grip, like a toddler letting go of their ice cream cone.

In fact, dynamic support is reported to lie somewhere between the $8.75 to $9.00 range, about 25% below where we find ourselves today. Should the price revisit this territory, it would echo past accumulation phases seen before those glorious multi-month recoveries. Thus, one can’t help but note that while the longer-term fundamentals remain robust, the short-term forecast for LINK seems as precarious as a tightrope walker without a safety net.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- Gold Rate Forecast

- CNY JPY PREDICTION

- USD MYR PREDICTION

- WLD PREDICTION. WLD cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- EUR RUB PREDICTION

2026-01-27 19:47