What to Know:

- Bitcoin’s rejection at 70,000 is whispered by a reversal in ETF flows, as if corridors of money paused to look in the mirror.

- The market tilts toward utility, as if capital hesitates from capricious flights to build the quiet machines that endure the long night.

- BMIC gains pace by answering the looming quantum threat with a wallet and security tuned by AI- a kind of fortress for a fragile era.

- Presales grow despite stormy weather, signaling a hunger for post-quantum armor in a world that loves to gamble with fate.

Bitcoin has once again found the thresholds of price discovery and stumbles below the ghostly line of 70k. Momentum? It wobbles, like a man who senses the step before taking it.

The catalyst is the fresh tide of net outflows from U.S. Spot Bitcoin ETFs, a sign that the euphoria of the “Trump trade” is cooling in the face of macro fog. Data from the past week shows major funds (Fidelity, ARK Invest) seeing withdrawals outpace inflows for the first time in nearly a month, leaving BlackRock’s IBIT as the lone stubborn lighthouse against a rising sea of bearish wind.

Why does this matter? 70,000 was not merely a price; it was a ritual, a validation of the post-halving dream. The rejection hints that retail liquidity cannot swallow the appetite of institutions at these heights.

Traders know the dance: when ETF flows turn negative, a cascade of leverage may drain other markets. The immediate risk is a test of the mid-60s, where heatmaps of losses glow like embers in a winter night.

Yet corrections have a way of nudging capital toward sturdier things-the infrastructure that keeps systems alive in the long winter, not merely flashy trades. While the majors bleed, the clever money seeks hedges against deeper storms, including the threats from technology itself.

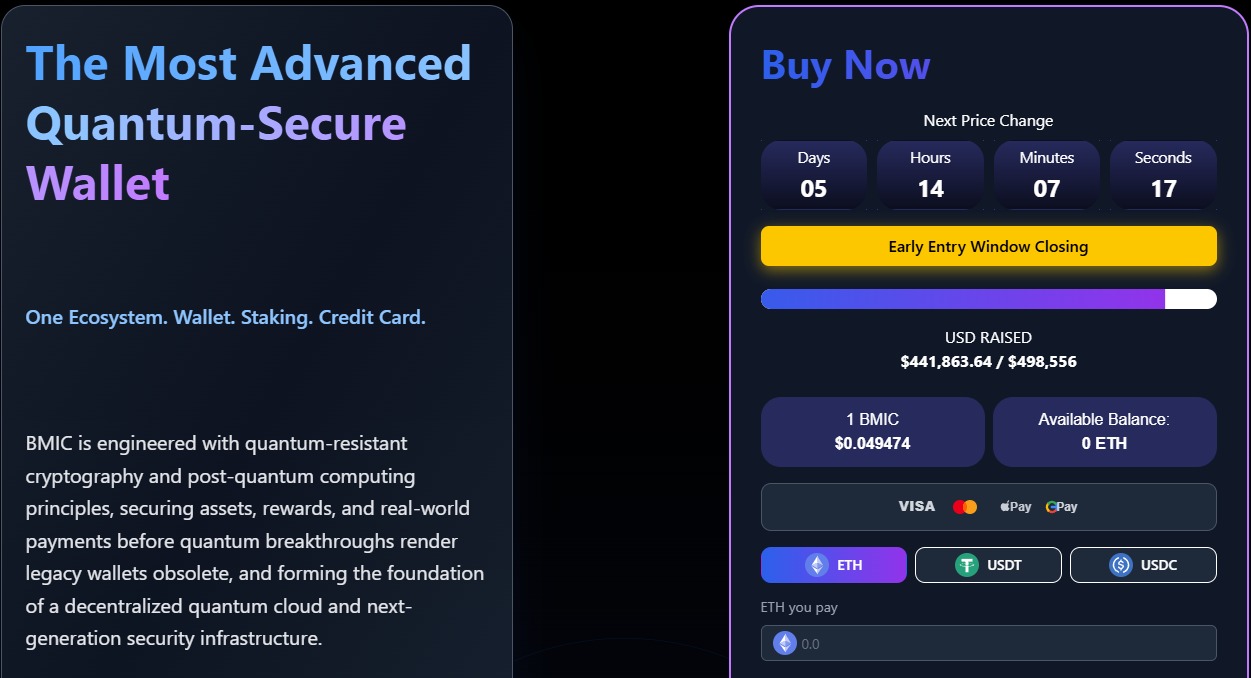

This rotation brings fresh gaze to BMIC ($BMIC), a project facing the quantum specter with a shield of AI-enhanced security and an architecture of post-quantum guardianship. It attracts capital even as the market retraces, because it promises something that stubbornly endures.

Get your $BMIC here.

Quantum-Proof Infrastructure Emerges as the Next Hedge

While the market stares at candles, a darker threat lurks: the harvest-now, decrypt-later strategy practiced by state-like powers. Hackers hoard encrypted data, waiting for the day when quantum machines can crack what we thought was safe.

BMIC positions itself as the primary shield against this fate. It offers a platform with wallet, staking, and payments stacked in post-quantum armor.

The architecture goes beyond cold storage. By using ERC-4337 Smart Accounts and a Quantum Meta-Cloud, BMIC aims to obscure even public keys, reducing exposure to future pirates of the code. Not just for the vaults of merchants but for enterprises and the wealthy who cannot gamble with yesterday’s encryption.

Investors discover that AI-powered threat detection plus quantum resistance isn’t a luxury; it feels like the small habit you keep for the long road ahead. This narrative shifts attention toward the ecosystem, enabling burn-to-compute mechanics and governance that pretend to a closed loop secure from the one existential threat to crypto-the forgetting of protection.

Explore the BMIC ecosystem.

$BMIC Presale Defies Gravity, Draws Fresh Inflows

Against the Bitcoin ETF lull, the BMIC presale hums. Official data shows the project has raised over $441K, a buoy in the economic storm, testament to early confidence beyond the broader market’s sighs.

While Bitcoin clings to fragile support, capital flows here at an entry of about $0.049 per token, a curious contrast to the heady valuations of the top assets, as if one currency could still be practical even when the others dream of myth.

The split in capital flow reveals two climates: ETF investors react to policy and rates, presale participants bet on deeper tech shifts. The $BMIC raise signals a growing sense that old guards of security are thinning, and those who grasp the true horizon are staking now for a future where exposure to public keys belongs to a museum of the past.

The presale structure nudges early birds before price discovery in public markets, where volatility still sings the old, familiar tune. With a focus on building a digital safety net-an infrastructure stack that addresses a multi-trillion-dollar worry-the current value hints at a meaningful hedge for the patient investor.

Check BMIC here.

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2026-02-09 15:58