What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

So, Bitcoin decided to take a little tumble-down almost 2.5% in the last 24 hours, because why not? It just couldn’t hold onto that sweet $71,000 high it reached after a dramatic week-long rollercoaster ride.

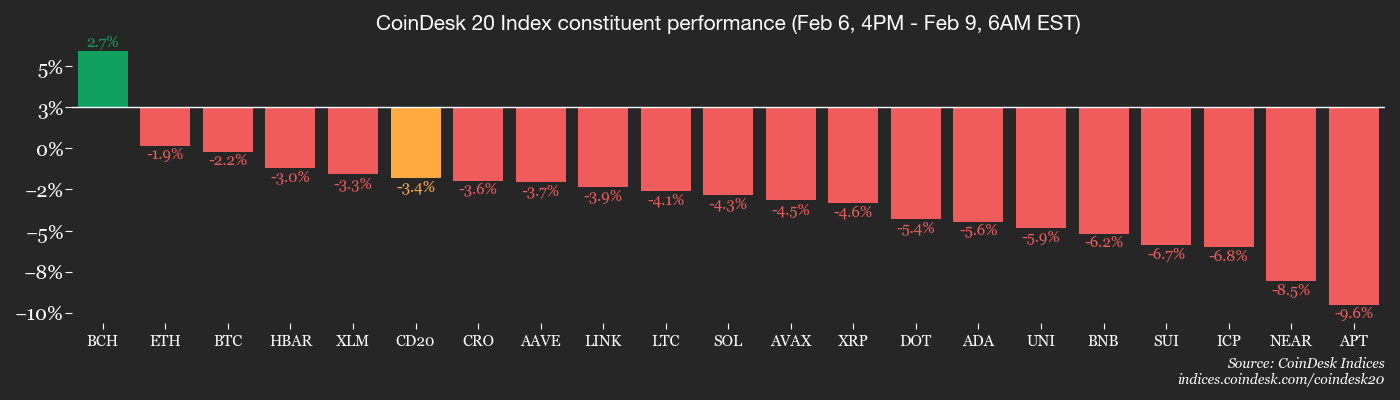

One minute, we’re partying at $71,000, and the next, we’re crying at $60,000. Remind you of any relationship you’ve had? BTC is still down more than 11% over the past week, but hey, look on the bright side: at least it’s doing better than most of the CoinDesk 20 index, which dropped like my hopes of winning the lottery-13.5% in 24 hours.

But wait! Institutions are swooping in like they’re at a Black Friday sale. Bitwise CEO Hunter Horsley said they saw significant cash fly in as prices dipped. Who would’ve thought that a little panic could turn into a shopping spree?

“I think long-time holders are feeling unsure,” he said. “New investors see this as their golden ticket to the party.” Because who doesn’t love crashing a party when everyone else is too busy frowning at their falling stocks?

Spot bitcoin ETFs made a comeback, reversing a three-day streak of outflows and bringing in a net $371 million. It’s like the universe said, “Surprise! There’s still money in crypto!” Meanwhile, retail sentiment is as fragile as my confidence after binge-watching reality TV.

People are frantically Googling “crypto capitulation” like it’s the latest diet trend. Thanks to Santiment, we know this spike in interest gives value investors a chance to pounce. It’s like watching your friends run for the last slice of pizza; you know you’ve got to act fast!

Meanwhile, capital is flowing into traditional safe havens, which is code for gold and silver. Gold is back on its throne above $5,000, and Tether’s stash has topped $23 billion. So, while Bitcoin plays peek-a-boo with the market, gold is just chilling like, “I got this.”

Stock market futures are looking a little sad ahead of today’s opening, after Japan’s equities celebrated a ruling party win like they just found out their favorite show got renewed. Prime Minister Sanae Takaichi is all about low interest rates and spending. Sounds like my last shopping spree!

The yield on Japanese government bonds is rising, which is causing a bit of a mess in the crypto world. Just imagine your friend trying to unwind a party balloon-there’s a lot of popping and chaos involved. This could bring back nearly $5 trillion of overseas investments. So, keep those eyes peeled!

What to Watch

For a more comprehensive list of events this week, check out CoinDesk’s “Crypto Week Ahead”.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Governance votes & calls

- No major governance votes.

- Unlocks

- No major unlocks.

- Token Launches

- Feb. 9: Pendle to launch sPENDLE buybacks starting Feb. 13. Rewards time-weighted from Jan. 29, because timing is everything!

- Feb. 9: ZKsync to kick off Season 1 of the ZKnomics Staking Pilot Program via Tally. Get your popcorn ready!

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Feb. 9: Liquidity 2026 (Hong Kong). Yes, it’s a real thing!

Market Movements

- BTC is down 2.90% from 4 p.m. ET Sunday at $69,045.23 (24hrs: -2.44%).

- ETH is down 4.07% at $2,034.28 (24hrs: -4.40%).

- CoinDesk 20 is down 3.09% at 1,973.38 (24hrs: -3.46%).

- Ether CESR Composite Staking Rate is down 25 bps at 2.74%. Seriously, what even is that?

- BTC funding rate is at -0.037% (-4.0362% annualized) on Binance. Math is hard, folks.

- DXY is down 0.33% at 97.31. What does that mean? I have no idea!

- Gold futures are up 1.67% at $5,033.80.

- Silver futures are up 5.62% at $81.05. Shine on, you crazy diamond!

- Nikkei 225 closed up 3.89% at 56,363.94. Party time!

- Hang Seng closed up 1.76% at 27,027.16. Everyone loves a comeback!

- FTSE 100 is up 0.31% at 10,402.44. Look at it go!

- Euro Stoxx 50 is up 0.39% at 6,021.78. Just keep climbing!

- DJIA closed on Friday up 2.47% at 50,115.67. Can I get a “whoop whoop”?

- S&P 500 closed up 1.97% at 6,932.30. It’s a good day!

- Nasdaq Composite closed up 2.18% at 23,031.21. Look at that growth!

- S&P/TSX Composite closed up 1.49% at 32,471.00. High fives all around!

- S&P 40 Latin America closed down 2.89% at 3,653.05. Oof, someone check on them!

- U.S. 10-Year Treasury rate is up 2 bps at 4.23%. Hold tight, folks!

- E-mini S&P 500 futures are unchanged at 6,949.25. Just hanging out!

- E-mini Nasdaq-100 futures are down 0.20% at 25,113.25. It’s fine, really!

- E-mini Dow Jones Industrial Average futures are unchanged at 50,246.00. Consistency is key!

Bitcoin Stats

- BTC Dominance: 59.33% (-0.05%).

- Ether-bitcoin ratio: 0.02944 (-0.92%).

- Hashrate (seven-day moving average): 977 EH/s. That’s a lot of hash!

- Hashprice (spot): $34.55.

- Total fees: 2.23 BTC / $157,182. Cha-ching!

- CME Futures Open Interest: 116,125 BTC. Can we get a round of applause?

- BTC priced in gold: 13.8 oz.

- BTC vs gold market cap: 4.62%. Gold’s still the boss!

Technical Analysis

- Bitcoin is testing the 200-week exponential moving average (~$68,339), a critical support level to prevent an extended structural drawdown. It’s like holding onto the last piece of cake!

- The weekly RSI is firmly oversold at 28.18, a level that has historically preceded short-term rebounds. Think of it as a spring waiting to bounce back!

- While this positioning suggests there’s a high probability of a bounce, a clear reversal of the downtrend requires a sustained breakout above $74,000. Kind of like needing to lift weights before prom!

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $165.12 (+13.00%), -1.24% at $163.07 in pre-market. Still fabulous!

- Galaxy Digital (GLXY): closed at $19.76 (+17.34%), -0.30% at $19.70. Look at that shine!

- MARA Holdings, Inc. (MARA): closed at $8.24 (+22.44%), -2.67% at $8.02. They’re still in the game!

- Riot Platforms, Inc. (RIOT): closed at $14.45 (+19.82%), -1.18% at $14.28. Keep it up, team!

- Core Scientific, Inc. (CORZ): closed at $16.81 (+13.47%), -0.30% at $16.76. Science rules!

- CleanSpark (CLSK): closed at $10.08 (+21.96%), -0.89% at $9.99. Clean energy vibes!

- Exodus Movement (EXOD): closed at $10.56 (+12.10%). Keep on keeping on!

- CoinShares Bitcoin Mining ETF (WGMI): closed at $40.43 (+14.76%). Mining for gold!

- Circle Internet Group (CRCL): closed at $57.04 (+13.56%), -1.05% at $56.44. Round and round we go!

- Bullish (BLSH): closed at $27.45 (+10.24%), unchanged at $27.45. Steady as she goes!

Crypto Treasury Companies

- Strategy (MSTR): closed at $134.93 (+26.11%), -3.47% at $130.25. Strategy is key!

- Strive Asset Management (ASST): closed at $11.91 (+20.84%), -3.40% at $11.51. Strong moves!

- Sharplink Gaming (SBET): closed at $7.03 (+15.82%), -0.71% at $6.98. Game on!

- Upexi, Inc. (UPXI): closed at $1.14 (+4.59%), +0.88% at $1.15. Every penny counts!

- Lite Strategy, Inc. (LITS): closed at $1.06 (+11.58%). Light and bright!

ETF Flows

Spot BTC ETFs

- Daily net flows: $330.7 million. That’s a lot of dough!

- Cumulative net flows: $54.63 billion. Chaching!

- Total BTC holdings ~1.27 million. That’s a hefty collection!

Spot ETH ETFs

- Daily net flows: -$21.3 million. Sad face!

- Cumulative net flows: $11.83 billion. Still rolling in it!

- Total ETH holdings ~5.83 million. Ethereum is here to stay!

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- EUR USD PREDICTION

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2026-02-09 16:23