Oh, what a frosty pickle we find ourselves in! As an Arctic storm front wooshes and whooshes its way across the U.S., bitcoin mining has taken a nosedive faster than a penguin on an icy slide. Yes, dear reader, our American miners have decided to press the pause button on their operations, all in the name of saving our precious power grid from becoming a shivering mess during this chilly spell. The result? A rather notable dip in Bitcoin’s network hashrate, now teetering between 800 and 875 exahash per second (EH/s) like a toddler on a seesaw.

Six-Day Slide: Bitcoin Hashrate Loses Nearly 250 EH/s During Arctic Blast

This blustery Arctic storm has officially made the South and the lower Ohio Valley its chilly playground, with Tennessee, Texas, Louisiana, Mississippi, Kentucky, Georgia, Alabama, and West Virginia feeling the brunt of it. These states aren’t just cozying up with hot chocolate; they also host sizable clusters of bitcoin mining facilities, with Texas strutting around like a peacock in a mining competition.

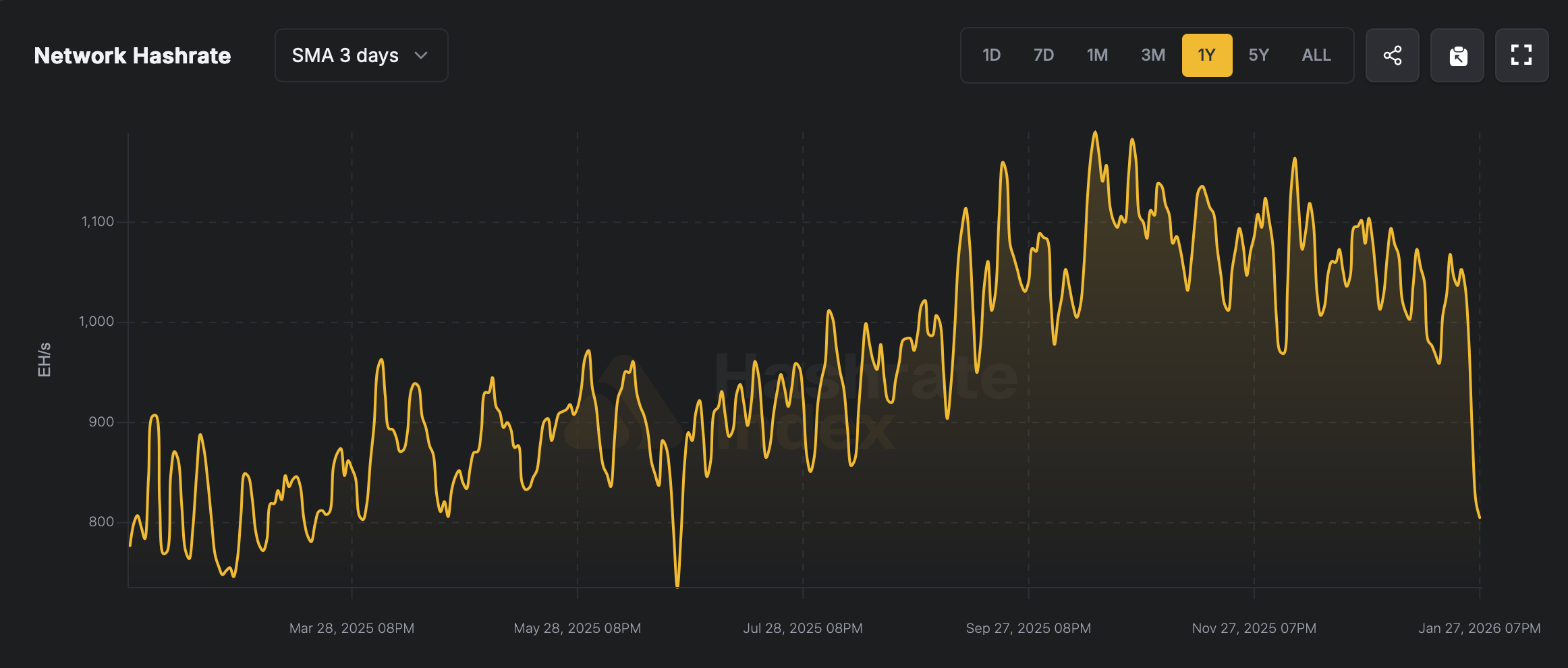

Just three days ago, Bitcoin.com News reported that the world’s largest mining pool, Foundry USA, decided to pull back some of its shiny hashrate before the storm swept in, after a friendly nudge from theminermag.com. Since then, the downward trend in hashrate has been as steady as a snail in molasses. When we measure using a three-day simple moving average (SMA), Bitcoin has shed a staggering 385 EH/s since the bustling day of Oct. 15, 2025.

However, network data compiled by hashrateindex.com shows that the sharpest decline really unfolded after Jan. 22, 2026. On that fateful date, total hashrate was a sprightly 1,053 EH/s, and today, like an old man’s back, it’s slumped down to 805 EH/s using the three-day SMA. In practical terms, of the full 385 EH/s decline from the all-time high of 1,190 EH/s on Oct. 15, 2025, about 248 EH/s took a vacation between Jan. 22 and Jan. 28.

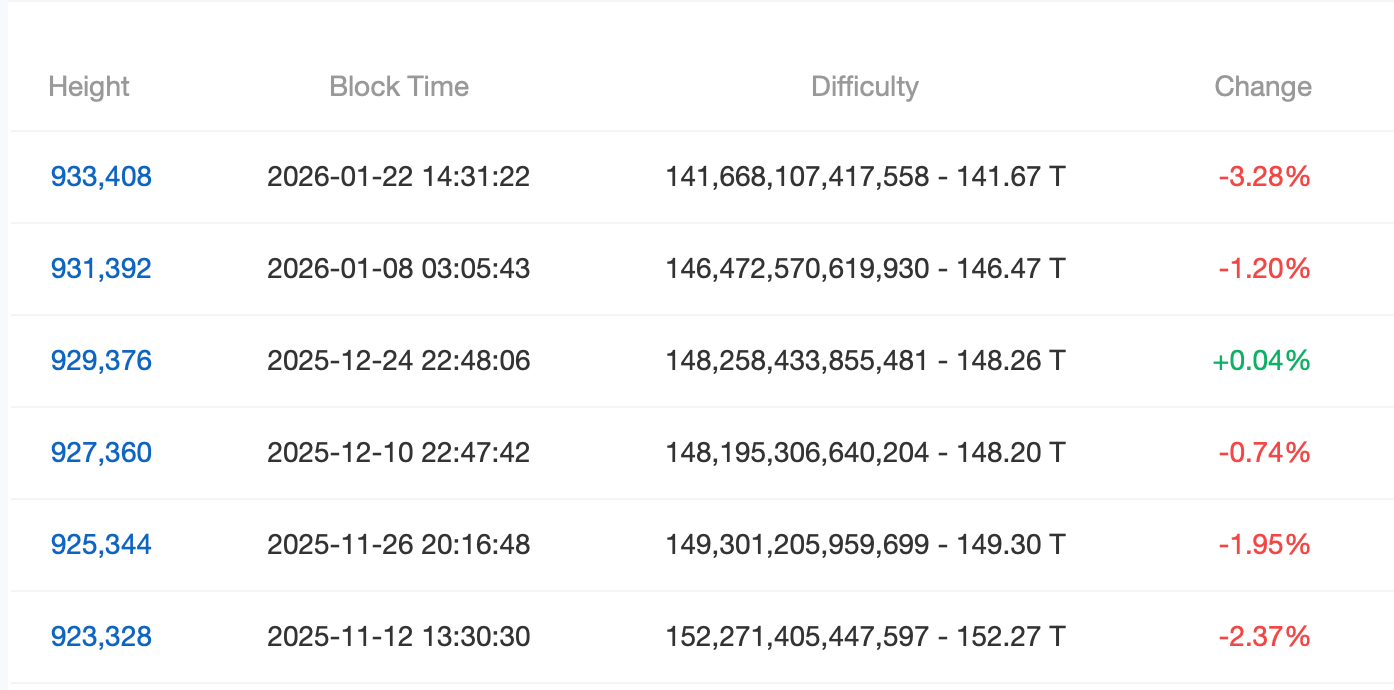

As noted in our report, the slowdown in hashrate has pushed block intervals well beyond the usual 10-minute target. Average block times have exceeded 12 minutes-bless their hearts!-and continue to hover at 12 minutes and 12 seconds. If this pace holds, the difficulty epoch arriving around Feb. 8, 2026, would rank among the largest adjustments seen in years. That’s right, folks! We’re talking bigger than Grandma’s famous fruitcake!

At present, hashrateindex.com and other tracking platforms are projecting a difficulty reduction of more than 18%. Oh, the drama! This outcome remains highly plausible, as the Arctic storm continues to frolic across the U.S., uncomfortably close to the upcoming difficulty epoch. Should the hashrate decide to recover and block times return to normal before the adjustment, the projected drop would shrink like a balloon losing air. But for now, the data points toward a record-setting difficulty drop, and who doesn’t love a good plot twist?

For bitcoin miners wrestling with softer BTC exchange rates and thinner hashprice-based revenue, the timing could hardly be better. Such a hefty difficulty adjustment would offer immediate relief, like finding a twenty-dollar bill in an old jacket. It would ease competitive pressure and improve the odds of earning block rewards with the same infrastructure. In this tight-margin world, even a wee bit of improvement could translate into a marvelous boost to operating efficiency and make a miner’s day just a smidge brighter!

FAQ ⛏️

- Why is Bitcoin’s mining difficulty expected to drop in early Feb. 2026?

A sharp slowdown in hashrate and longer block times following U.S. storm-related mining curtailments have pushed the network toward a sizable downward adjustment. - How large could the upcoming Bitcoin difficulty change be?

Current estimates from hashrateindex.com suggest the difficulty could fall by more than 18% if network conditions remain unchanged-like a wobbly Jenga tower! - What caused Bitcoin’s hashrate to decline so quickly in late January?

An Arctic storm front across major U.S. mining states forced operators, especially in Texas, to scale back activity to relieve stress on power grids. Who knew Mother Nature could be such a party pooper? - Why does a difficulty drop matter for Bitcoin miners?

Lower difficulty reduces competition per block, improving mining efficiency and revenue potential during periods of weaker hashprice. So, it’s like having a secret weapon in a pie-eating contest!

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

- EUR ARS PREDICTION

- Oh Dear, Plunge in Crypto Could Have You Pining for Traditional Acorns

2026-01-28 21:07