Ah, the markets, old bean! A place where fortunes are made and lost with the whimsy of a particularly fickle aunt. And speaking of whimsy, let’s dive into the latest escapade of Strategy, the Michael Saylor-led firm that’s been stacking Bitcoin like a chap hoarding marmalade at a country house weekend.

What ho, here’s the lowdown:

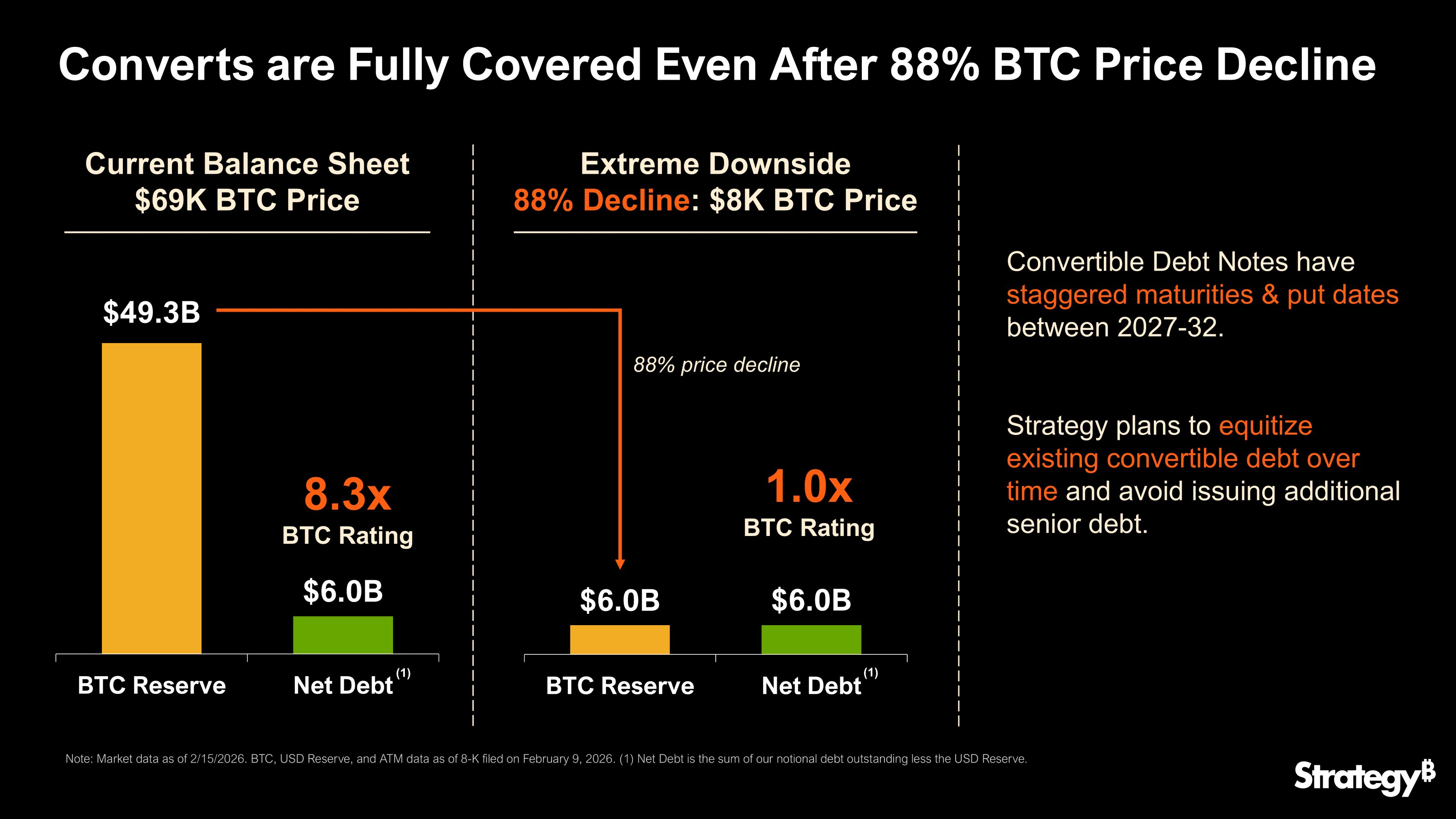

- Strategy, with the dash of a man who’s just discovered the last crumpet at tea, claims it can weather a Bitcoin price drop to $8,000. Jolly good show, what? Its 714,644-Bitcoin treasury, they say, will cover the $6 billion in debt. Stiff upper lip and all that.

- The plan? To “equitize” its convertible debt, a move as bold as wearing a monocle to a rugby match. Critics, however, mutter darkly about shareholder dilution, as if someone’s spilled the port before dinner.

- Skeptics, those eternal party poopers, warn that a Bitcoin nosedive would leave Strategy sitting on paper losses so vast, one might need a map to navigate them. Refinancing? As likely as finding a decent cup of tea in the colonies.

Strategy (MSTR), the Bitcoin treasury firm with more BTC than a Rothschild has silver spoons, insists it can ride out a plunge to $8,000. “Stiff upper lip, old chap,” they tweeted on X, or whatever they’re calling it these days. “Our assets will cover the debt, no need to sell the family silver.”

Since 2020, Strategy has amassed 714,644 BTC, currently worth a cool $49.3 billion. Not bad for a firm that’s been borrowing like a toff at Ascot. But with $6 billion in debt-equivalent to 86,956 BTC-one wonders if they’ve bitten off more than they can chew. Or, as Aunt Agatha would say, “Too much pudding makes for a heavy stomach.”

During the crypto bull run, this debt-financed Bitcoin binge was all the rage, like jazz music and flappers in the Roaring Twenties. But now, with Bitcoin crashing from $126,000 to nearly $60,000, it’s all looking a bit like a hangover after a night at the Drones Club.

If Strategy has to liquidate its Bitcoin to pay off the debt, it could flood the market faster than Jeeves can mix a martini. But fear not, they say! Even at $8,000 per BTC, their holdings would still be worth $6 billion, enough to cover the debt. Phew, that’s a relief. Almost as relieving as finding out the butler didn’t steal the silver.

And let’s not forget, the debt isn’t due all at once. It’s spread out until 2027 and 2032, giving Strategy plenty of time to sort things out. Or, as Bertie Wooster might say, “Plenty of time to find another aunt to borrow from.”

To further calm the nerves of jittery investors, Strategy plans to convert its convertible debt into equity. Clever, eh? Like turning a soggy biscuit into a respectable tea cake. But not everyone’s convinced.

Not everyone’s raising a glass

Critics, those eternal wet blankets, point out that while $8,000 Bitcoin might cover the debt, Strategy paid around $54 billion for its stash. That’s an average of $76,000 per BTC. A drop to $8,000 would mean a $48 billion paper loss, enough to make even the sturdiest balance sheet look like a house of cards in a hurricane.

Cash on hand? Barely enough to cover 2.5 years of debt and dividends. And the software business? Pulls in a mere $500 million a year. That’s like trying to bail out the Titanic with a teacup.

“Traditional lenders,” one observer quipped, “are about as likely to refinance Strategy as I am to wear spats to a football match. With Bitcoin as collateral, they’d rather take their chances with a game of darts.”

A dump on retail investors?

Anton Golub, chief business officer at crypto exchange Freedx, calls the “equitizing” move a “dump on retail investors.” Harsh words, but then again, he’s not the one holding the bag.

According to Golub, the convertible bonds were snapped up by Wall Street hedge funds, those cunning chaps who profit from volatility like Bertie Wooster profits from a good excuse. They bought the bonds cheaply, bet against the stock, and now, with shares at $130, they’re demanding cash repayment. Strategy’s response? Dilute shares faster than a bartender watering down the gin.

“Strategy only looks genius during Bitcoin bull markets,” Golub noted. “In bear markets, dilution is as real as Aunt Agatha’s disapproval. And let me tell you, old boy, that’s very real indeed.”

So there you have it, the tale of Strategy and its Bitcoin treasury. Will they weather the storm, or will it all end in tears and a very large bill? Only time will tell. In the meantime, I’m off to find Jeeves. A chap could use a stiff drink.

Read More

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- Gold Rate Forecast

- USD MYR PREDICTION

- Silver Rate Forecast

- USD VND PREDICTION

- GBP EUR PREDICTION

- EUR ILS PREDICTION

- USD TRY PREDICTION

- EUR JPY PREDICTION

2026-02-16 13:44