In the grand theater of finance, where chaos often reigns supreme, Tether’s USDT has taken the stage with unexpected aplomb, achieving record highs in usage, transfers, and reserves during the fourth quarter of 2025. This remarkable ascent continues unabated, even as the broader cryptocurrency market finds itself gasping for breath after October’s infamous liquidation debacle.

Tether Soars as Stablecoin Market Hits a Snag

As 2025 drew to a close, Tether’s USDT not only survived but thrived, solidifying its status as the reigning champion of stablecoins. According to Tether’s Q4 2025 Market Report, USDT boasts a staggering market capitalization of $187.3 billion, an increase of $12.4 billion in just one quarter-impressive, considering the total cryptocurrency market cap plummeted by over a third post-October liquidation.

Furthermore, the fourth quarter marked the eighth consecutive quarter of adding over 30 million new users. The total user count skyrocketed to 534.5 million, while on-chain holders surged by a staggering 14.7 million to reach 139.1 million wallets. With wallets holding USDT now representing over 70% of all stablecoin wallets, Tether’s dominance is undeniable.

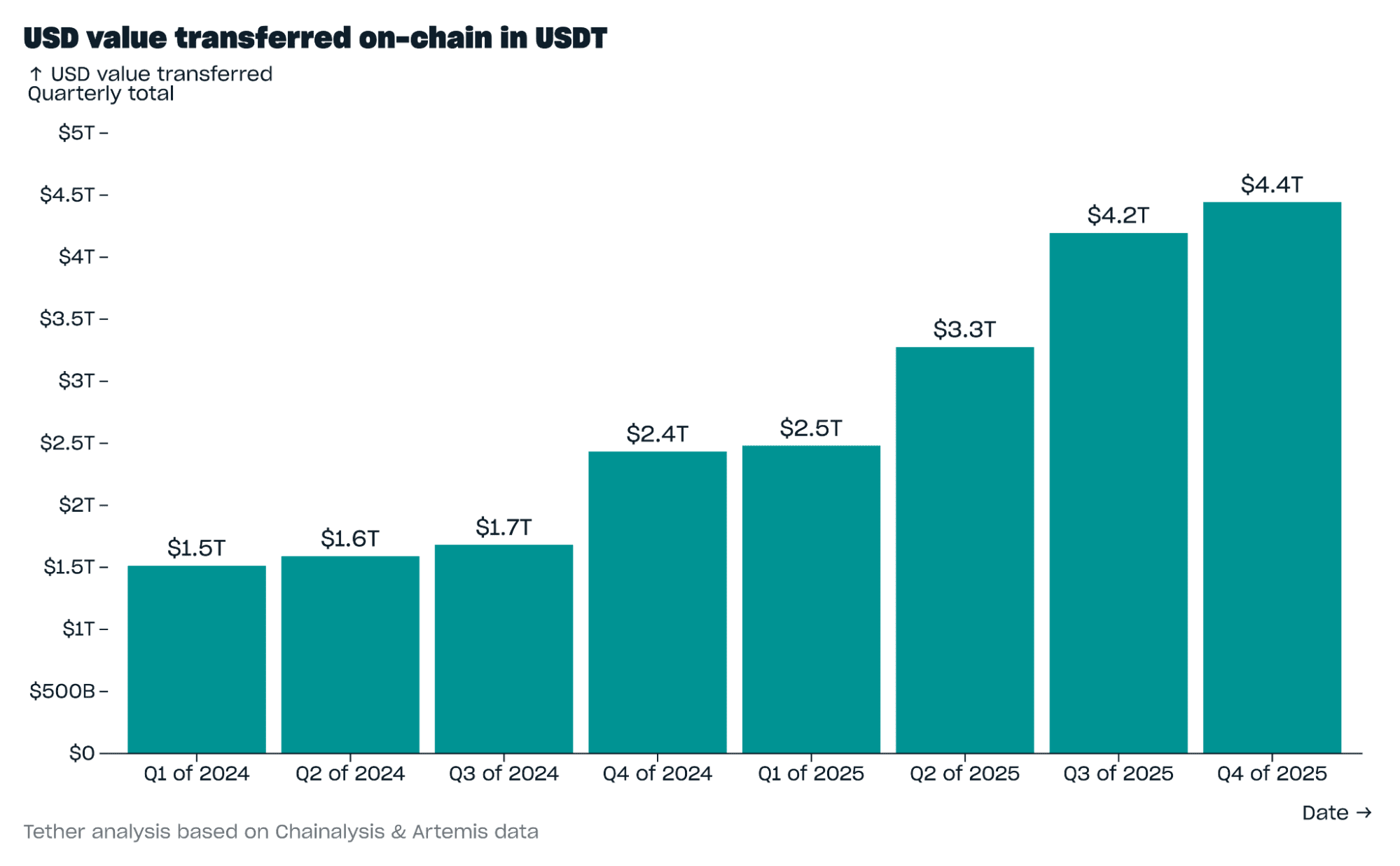

On-chain activity reached unprecedented heights, with monthly active USDT wallets averaging 24.8 million, comprising roughly 68% of all stablecoin transactions. The total value exchanged on-chain climbed to a staggering $4.4 trillion, marking the highest level ever recorded. Notably, the majority of transfers were under the paltry sum of $1,000, highlighting the currency’s everyday utility.

On the financial front, Tether proudly declared total reserves of $192.9 billion, with U.S. Treasuries accounting for a hefty $141.6 billion. Were Tether a sovereign power, it would hold the title of the world’s 18th-largest state entity! Over the past year, Tether added a whopping $28.2 billion in Treasuries, establishing itself as one of the globe’s largest buyers. Its reserve portfolio also includes 96,184 bitcoin and 127.5 metric tons of gold.

Despite a slowdown following the notorious October 10 liquidation, USDT still managed to expand by 3.5% between then and early February 2026. Tether attributes this remarkable resilience to a growing reliance on crypto trading alternatives, as users flock to USDT for both storing value and executing transactions.

The data paints a picture that suggests USDT’s blend of low-velocity savings and high-velocity transactional flows provides an elusive balance of stability and liquidity, enabling it to flourish even amidst the tumultuous contractions of the wider market.

FAQ 💵

- How did USDT thrive while crypto markets faltered?

The enduring demand for USDT as a reliable store of value and payment mechanism persisted after October’s wild liquidation spectacle. - What’s the current size of Tether’s USDT market cap?

By the end of Q4 2025, USDT reached an astounding $187.3 billion market cap. - What’s fueling the surge in USDT’s on-chain activity?

Everyday transactions dominate the scene, with most transfers lingering below $1,000, all while usage soars to new heights. - How solid are Tether’s reserves?

Tether holds an impressive $192.9 billion in reserves, prominently featuring $141.6 billion in U.S. Treasuries.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ETH PREDICTION. ETH cryptocurrency

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2026-02-08 00:13