The city’s breath chilled by winter, the market stood like a factory foreman with a ledger in hand. Not long ago, bitcoin wore a crown above 95,000, and the crowd, feverish with gossip, dreamed aloud of six-digit splendor in 2026. It was a jest the street trusted, a bright rumor that kept the coffee warm and the pockets hopeful.

And then, as if a cold iron went through the heart of fortune, the bears rose with the first frost, and the ascent turned into a retreat. The rallies faltered, the graph gnawed its own tail, and BTC slid into a multi‑month trough. With that fall came a heavier thing: the mood of the crowd, a gray cloth pressed over the eyes of many who believed in miracles on a Tuesday.

Fear and Greed Goes South

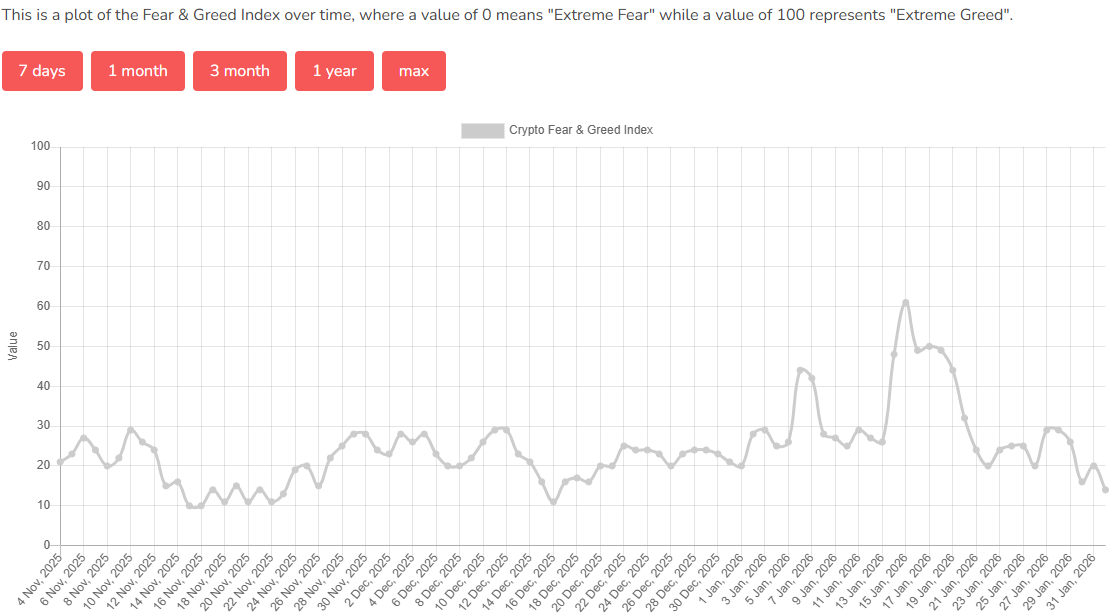

The Fear and Greed Index of Bitcoin-a crude device fashioned from volatility, momentum, BTC’s stubborn dominance, and the chatter of social corners-measures the tremor of the people’s souls. It assigns a number from 0 (extreme fear) to 100 (extreme greed). Logical, perhaps, that the meter now stares into 14, a bleak glance that would embarrass even a winter night. The graph, stubborn as a factory drum, proves the point with a quiet cruelty: fear rules this moment.

As the image below shows, extreme fear sits like a winter sentinel over the market. It has kept company with 30 or less since January 22, when the correction began. After Saturday’s market-wide collapse, where over $2.5 billion of leveraged thirsts were drowned, the index has settled at 14-the lowest mood in memory, save for a December echo.

If you missed what happened Saturday, here is the shorthand of sorrow. BTC clawed back to about $84,000 after Thursday’s crash, only to plunge to $75,500, the lowest mark since last April. A $20,000 slide from January 18-when it stood at $95,500-makes the crowd blink. The altcoins followed, their values collapsing in a chorus of lows not heard in more than a year.

Blessing in Disguise?

Before we declare BTC dead again, according to the Fear and Greed Index, let us recall the ancient rule whispered by a different street sage, Warren Buffett: be greedy when others are fearful, and be fearful when others are greedy. If the widowed logic of history lends him a hand, perhaps now would be the hour to lean forward, to seek the silver of the crash rather than its iron grip.

And if credence is to be given to such rumbles, history’s stubborn door creaks open whenever the market trembles. Previous waves of feverish sentiment have given way to swift revivals, the kind that make the tired heart beat with reckless optimism for a moment longer than reason allows.

Robert Kiyosaki has his own tale of two classes walking the same Earth but living in different houses. He contends that the rich rush in when the markets are “on sale,” while the poor scatter like frightened birds when the roof collapses. The mathematics of class and cash, painted in stark colors, sits beside the news like an old poster that refuses to peel off the wall.

Difference between Rich People and Poor People:

When Walmart has a SALE poor people rush in and buy, buy, buy.

Yet when the Financial Asset Market has a sale… a.k.a. CRASH… the poor sell and run… while the rich rush in… and buy, buy, buy.

The gold, silver, and Bitcoin…

– Robert Kiyosaki (@theRealKiyosaki) February 1, 2026

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- BTC PREDICTION. BTC cryptocurrency

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2026-02-02 00:13