In a most unexpected twist of fate, following the rather theatrical capture of Nicolás Maduro, President of Venezuela, the United States has allegedly offloaded its inaugural shipment of Venezuelan crude, raking in a tidy sum of $500 million. Meanwhile, oil-now the world’s second-largest asset by market capitalization, just behind real estate and ahead of your uncle’s collection of vintage stamps-has surged nearly 14% since the year commenced, all amidst geopolitical tensions and a trade spat that would make a soap opera seem dull.

Citgo Dives Back Into Venezuelan Crude After Seven-Year Hiatus

On Thursday, it was reported that Citgo Petroleum, taking a page from the playbook of bold entrepreneurs everywhere, has secured Venezuelan crude for the first time since 2019. This revelation springs forth from two “sources familiar with the matter” (one can only imagine the clandestine whispers over coffee). The backdrop to this development is the recent sale that netted a cool $500 million, as also chronicled by Reuters and CNN, whose sources prefer to remain incognito.

The U.S., ever the diligent strategist, has been advancing on this front since the dramatic takedown of Nicolás Maduro by U.S. forces, courtesy of a directive from President Trump on January 3, 2026. Maduro was whisked away to the United States, where he now resides at the Metropolitan Detention Center in Brooklyn, facing charges that include narco-terrorism conspiracy and conspiracy to import cocaine-quite the résumé. He plead not guilty on January 5-6, 2026, presumably while looking for a good lawyer.

His next court appearance is scheduled for March 17, 2026, likely for yet another pretrial hearing or status conference-because who doesn’t love a good legal drama? In the meantime, Vice President Delcy Rodríguez has stepped into the vacuum left by Maduro, being sworn in as interim president on January 5, 2026, by Venezuela’s parliament and Supreme Tribunal of Justice, which insists that Maduro still holds the title of de jure president. Seems a bit like arguing over who gets the last slice of cake.

U.S. Diluent: The Unsung Hero of Orinoco Oil

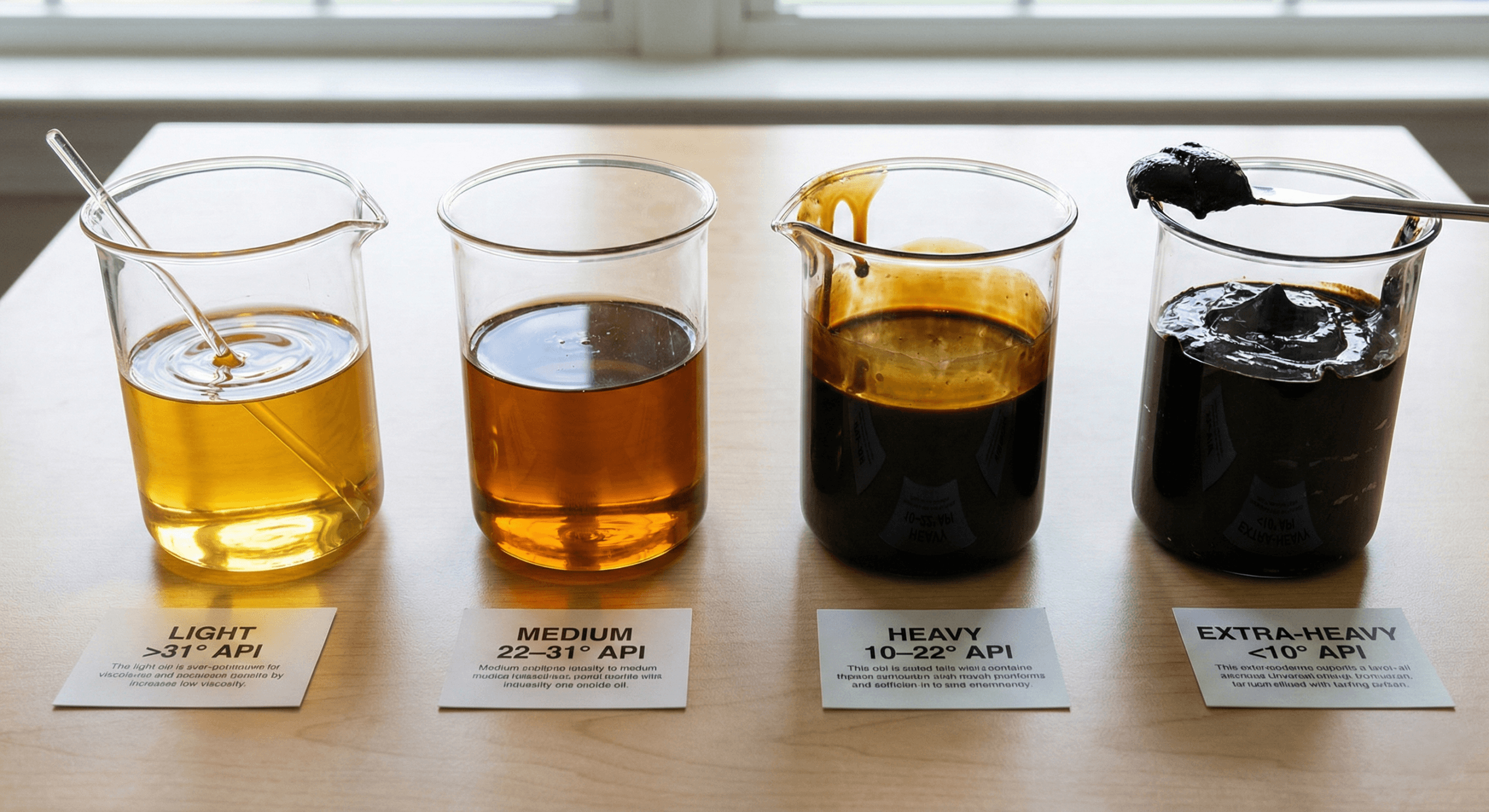

Now, Venezuelan crude from the illustrious Orinoco Belt-the globe’s largest known oil reserves-is known for its thick nature (much like your average Sunday newspaper) and is often “sour” (high in sulfur), necessitating some rather specialized handling. According to Reuters, Citgo has been sourcing other heavy grades from Latin America in the interim, but thanks to anonymous whispers of “confidential details,” it appears they’ve snagged around 500,000 barrels of dense Venezuelan crude.

A pivotal aspect of this American strategy is the fact that U.S. crude tends to be light and easy to refine-quite the opposite of Venezuela’s heavy and extra-heavy blends. This fortunate abundance of lighter U.S. crude is precisely why the Trump administration can provide diluent-think light hydrocarbons or naphtha-rendering Venezuela’s dense oil pumpable and ready for refinement. It’s all rather like adding water to soup to make it go further, isn’t it?

Could an influx of Venezuelan Oil Sink Prices?

So far this year, oil has been strutting its stuff against the U.S. dollar, with spot prices for U.S. crude surging approximately 13.96%. Currently, a barrel is trading at around $64.74-still a long way from the heady heights of over $120 in late May 2022, or the mid-June 2025 flirtation with $75. Oil remains the second-largest asset class globally, carrying an estimated $117 trillion market cap, comfortably trailing real estate’s staggering $671 trillion.

If more Venezuelan heavy crude manages to waltz into the market-thanks to the indispensable light U.S. diluent for blending-oil prices could be in for a downward slide later this year, provided demand doesn’t pull a fast one on us. Both the reported Venezuelan crude sale and Citgo’s recent acquisition mark a substantial shift in U.S.-Venezuela energy dynamics, reminiscent of a long-overdue reconciliation at a family reunion.

Moreover, given the current legal entanglement-federal custody, serious charges, and no sign of a negotiated exit-Maduro seems distinctly unlikely to reclaim his throne. Nationally, Venezuela might actually see a revenue bump greater than in the past, as its crude is once again fetching prices far above the steep discounts of yore. Who knew getting back to business could be so profitable?

FAQ 🛢️

- Why did Citgo purchase Venezuelan crude now?

Citgo’s acquisition follows a strategic pivot in U.S. policy post-Maduro’s capture, enabling limited Venezuelan crude sales under U.S. oversight. - Why does Venezuelan oil require U.S. involvement to move efficiently?

Venezuelan heavy crude from the Orinoco Belt must be blended with light U.S. diluent to transform it into something transportable and refinable. - Could Venezuelan oil flows affect global prices?

An increase in efficiently blended Venezuelan supply could exert downward pressure on oil prices later this year if demand remains steady. - Does Venezuela benefit financially from renewed oil sales?

Indeed, Venezuela stands to earn more revenue than in previous sanctions, as their crude now sells at much higher prices than during those heavily discounted periods.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2026-02-01 03:28