Ah, the noble KBank, Thailand’s second-largest lender, now plots to conquer the digital asset realm with the grace of a court jester armed with a ledger. One might think they’d settle for mere loans, but no! They’ve filed trademarks for stablecoin wallets, a move as bold as declaring war on tradition with a smile and a bow tie.

These filings, oh these papers (as thick as a play’s script), reveal a grand design: a proprietary stablecoin wallet ecosystem. After acquiring Satang Pro (now rebranded as Orbix, because why not?), KBank now dreams of a world where their walls are higher than Versailles and their gardens bloom with tokenized Thai Baht. A “walled garden,” they call it. How quaint.

But let us not mistake ambition for folly. By claiming IP rights for custodial and non-custodial interfaces, KBank constructs a fortress where liquidity is trapped like a nobleman in a gilded cage. Mirroring the trend of banks bypassing SWIFT with blockchain’s “instant settlement,” they ignore the obvious: when one builds a moat, one must also consider the frogs.

Behold, the age of “infrastructure wars” has dawned! The value no longer lies in the coins, but in who owns the rails-those metaphorical tracks that crisscross the globe, carrying billions in liquidity like a train with no conductor. Yet, as institutions build their private ledgers, they’ve created a labyrinth of incompatible networks. A true comedy of errors, where efficiency is as rare as a honest banker.

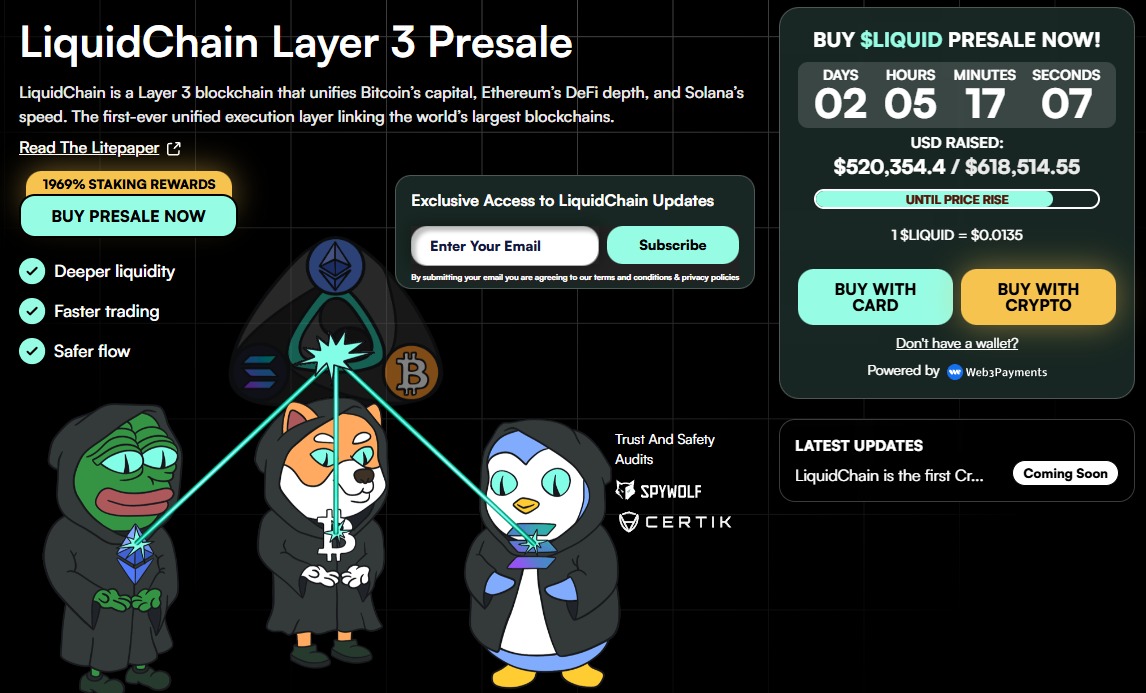

Enter LiquidChain ($LIQUID), a Layer 3 protocol so audacious it claims to unify these fractured execution environments. While KBank dabbles in local compliance, LiquidChain promises to bridge the liquidity islands with a Cross-Chain Virtual Machine. No need for wrapped assets or honeypots for hackers-just a VM that operates like a well-rehearsed farce, where everything clicks into place.

And for the developers, LiquidChain offers a “Deploy-Once Architecture,” a marvel that allows smart contracts to reach Ethereum, Solana, and beyond with a single deployment. No more juggling gas fees or chain-switching-just a seamless performance where the audience (and investors) are none the wiser.

Frankly, this interoperability is the only thing keeping institutional players from fleeing to greener pastures. With LiquidChain’s Single-Step Execution, even the most complex cross-chain swaps become as simple as a well-timed punchline. No gas fee juggling, no chain switching-just a final, secure transaction. Oh, and $LIQUID tokens fuel the whole affair, like a well-stocked wine cellar at a royal banquet.

Meanwhile, the presale has already raised over $520K, with a token price of $0.0135. One might call it a steal, or perhaps a gamble. But in the theater of finance, the curtain rises for those who dare to bet on the next act.

As KBank and others bring real-world assets on-chain, protocols like LiquidChain stand to inherit the crown. But remember, dear reader: this is not financial advice. It’s a play, and the house always wins.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2026-02-03 13:46