The Treasury speaks in a measured cadence, as if the truth were a ledger that can be balanced with a smile; outside, the wind carries rumors of bread and cages, and one wonders which is heavier-the promise or the chain.

Treasury Secretary Scott Bessent Details ‘Bountiful 2026’ Vision After Davos

From the glare of Davos and the press corps that loves a good miracle, he proclaimed a future where growth runs light on inflation, as if economics could be coaxed from a whisper and a well-timed graph. Accelerated growth, he says, none of the grimacing inflation that gnaws at the ankles of ordinary folk. The rhetoric wears a polite suit, but the room smells of machinery and the faint scent of propaganda.

In a series of media appearances and official remarks, Scott Bessent argued that the present economy might unfold into a non-inflationary expansion, driven not by a flood of demand but by loosening the tight knots of supply-policy changes, rising investment, and productivity gains wearing the mask of virtue while the clock ticks on wages and bills.

Back from the World Economic Forum in Davos, where he met with international leaders and financiers who pretend to be guardians of the common good, he described the U.S. economy as “accelerating” and framed the country as a magnet for global capital, a lighthouse in a squall of currencies and predictions.

Central to his argument is a fourth-quarter growth estimate of 5.4% from the Federal Reserve Bank of Atlanta’s GDPNow model. He cites the projection as if it were a banner, proving the momentum is more than a rumor-though momentum, like all great things, tends to be overworked and misinterpreted by those who stand at a podium.

According to Bessent, the administration’s strategy focuses on clearing bottlenecks rather than inflaming appetite. Inflation is blamed on “friction” in supply chains and regulatory constraints, not on growth itself, and the suggestion is that removing those barriers will allow output to rise without prices rising in chorus behind it.

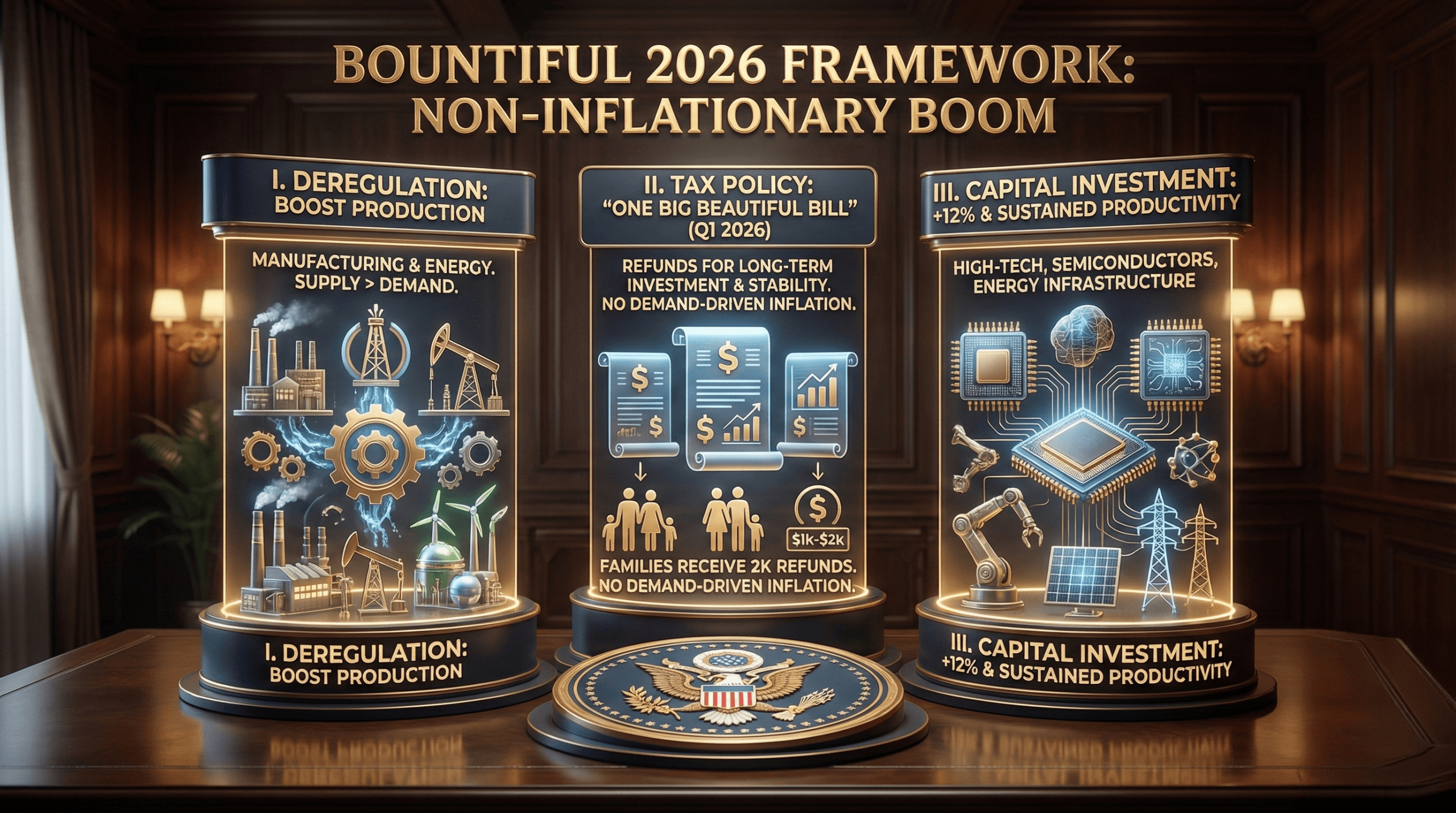

Deregulation forms one of the three pillars of the “Bountiful 2026” framework. Easing constraints across sectors is meant to boost production capacity, especially in manufacturing and energy, so that supply might meet or surpass demand without the theater of crisis.

A second component concerns tax policy. The Working Families Tax Cut Act-admired by administration officials as the “One Big Beautiful Bill”-is expected to begin delivering in the first quarter of 2026. He estimated that eligible households could receive refunds ranging from $1,000 to $2,000, a sum to be counted as real income, not a raffle ticket.

Bessent stressed that these funds are intended to support longer-term investment and financial stability, rather than triggering a brief spending spree that would echo in the private sector with a cry of inflation.

The third pillar is capital investment. He pointed to a 12% increase in business investment over the past three quarters, with capital flowing primarily into high-tech manufacturing, semiconductor production, and energy infrastructure. He argued these investments are expected to yield sustained productivity gains, the kind of gains that feel like progress until you try to balance the books at month’s end.

Energy production also plays a role in the administration’s outlook. Plans to increase domestic oil output by roughly 3 million barrels per day would help reduce input costs across the economy, reinforcing downward pressure on prices even as growth accelerates-a neat trick, if you forget the lens of history for a moment.

In Treasury briefings held at the White House on Jan. 27, Bessent said policy efforts address the “three I’s”: immigration, interest rates, and inflation. He argued that progress in those areas supports the conditions for a strong 2026, a year that promises to be less eventful in the press than in the ledger.

Bessent also rejected traditional economic models that assume higher growth inevitably leads to higher inflation. Instead, he asserted that productivity-driven expansion creates “more goods chasing the same money,” reducing price pressure while allowing output to rise-a sentence that sounds grand until you realize the same money must still be earned, saved, and spent by real people.

While his remarks focused on the real economy, Bessent has repeatedly described the United States as a global center for innovation, a framing he returns to this week when discussing the country’s appeal to technology and finance-the blacksmith’s forge glittering with glass and rhetoric.

FAQ ❓

- What is the “Bountiful 2026” blueprint? It is a framework for achieving robust economic growth through supply-side expansion and productivity gains, dressed in promises of fairness and restraint.

- Why does Bessent say the boom would be non-inflationary? He argues that higher productivity and increased supply reduce price pressure even as output rises.

- What role does tax policy play in the plan? He says tax refunds from the Working Families Tax Cut Act could begin to raise household incomes in early 2026.

- Which sectors are seeing increased investment? Manufacturing, semiconductors, and energy are named as key areas of capital growth.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- Gold Rate Forecast

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- WLD PREDICTION. WLD cryptocurrency

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

2026-01-27 21:27