Darling Ethereum, the little asset with more personality than prudence, waltzed into the week under a cloud and a chorus of crypto chitchat. It slid nearly 8% today and slipped decisively below the $2300 line, while the market as a whole pranced to the downbeat. The dash of momentum was brisk, as leveraged long positions were politely untrussed and spot demand failed to hold the lamps aloft. All the on-chain teacup readings suggest capital is sashaying toward exchanges rather than tucking away in long-term storage, murmuring that ETH may be flirting with a distribution phase rather than a mere routine pullback.

On-Chain Flows Signal Elevated Distribution Risk

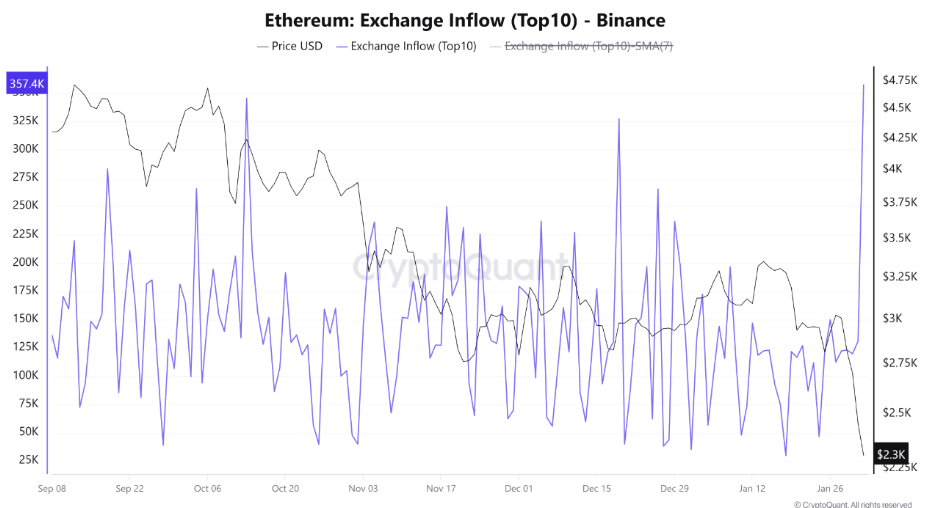

There was a notable tilt in the on-chain ballroom, especially among the grandees of the wallet world. Exchange inflow data shows a brisk, synchronized rise in ETH deposits-a gesture often associated with selling, hedging, or simply hedging one’s bets with a fanfare. On February 1, inflows into Binance surged to roughly 357,000 ETH, the exchange’s highest daily inflow since September. Meanwhile, total inflows across major venues flirted with 600,000 ETH, one of the most coordinated inflow spectacles in recent months.

Such concentrated inflows are hardly what one expects during a period of robust accumulation. They tend to surface when grandees reposition exposure near key price levels. The timing of this surge, just before ETH slid below 2,300, made the market even more jittery, and the combination of rising leverage and these inflows reduced the market’s appetite to swallow selling, turning a small squeeze into a proper liquidation cascade.

Liquidation Pressure Builds as Leverage Unwinds Aggressively

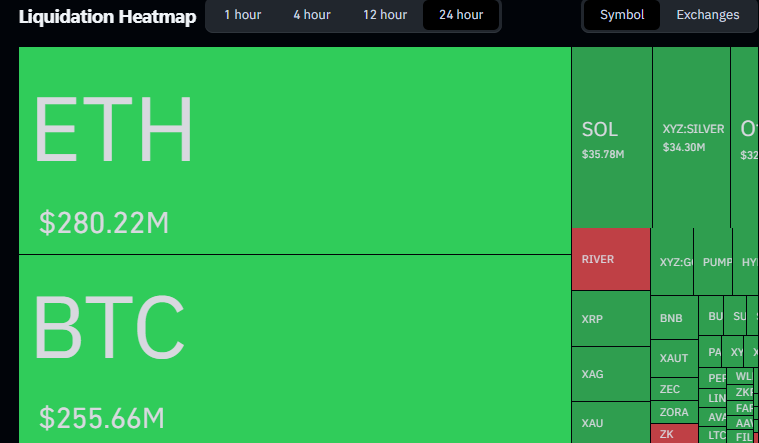

Derivatives data has ETH center-stage in the latest bout of liquidations. In the last 24 hours, ETH-related liquidations swelled to roughly $280 million, nudging Bitcoin’s $250 million and securing Ethereum’s role as the principal stress point in the market.

The heatmap shows long positions taking the hardest hits, a sign the bullish crowd had crowded the party near recent highs.

When ETH slipped below short-term support, stop-outs multiplied and the move accelerated, pushing prices through thin liquidity. This reads more as structural frailty than panic, and when liquidations cluster this tightly, prices can overshoot fair value before returning to something resembling civility-leaving ETH vulnerable to more drama in the near term.

Ethereum Price Structure Weakens Below Key Support

The breakdown below the 2,500 support zone carries real signposts. Losing the 2,300-2,500 corridor shattered the prior consolidation and handed the reins to sellers. ETH is now trading below its short-term moving averages, with momentum pointing south instead of staging a comeback.

The lack of robust buying volume on the way down suggests demand is cautious rather than hamming it up. Immediate support sits near 2,000, and if that gives way we might be looking at a fairly dramatic slide toward 1,600-so pack a parachute, darling.

Is the Worst of the ETH Selloff Already Priced In?

Even as the downdraft persists, the higher-timeframe structure hints at a possible inverse head-and-shoulders in the wings. The pattern seems to have formed after ETH slid to the 2,100-2,500 range, where selling momentum faded and volume failed to expand at fresh lows. A right shoulder may be forming, suggesting stabilization rather than another plunge.

The dream remains conditional: ETH would need to reclaim the 2,500 neckline with brass in volume to confirm the pop. Until then, the pattern stays in the wings, and a loss of 2,100 could re-open the floor to further downside. A spell of consolidation or a modest relief bounce cannot be ruled out if ETH guards its current demand zone. Until the reclaim levels break decisively, the broader outlook stays cautious, with volatility likely to linger like an overbearing guest at a dinner party.

FAQs

Why Ethereum Is Going Down Today? Ethereum is stepping out in a frock with rising exchange inflows, long-liquidation drama, and a general sense that the market is feeling the chill of the broader crypto scene.

How much ETH was liquidated recently? Over $280 million in ETH long positions were liquidated in the last 24 hours, underscoring market stress and a fear of the unknown.

Could Ethereum stabilize or reverse soon? A potential inverse head-and-shoulders hints at stabilization, but ETH must reclaim the 2,500 mark on strong volume to seal the deal.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

2026-02-02 11:22